Region:Middle East

Author(s):Shubham

Product Code:KRAC2244

Pages:92

Published On:October 2025

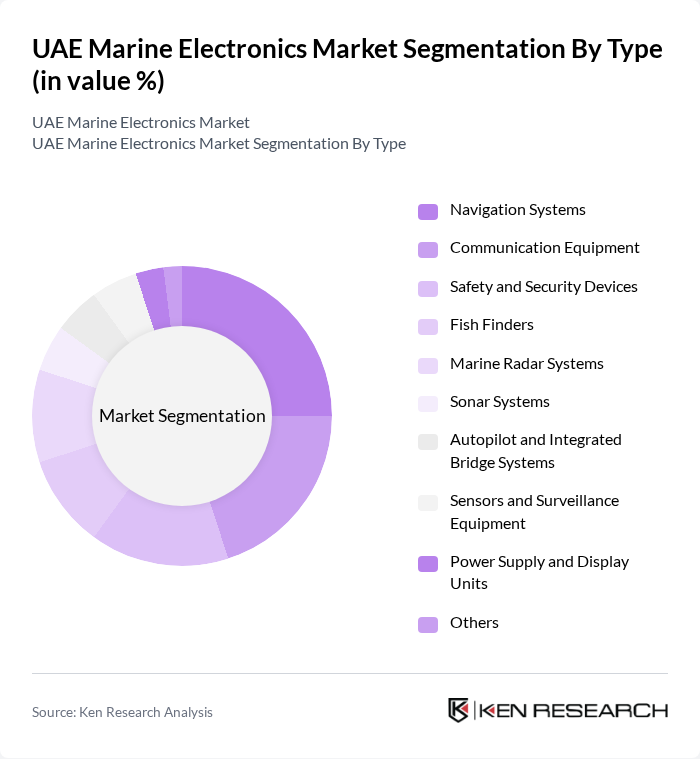

By Type:The market is segmented into various types of marine electronics, including navigation systems, communication equipment, safety and security devices, fish finders, marine radar systems, sonar systems, autopilot and integrated bridge systems, sensors and surveillance equipment, power supply and display units, and others. Each of these subsegments plays a crucial role in enhancing the functionality and safety of marine operations. Hardware remains the largest revenue-generating segment, reflecting the ongoing investment in physical navigation and safety infrastructure .

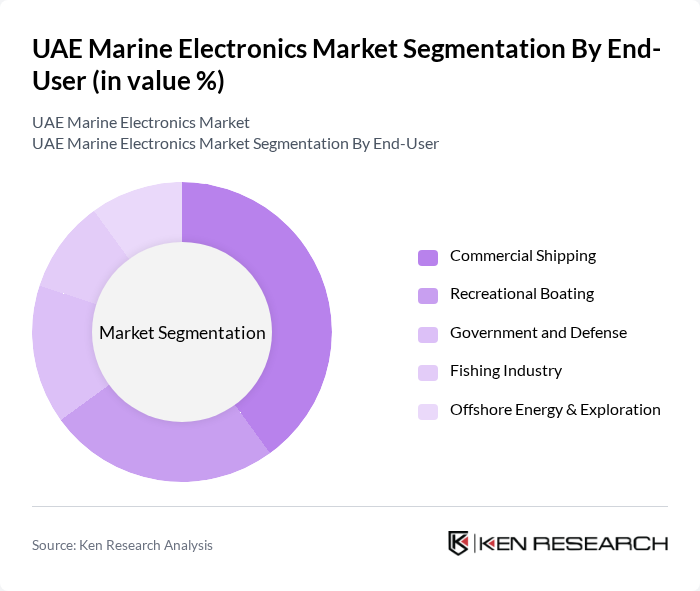

By End-User:The end-user segmentation includes commercial shipping, recreational boating, government and defense, fishing industry, and offshore energy & exploration. Each segment has unique requirements and contributes differently to the overall market dynamics. Commercial shipping remains the dominant end-user, driven by regulatory compliance and the need for operational efficiency, while recreational boating continues to grow due to tourism and leisure trends .

The UAE Marine Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garmin Ltd., Raymarine (FLIR Systems, Inc.), Furuno Electric Co., Ltd., Navico Group, Simrad Yachting, B&G, Lowrance, KVH Industries, Inc., Airmar Technology Corporation, JRC (Japan Radio Co., Ltd.), Icom Inc., Standard Horizon (Yaesu Musen Co., Ltd.), Ocean Signal Ltd., Vesper Marine, Digital Yacht Ltd., SRT Marine Systems plc, Ultra Electronics Holdings plc, Thales Group, Northrop Grumman Corporation, Kongsberg Gruppen ASA, and Wartsila SAM Electronics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE marine electronics market appears promising, driven by ongoing technological advancements and increasing maritime activities. The rise of autonomous marine vehicles and the integration of cloud-based solutions are expected to reshape the industry landscape. Additionally, enhanced cybersecurity measures will become critical as digitalization increases. As the UAE continues to invest in maritime infrastructure, the market is poised for significant growth, fostering innovation and attracting global players to the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Navigation Systems Communication Equipment Safety and Security Devices Fish Finders Marine Radar Systems Sonar Systems Autopilot and Integrated Bridge Systems Sensors and Surveillance Equipment Power Supply and Display Units Others |

| By End-User | Commercial Shipping Recreational Boating Government and Defense Fishing Industry Offshore Energy & Exploration |

| By Application | Navigation Communication Surveillance Safety Automation & Control |

| By Distribution Channel | Direct Sales Online Retail Distributors and Resellers |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Analog Technology Digital Technology Hybrid Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Electronics | 100 | Fleet Managers, Marine Operations Directors |

| Recreational Boating Equipment | 70 | Boat Owners, Marine Retailers |

| Marine Safety Systems | 60 | Safety Officers, Compliance Managers |

| Navigation and Communication Devices | 80 | Marine Engineers, Technical Support Staff |

| Marine Electronics Maintenance Services | 50 | Service Managers, Technicians |

The UAE Marine Electronics Market is valued at approximately USD 125 million, reflecting a significant growth driven by the increasing demand for advanced navigation and communication systems, as well as the expansion of the maritime industry in the region.