Region:Global

Author(s):Rebecca

Product Code:KRAA9417

Pages:99

Published On:November 2025

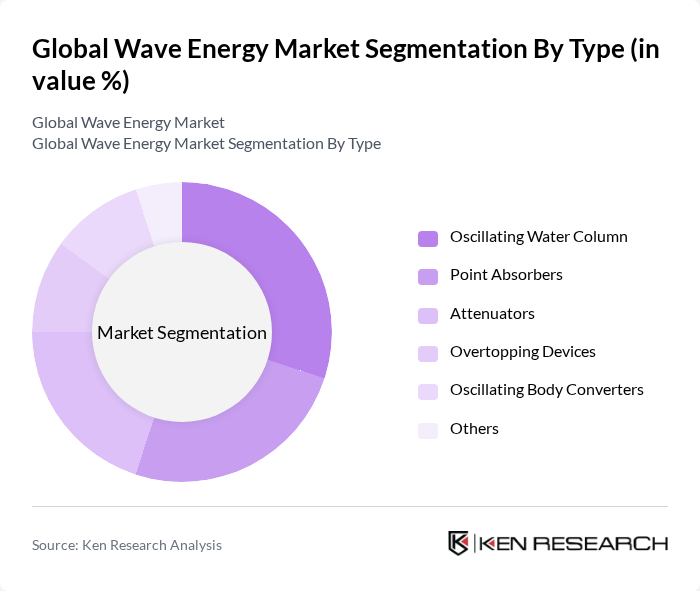

By Type:The wave energy market can be segmented into various types, including Oscillating Water Column, Point Absorbers, Attenuators, Overtopping Devices, Oscillating Body Converters, and Others. Each type features distinct conversion mechanisms and deployment strategies, catering to different energy generation needs. Oscillating Water Columns utilize air chambers and turbines, Point Absorbers harness vertical wave motion, Attenuators capture energy along the wave front, Overtopping Devices collect water for gravity-driven turbines, and Oscillating Body Converters use the movement of floating structures.

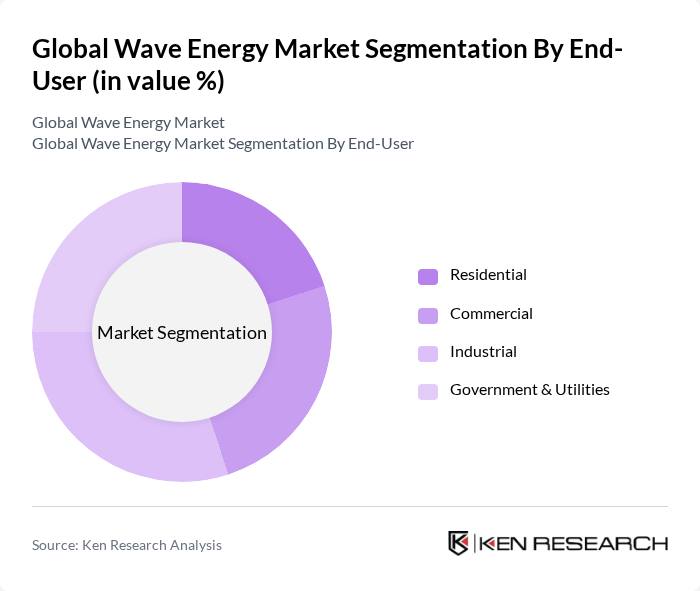

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct energy requirements and regulatory frameworks that influence the adoption of wave energy technologies. Industrial and Government & Utilities segments are the primary adopters due to large-scale energy needs and policy-driven mandates, while the Commercial segment is increasingly utilizing wave energy for off-grid and coastal operations. Residential adoption remains limited but is growing in remote coastal communities.

The Global Wave Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ocean Power Technologies, Carnegie Clean Energy, Wave Swell Energy, Eco Wave Power, Seabased AB, AW-Energy Oy, Pelamis Wave Power, Ocean Renewable Power Company, HydroQuest, Wello Oy, Marine Power Systems, Blue Energy Canada Inc., Mocean Energy, WaveRoller (AW-Energy Oy), CorPower Ocean AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of wave energy in None appears promising, driven by increasing investments and technological advancements. In future, the integration of wave energy with smart grid technology is expected to enhance energy distribution efficiency. Additionally, community-based initiatives are gaining traction, fostering local engagement and investment. As environmental concerns continue to rise, the focus on sustainable energy solutions will likely propel wave energy to the forefront of the renewable energy landscape, creating a more resilient energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Oscillating Water Column Point Absorbers Attenuators Overtopping Devices Oscillating Body Converters Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Technology | Mechanical Systems Electrical Systems Hybrid Systems Others |

| By Application | Power Generation Desalination Environmental Protection Grid-Connected Off-Grid Utility-Scale Projects Others |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wave Energy Project Developers | 120 | Project Managers, Technical Directors |

| Government Energy Policy Makers | 100 | Regulatory Affairs Specialists, Energy Policy Analysts |

| Investors in Renewable Energy | 90 | Investment Analysts, Portfolio Managers |

| Marine Energy Researchers | 80 | Academic Researchers, Industry Consultants |

| Utility Company Executives | 110 | Energy Managers, Strategic Planners |

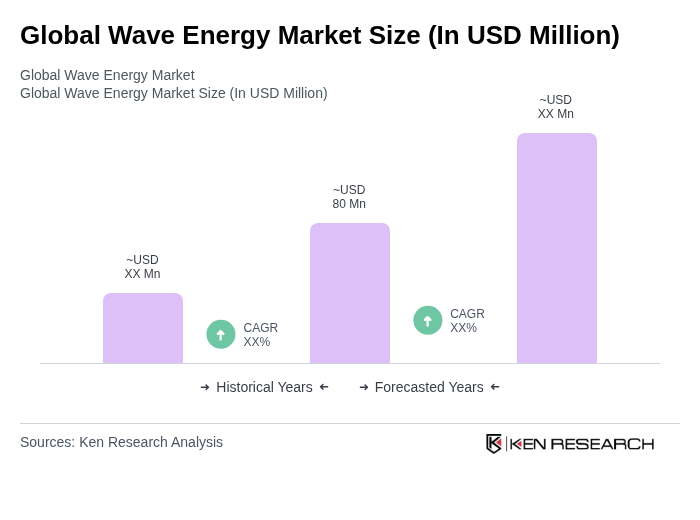

The Global Wave Energy Market is currently valued at approximately USD 80 million, reflecting a five-year historical analysis. This growth is attributed to increased investments in renewable energy and advancements in wave energy conversion technologies.