Region:Middle East

Author(s):Dev

Product Code:KRAC3447

Pages:92

Published On:October 2025

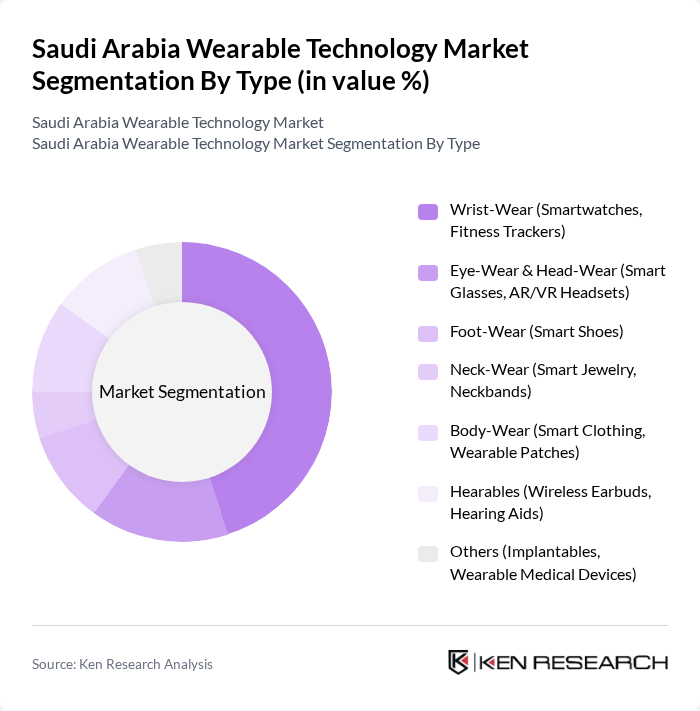

By Type:The wearable technology market can be segmented into various types, including wrist-wear, eye-wear & head-wear, foot-wear, neck-wear, body-wear, hearables, and others. Among these, wrist-wear—comprising smartwatches and fitness trackers—is the most dominant segment due to its popularity among consumers for health monitoring and fitness tracking. Wrist-wear devices accounted for the largest revenue share in the market, driven by features such as heart rate monitoring, GPS, and fitness tracking, which appeal to both fitness enthusiasts and health-conscious individuals. The head & eyewear segment is also growing rapidly, fueled by demand for wireless earbuds, headphones, and augmented reality glasses.

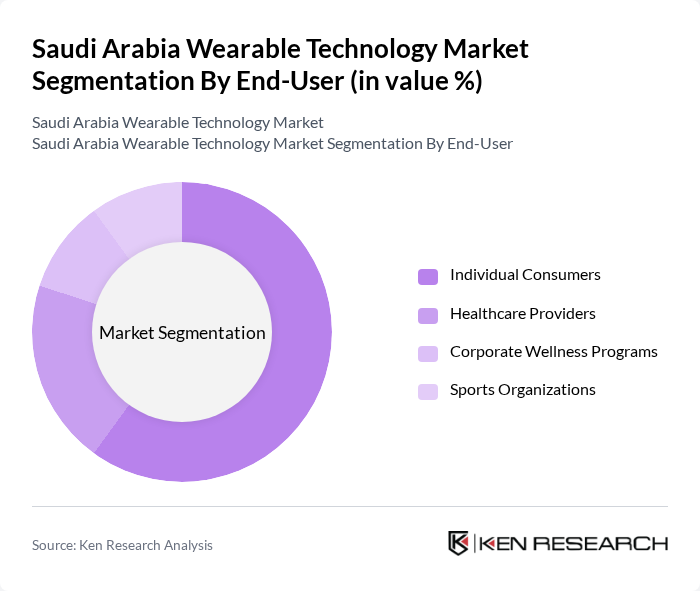

By End-User:The end-user segmentation includes individual consumers, healthcare providers, corporate wellness programs, and sports organizations. Individual consumers represent the largest segment, driven by the growing trend of personal health management and fitness tracking among the general population.

The Saudi Arabia Wearable Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Garmin Ltd., Fitbit, Inc. (Google LLC), Sony Corporation, Fossil Group, Inc., Withings S.A., Amazfit (Huami Corporation), Polar Electro Oy, Suunto (Amer Sports), Jabra (GN Group), Oura Health Ltd., Adidas AG (Adidas Runtastic), Nike, Inc. (Nike FuelBand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable technology market in Saudi Arabia appears promising, driven by increasing health awareness and technological advancements. As the government continues to invest in digital health initiatives, the integration of wearables with healthcare systems is expected to enhance user engagement. Additionally, the rise of e-commerce platforms will facilitate easier access to these devices, further boosting adoption rates. The market is likely to witness innovative product launches that cater to diverse consumer needs, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wrist-Wear (Smartwatches, Fitness Trackers) Eye-Wear & Head-Wear (Smart Glasses, AR/VR Headsets) Foot-Wear (Smart Shoes) Neck-Wear (Smart Jewelry, Neckbands) Body-Wear (Smart Clothing, Wearable Patches) Hearables (Wireless Earbuds, Hearing Aids) Others (Implantables, Wearable Medical Devices) |

| By End-User | Individual Consumers Healthcare Providers Corporate Wellness Programs Sports Organizations |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales |

| By Price Range | Budget Mid-Range Premium |

| By Application | Health Monitoring Fitness Tracking Communication Entertainment |

| By Technology | Bluetooth Wi-Fi NFC GPS |

| By User Demographics | Age Group Gender Lifestyle Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 60 | Store Managers, Sales Representatives |

| Health and Fitness Enthusiasts | 70 | Fitness Trainers, Health Coaches |

| Healthcare Professionals | 40 | Doctors, Physiotherapists |

| Technology Adoption Researchers | 40 | Market Analysts, Academic Researchers |

| Corporate Wellness Program Managers | 40 | HR Managers, Wellness Coordinators |

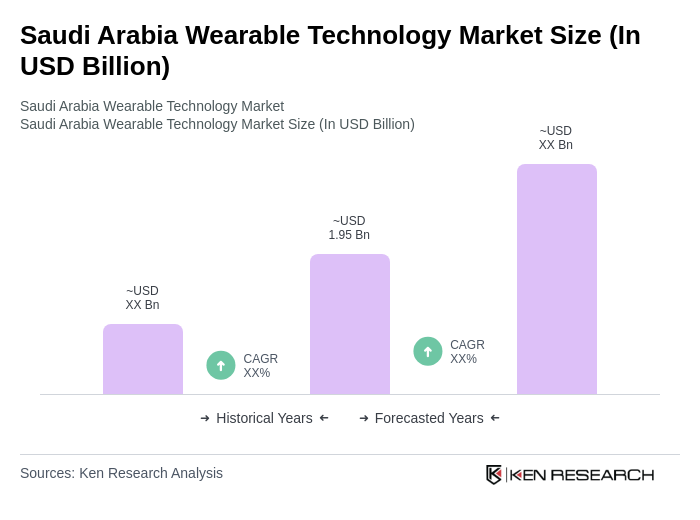

The Saudi Arabia Wearable Technology Market is valued at approximately USD 1.95 billion, reflecting significant growth driven by health consciousness, technological advancements, and the increasing adoption of smart devices in daily life.