Region:Global

Author(s):Shubham

Product Code:KRAC0865

Pages:95

Published On:August 2025

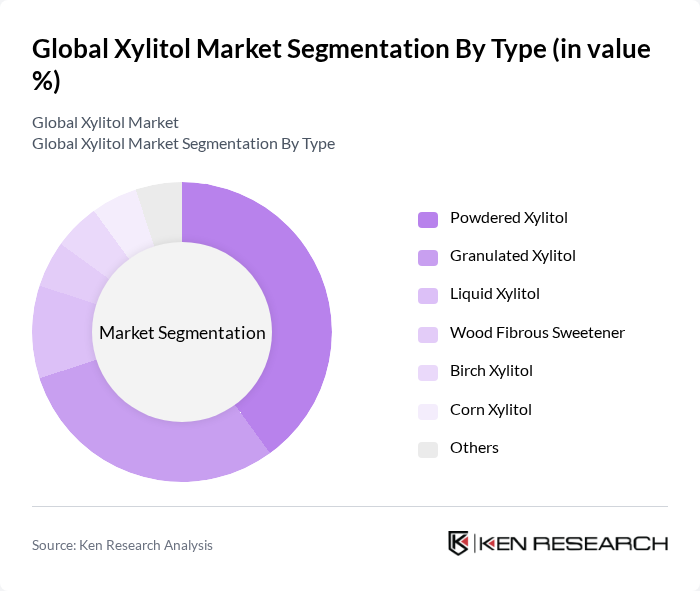

By Type:The xylitol market can be segmented into various types, including powdered xylitol, granulated xylitol, liquid xylitol, wood fibrous sweetener, birch xylitol, corn xylitol, and others. Among these, powdered xylitol is gaining traction due to its versatility in food applications and ease of use in various formulations. Granulated xylitol is also popular, particularly in the confectionery sector, where it mimics the texture and sweetness of sugar. The demand for liquid xylitol is increasing in the beverage industry, while wood fibrous sweeteners are gaining attention for their natural sourcing. Overall, the powdered and granulated segments are leading the market due to their widespread application and consumer preference .

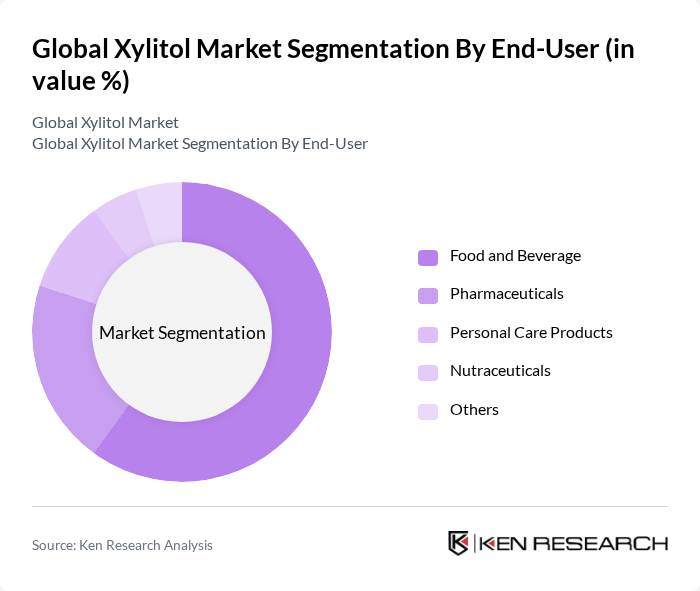

By End-User:The end-user segmentation of the xylitol market includes food and beverage, pharmaceuticals, personal care products, nutraceuticals, and others. The food and beverage sector is the largest consumer of xylitol, driven by the rising demand for low-calorie sweeteners in products such as chewing gum, candies, and baked goods. The pharmaceutical industry also plays a significant role, utilizing xylitol in oral care products and medications due to its health benefits. Personal care products and nutraceuticals are emerging segments, with increasing consumer awareness about natural ingredients. The food and beverage sector remains the dominant end-user, reflecting consumer trends towards healthier eating .

The Global Xylitol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danisco A/S (DuPont Nutrition & Health), Cargill, Incorporated, Archer Daniels Midland Company, Xylitol Canada Inc., Sweetener Supply Corporation, Huzhou Huanfu Chemical Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., Xylitol USA, Inc., Tereos S.A., Merisant Company, Hunan Huachang Chemical Co., Ltd., Hubei Yihua Chemical Industry Co., Ltd., Kexin Pharmaceutical Co., Ltd., Hunan Hualu-Hengsheng Chemical Co., Ltd., Hubei Huitian New Material Co., Ltd., Foodchem International Corporation, Herboveda India, Jining Hengda Green Engineering Co., Ltd., Merck KGaA, Mitsubishi Corporation Life Sciences Limited, Roquette Frères, Shandong Futaste Co., Ltd., Zhejiang Huakang Pharmaceutical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the xylitol market appears promising, driven by increasing consumer demand for healthier alternatives and the growing trend towards clean label products. Innovations in product development, particularly in the food and beverage sector, are expected to enhance the appeal of xylitol. Additionally, as sustainability becomes a priority, manufacturers are likely to explore eco-friendly production methods, further boosting market growth and expanding the application of xylitol in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Powdered Xylitol Granulated Xylitol Liquid Xylitol Wood Fibrous Sweetener Birch Xylitol Corn Xylitol Others |

| By End-User | Food and Beverage Pharmaceuticals Personal Care Products Nutraceuticals Others |

| By Application | Confectionery Bakery Products Dairy Products Chewing Gum Functional Beverages Diabetic Foods Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 60 | Regulatory Affairs Managers, R&D Directors |

| Oral Care Product Manufacturers | 50 | Marketing Managers, Product Line Managers |

| Health and Wellness Experts | 40 | Nutritionists, Dietitians |

| Retail Sector Buyers | 60 | Category Managers, Procurement Officers |

The Global Xylitol Market is valued at approximately USD 1.1 billion, driven by the increasing demand for sugar substitutes in food and beverage applications and rising health consciousness among consumers regarding sugar intake.