Region:Middle East

Author(s):Rebecca

Product Code:KRAC9839

Pages:82

Published On:November 2025

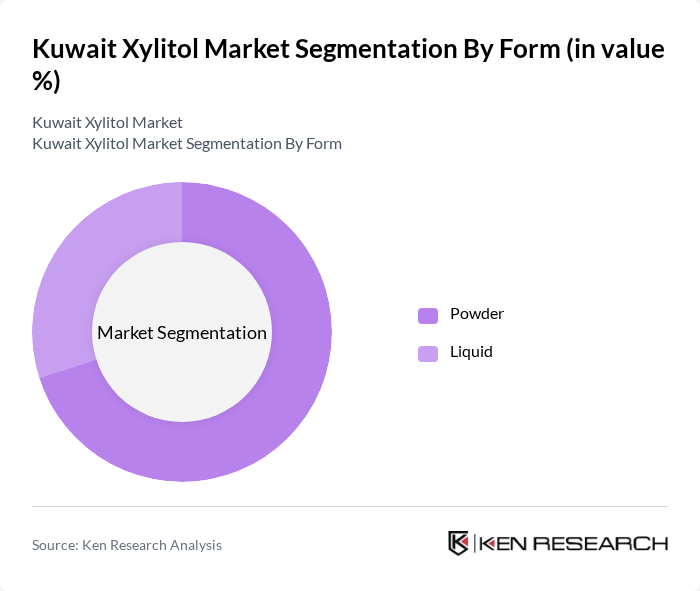

By Form:The market is segmented into two primary forms: Powder and Liquid. The Powder segment is currently leading the market due to its versatility and ease of use in various applications, particularly in food and beverages. Liquid xylitol, while gaining traction, is primarily used in specific applications such as pharmaceuticals and personal care products. The preference for powdered xylitol is driven by its convenience in baking and cooking, making it a popular choice among health-conscious consumers .

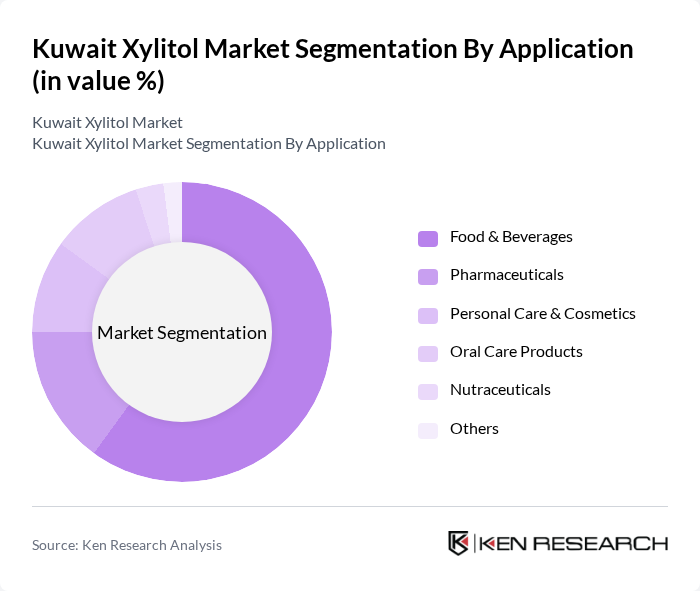

By Application:The xylitol market is segmented into several applications, including Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Oral Care Products, Nutraceuticals, and Others. The Food & Beverages segment dominates the market, driven by the increasing demand for healthier sweetening options in various food products. The rise in consumer awareness regarding the health benefits of xylitol, such as its low glycemic index and dental health properties, further propels its use in this sector. Other applications, while growing, do not match the scale of the food and beverage sector .

The Kuwait Xylitol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danisco A/S (a part of DuPont), Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Roquette Frères, Merisant Company, Futaste Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., Zhejiang Huakang Pharmaceutical Co., Ltd., Thomson Biotech (Xylitol China), Mitsubishi Shoji Foodtech Co., Ltd., NovaGreen, Inc., Sweetener Supply Corporation, Xylitol Canada Inc., BioCare Copenhagen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the xylitol market in Kuwait appears promising, driven by increasing health consciousness and a shift towards natural sweeteners. As the food and beverage industry continues to expand, manufacturers are likely to incorporate xylitol into a wider range of products. Additionally, the government's support for healthier food options will further enhance market growth. Innovations in production methods may also reduce costs, making xylitol more accessible to consumers and businesses alike, fostering a healthier market environment.

| Segment | Sub-Segments |

|---|---|

| By Form | Powder Liquid |

| By Application | Food & Beverages Pharmaceuticals Personal Care & Cosmetics Oral Care Products Nutraceuticals Others |

| By End-User Industry | Food Processing Companies Pharmaceutical Manufacturers Retailers & Distributors Hospitality Sector Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales (B2B) Others |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets/Single-Serve Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Health Awareness Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Stakeholders | 100 | Product Managers, Quality Assurance Officers |

| Pharmaceutical Sector Representatives | 70 | Regulatory Affairs Managers, R&D Scientists |

| Retail and Distribution Channels | 80 | Sales Managers, Supply Chain Coordinators |

| Consumer Insights | 120 | Health-Conscious Consumers, Dieticians |

| Market Analysts and Experts | 60 | Industry Analysts, Market Researchers |

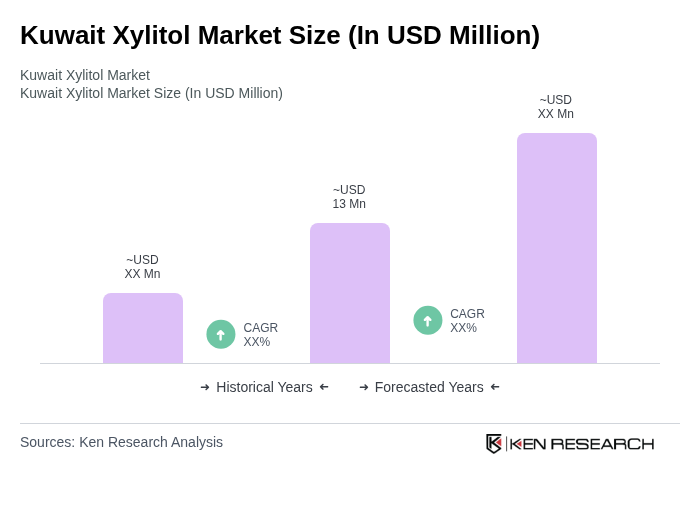

The Kuwait Xylitol Market is valued at approximately USD 13 million, reflecting a growing demand for sugar substitutes in food and beverage applications, driven by increasing health consciousness among consumers regarding sugar intake and dental health.