Region:Global

Author(s):Dev

Product Code:KRAA2994

Pages:86

Published On:August 2025

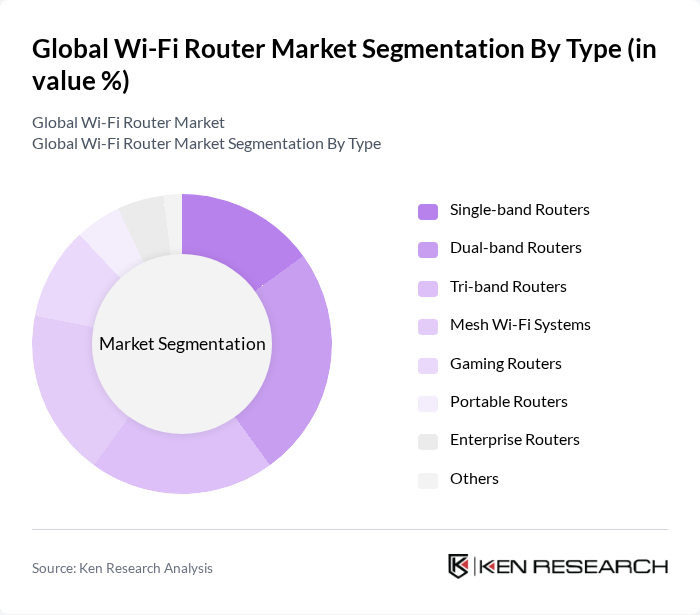

By Type:The market is segmented into Single-band Routers, Dual-band Routers, Tri-band Routers, Mesh Wi-Fi Systems, Gaming Routers, Portable Routers, Enterprise Routers, and Others. Single-band routers are typically used for basic internet needs, while dual-band and tri-band routers cater to households and businesses requiring higher speeds and reduced interference. Mesh Wi-Fi systems are increasingly popular for whole-home coverage, and enterprise routers are designed for large-scale, high-density environments. Gaming routers focus on low latency and high throughput, whereas portable routers serve mobile connectivity needs .

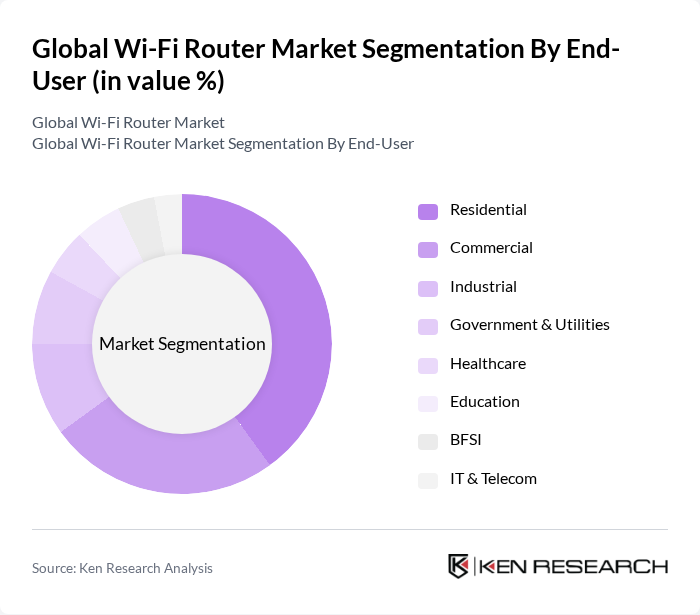

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, Government & Utilities, Healthcare, Education, BFSI, and IT & Telecom. Residential users drive the largest share due to the proliferation of smart home devices and remote work trends. Commercial and industrial users require robust, secure, and scalable solutions to support business operations and IoT integration. The government, healthcare, and education sectors increasingly adopt advanced routers for secure, high-capacity networking, while BFSI and IT & Telecom demand high reliability and compliance with stringent data standards .

The Global Wi-Fi Router Market is characterized by a dynamic mix of regional and international players. Leading participants such as TP-Link Technologies Co., Ltd., Netgear, Inc., ASUS Computer International (ASUSTeK Computer Inc.), Linksys (Belkin International, Inc.), D-Link Corporation, Huawei Technologies Co., Ltd., Xiaomi Corporation, Cisco Systems, Inc., Ubiquiti Inc., Arris International plc, Motorola Solutions, Inc., Tenda Technology, Inc., Zyxel Communications Corp., Synology Inc., Broadcom Inc., Juniper Networks, Inc., Ericsson Inc., Alcatel-Lucent Enterprise SAS, Nokia Corporation, ZTE Corporation, Edimax Technology Co., Ltd., Legrand SA, Actiontec Electronics, Inc., Amped Wireless, devolo AG, Hon Hai Precision Industry Co., Ltd. (Foxconn), Samsung Electronics Co., Ltd., Verizon Communications Inc., Alphabet Inc. (Google Nest Wi-Fi) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Wi-Fi router market appears promising, driven by technological advancements and evolving consumer needs. The integration of Wi-Fi 6 technology is expected to enhance connectivity speeds and efficiency, catering to the growing number of smart devices. Additionally, the increasing focus on energy-efficient solutions aligns with global sustainability goals, encouraging manufacturers to innovate. As the market adapts to these trends, opportunities for growth in emerging markets and partnerships with telecom providers will likely emerge, further shaping the industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-band Routers Dual-band Routers Tri-band Routers Mesh Wi-Fi Systems Gaming Routers Portable Routers Enterprise Routers Others |

| By End-User | Residential Commercial Industrial Government & Utilities Healthcare Education BFSI IT & Telecom |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Routers Mid-range Routers Premium Routers |

| By Application | Home Networking Office Networking Public Wi-Fi Hotspots IoT Connectivity Enterprise Networking |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Technology | Wi-Fi 5 (802.11ac) Wi-Fi 6 (802.11ax) Wi-Fi 6E Wi-Fi 7 (802.11be) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wi-Fi Router Users | 100 | Homeowners, Renters, Tech Enthusiasts |

| Small Business Wi-Fi Solutions | 60 | Small Business Owners, IT Consultants |

| Enterprise Network Managers | 40 | IT Managers, Network Administrators |

| Retail Consumer Insights | 50 | Store Managers, Sales Associates |

| Tech Retailers and Distributors | 40 | Product Buyers, Category Managers |

The Global Wi-Fi Router Market is valued at approximately USD 14 billion, driven by the increasing demand for high-speed internet connectivity, the rapid adoption of smart devices, and the expansion of IoT applications.