Region:Global

Author(s):Shubham

Product Code:KRAA2643

Pages:82

Published On:August 2025

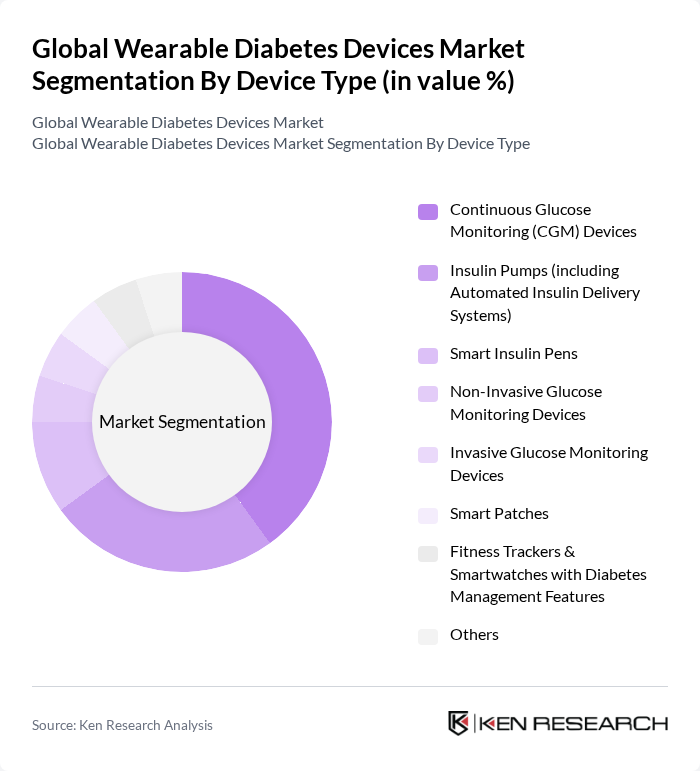

By Device Type:The device type segmentation includes various innovative technologies designed to assist in diabetes management. The subsegments are Continuous Glucose Monitoring (CGM) Devices, Insulin Pumps (including Automated Insulin Delivery Systems), Smart Insulin Pens, Non-Invasive Glucose Monitoring Devices, Invasive Glucose Monitoring Devices, Smart Patches, Fitness Trackers & Smartwatches with Diabetes Management Features, and Others. Among these, Continuous Glucose Monitoring (CGM) Devices are leading the market due to their ability to provide real-time glucose readings, which significantly enhance patient management and lifestyle adjustments. The adoption of CGM devices is further supported by technological integration with insulin pumps, mobile apps, and cloud-based platforms, improving both clinical outcomes and user experience .

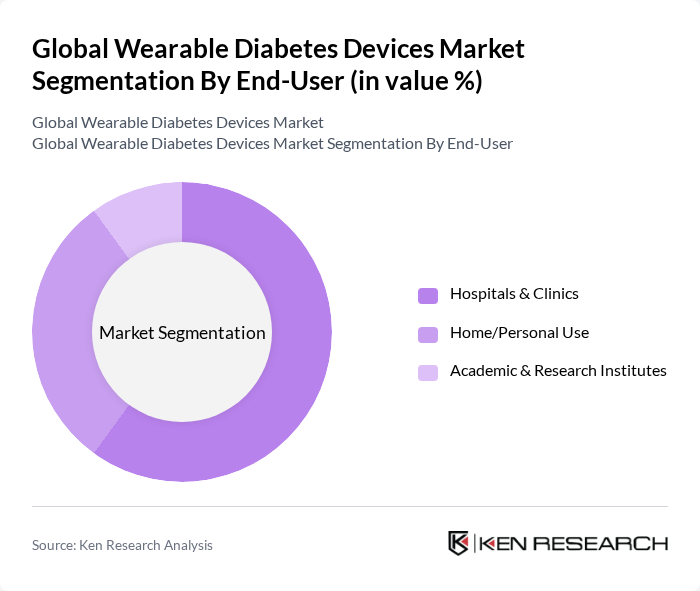

By End-User:The end-user segmentation encompasses Hospitals & Clinics, Home/Personal Use, and Academic & Research Institutes. The Hospitals & Clinics segment dominates the market as healthcare providers increasingly adopt wearable diabetes devices to enhance patient care and monitoring. This trend is driven by the need for efficient diabetes management solutions that can be integrated into clinical workflows.

The Global Wearable Diabetes Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Dexcom, Inc., Medtronic plc, Roche Diabetes Care, Johnson & Johnson (LifeScan, Inc.), Ascensia Diabetes Care, Insulet Corporation, Tandem Diabetes Care, Inc., Senseonics Holdings, Inc., Glooko, Inc., Nova Biomedical, Ypsomed AG, Biolinq, Inc., Medtrum Technologies Inc., AgaMatrix, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable diabetes devices market appears promising, driven by ongoing technological innovations and a growing emphasis on personalized healthcare. As telehealth services expand, the integration of wearable devices with mobile health applications will enhance patient engagement and monitoring capabilities. Furthermore, collaborations between device manufacturers and healthcare providers are likely to facilitate the development of tailored solutions, ensuring that patients receive the most effective diabetes management tools available, ultimately improving health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Continuous Glucose Monitoring (CGM) Devices Insulin Pumps (including Automated Insulin Delivery Systems) Smart Insulin Pens Non-Invasive Glucose Monitoring Devices Invasive Glucose Monitoring Devices Smart Patches Fitness Trackers & Smartwatches with Diabetes Management Features Others |

| By End-User | Hospitals & Clinics Home/Personal Use Academic & Research Institutes |

| By Distribution Channel | Online Retail Pharmacies Hospitals and Clinics Direct Sales |

| By Region | North America (United States, Canada, Rest of North America) Europe (Germany, United Kingdom, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (Japan, China, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Age Group | Children Adults Seniors |

| By Price Range | Budget Mid-Range Premium |

| By Application | Diabetes Management Health Monitoring Fitness Tracking Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Endocrinologists, Diabetes Educators |

| Patients Using Wearable Devices | 90 | Type 1 and Type 2 Diabetes Patients |

| Device Manufacturers | 60 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 50 | Health Economists, Regulatory Affairs Specialists |

| Insurance Providers | 40 | Claims Analysts, Policy Underwriters |

The Global Wearable Diabetes Devices Market is valued at approximately USD 11 billion, driven by the increasing prevalence of diabetes, health awareness, and technological advancements in real-time monitoring devices.