Region:Global

Author(s):Rebecca

Product Code:KRAD4900

Pages:85

Published On:December 2025

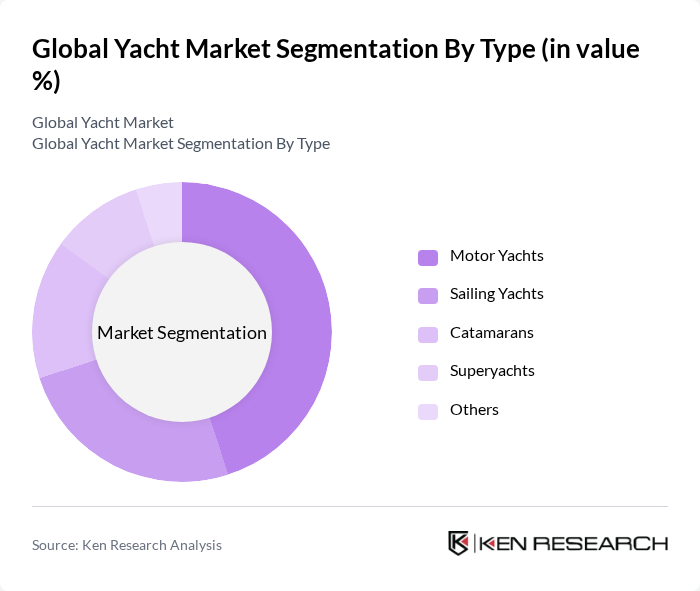

By Type:The yacht market is segmented into various types, including motor yachts, sailing yachts, catamarans, superyachts, and others. Among these, motor yachts are currently the most popular choice among consumers due to their speed, luxury, and ease of use, and motor-propelled yachts account for the clear majority of new builds in the global market. The demand for motor yachts has been bolstered by the growing trend of luxury travel and leisure activities, the expansion of marina infrastructure, and interest in high-performance and sport yachts. Sailing yachts, while also popular, tend to attract a niche market focused on traditional sailing experiences, racing, and eco-conscious cruising. The superyacht segment, characterized by its high-end luxury offerings, continues to grow as wealthy individuals seek unique and extravagant experiences on the water, with strong demand for vessels above 24 meters featuring extensive amenities and long-range cruising capability.

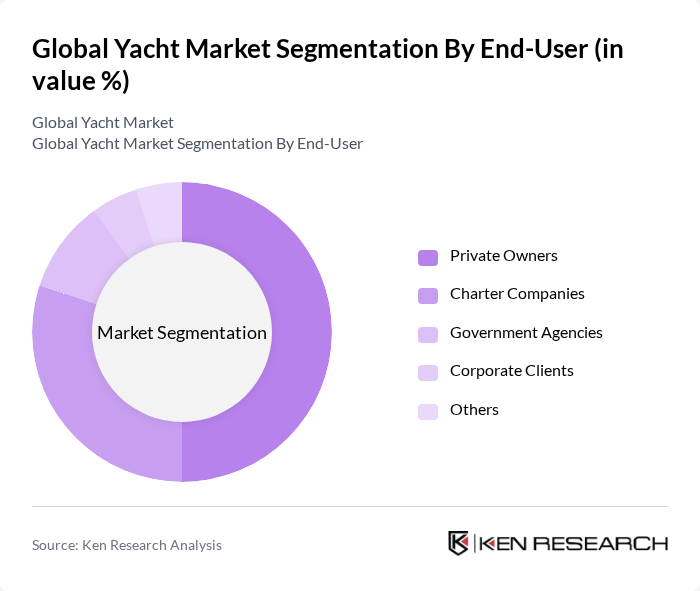

By End-User:The yacht market is also segmented by end-user categories, including private owners, charter companies, government agencies, corporate clients, and others. Private owners dominate the market, driven by the increasing number of high-net-worth and ultra-high-net-worth individuals seeking personal leisure vessels, second-home-on-water concepts, and highly customized yachts. Charter companies are also significant players, capitalizing on the growing trend of yacht rentals for vacations, experiential tourism, and events, and benefiting from platforms that make short-term and crewed charters more accessible. Government agencies and corporate clients utilize yachts for various purposes, including research, tourism promotion, hospitality, and corporate events, contributing to the overall market growth.

The Global Yacht Market is characterized by a dynamic mix of regional and international players. Leading participants such as Azimut-Benetti Group, Ferretti Group, Sunseeker International, Princess Yachts, Lürssen, Feadship, Gulf Craft, Sanlorenzo, Beneteau Group, Brunswick Corporation, Viking Yachts, Hatteras Yachts, Catalina Yachts, Hanse Yachts AG, Lagoon Catamarans contribute to innovation, geographic expansion, and service delivery in this space.

The future of the yacht market appears promising, driven by increasing consumer interest in luxury leisure activities and technological advancements. As disposable incomes rise, more individuals are likely to invest in yachts, while the demand for eco-friendly options will shape manufacturing trends. Additionally, the integration of smart technologies in yacht design will enhance user experience, making yachts more appealing. Overall, the market is poised for growth, with evolving consumer preferences and regulatory landscapes influencing its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Yachts Sailing Yachts Catamarans Superyachts Others |

| By End-User | Private Owners Charter Companies Government Agencies Corporate Clients Others |

| By Size | Small Yachts (up to 30 feet) Medium Yachts (30 to 60 feet) Large Yachts (over 60 feet) Others |

| By Material | Fiberglass Aluminum Steel Wood Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Usage | Recreational Commercial Research and Survey Others |

| By Technology | Navigation Systems Communication Systems Safety Equipment Entertainment Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Motor Yachts | 120 | Yacht Owners, Brokers, and Dealers |

| Sailing Yachts | 90 | Enthusiasts, Sailing Club Members, and Manufacturers |

| Superyacht Market | 40 | High Net-Worth Individuals, Charter Companies |

| Yacht Maintenance Services | 70 | Service Providers, Yacht Managers, and Technicians |

| Yacht Financing and Insurance | 60 | Financial Advisors, Insurance Brokers, and Yacht Owners |

The Global Yacht Market is valued at approximately USD 12.5 billion, driven by increasing disposable incomes, a growing interest in luxury leisure activities, and advancements in yacht technology. This market is expected to continue its growth trajectory in the coming years.