Region:Global

Author(s):Dev

Product Code:KRAA1593

Pages:98

Published On:August 2025

By Type:The wearable technology market can be segmented into various types, including wrist-worn devices, hearables, smart glasses, body-worn medical wearables, smart clothing, smart rings, and others. Among these, wrist-worn devices, such as smartwatches and fitness bands, dominate unit volumes and value due to multifunctionality, daily health insights, payments, and notifications, while hearables maintain strong momentum on the back of true wireless form factors and integrated health features like heart-rate and hearing assistance .

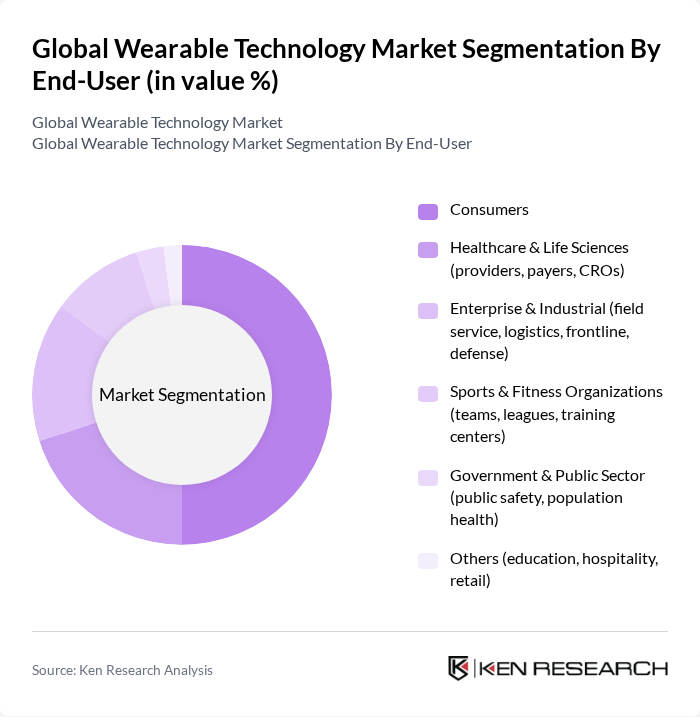

By End-User:The end-user segmentation of the wearable technology market includes consumers, healthcare and life sciences, enterprise and industrial, sports and fitness organizations, government and public sector, and others. The consumer segment leads due to pervasive use of smartwatches and hearables for health tracking and communications; healthcare adoption is expanding with remote patient monitoring, chronic disease management, and clinical-grade sensors integrated into patches and CGMs .

The Global Wearable Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Fitbit LLC (Google), Garmin Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Fossil Group, Inc., Sony Group Corporation, Withings S.A.S., Polar Electro Oy, Zepp Health Corporation (Amazfit), Oura Health Oy, WHOOP, Inc., Bose Corporation, Jabra (GN Audio A/S), Vuzix Corporation, Meta Platforms, Inc. (Ray-Ban Meta smart glasses), OPPO, Nothing Technology Limited, Amazfit contribute to innovation, geographic expansion, and service delivery in this space .

The future of the wearable technology market appears promising, driven by continuous innovation and evolving consumer preferences. As health awareness increases, the demand for advanced wearables that offer comprehensive health monitoring will likely rise. Additionally, the integration of artificial intelligence and machine learning into wearables is expected to enhance user engagement and functionality, paving the way for new applications in health and fitness, thus expanding market potential significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Wrist-worn (Smartwatches, Fitness Bands) Hearables (TWS Earbuds, Smart Hearing Aids) Smart Glasses & Head-mounted Displays (AR/VR/MR) Body-worn Medical Wearables (ECG patches, Continuous Glucose Monitors, BP monitors) Smart Clothing & Textiles (sensors, e-textiles) Smart Rings Others (smart footwear, safety wearables, pet wearables) |

| By End-User | Consumers Healthcare & Life Sciences (providers, payers, CROs) Enterprise & Industrial (field service, logistics, frontline, defense) Sports & Fitness Organizations (teams, leagues, training centers) Government & Public Sector (public safety, population health) Others (education, hospitality, retail) |

| By Distribution Channel | Online Retail (brand.com, marketplaces) Offline Retail (electronics, telecom, specialty, big-box) Telco Channels (bundled device plans, operator stores) Enterprise/Institutional Sales (B2B, healthcare procurement) Distributors & Value-added Resellers Others |

| By Application | Health & Fitness Tracking Medical & Remote Patient Monitoring Communication & Notifications Payments & Access Control Entertainment & Media (audio, AR/VR) Safety, Navigation & Workforce Productivity Others |

| By Component | Hardware (sensors, batteries, chips, displays) Software & Firmware (OS, apps, algorithms) Services (cloud, data analytics, integration, subscriptions) Accessories & Consumables (bands, chargers, electrodes) |

| By Price Range | Entry (sub-$100) Mid ($100–$299) Premium ($300–$599) Ultra-premium ($600+) |

| By User Demographics | Age Group Gender Lifestyle & Activity Level Health Status & Conditions (e.g., diabetes, cardiovascular) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Tracker Users | 150 | Health Enthusiasts, Personal Trainers |

| Smartwatch Owners | 120 | Tech Savvy Consumers, Early Adopters |

| Healthcare Professionals | 100 | Doctors, Physiotherapists |

| Corporate Wellness Program Participants | 80 | HR Specialists, Wellness Coordinators |

| Retailers of Wearable Technology | 90 | Store Managers, Merchandisers |

The Global Wearable Technology Market is valued at approximately USD 7273 billion, with recent analyses reporting figures of USD 71.91 billion and USD 72.46 billion. This valuation reflects a five-year analysis of market trends and consumer demand.