Region:Asia

Author(s):Dev

Product Code:KRAB0580

Pages:85

Published On:August 2025

By Card Type:The credit card market can be segmented into General Purpose Credit Cards and Specialty & Other Credit Cards. General Purpose Credit Cards are widely used for everyday transactions, while Specialty & Other Credit Cards cater to specific consumer needs, such as travel rewards or cashback offers. The General Purpose segment dominates the market due to its versatility and broad acceptance across various merchants.

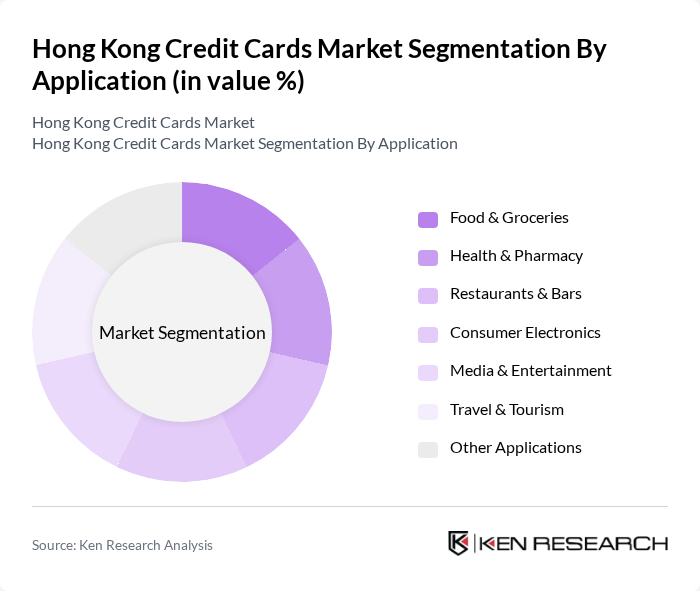

By Application:The applications of credit cards can be categorized into Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, and Other Applications. The Food & Groceries segment leads the market, driven by the increasing trend of online grocery shopping and the convenience of using credit cards for daily purchases.

The Hong Kong Credit Cards Market is characterized by a dynamic mix of regional and international players. Leading participants such as HSBC Holdings plc, Standard Chartered Bank (Hong Kong) Limited, Citibank (Hong Kong) Limited, Bank of China (Hong Kong) Limited, Hang Seng Bank Limited, DBS Bank (Hong Kong) Limited, China Construction Bank (Asia) Corporation Limited, OCBC Wing Hang Bank Limited, United Overseas Bank (UOB) Hong Kong, American Express International, Inc., Citigroup Inc., JPMorgan Chase & Co., Maybank Hong Kong Limited, CMB Wing Lung Bank Limited, Shanghai Commercial Bank Limited, PrimeCredit Limited, AEON Credit Service (Asia) Co., Ltd., Dah Sing Bank, Limited, Fubon Bank (Hong Kong) Limited, Public Bank (Hong Kong) Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Hong Kong credit card market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in fraud detection is expected to enhance security, while the shift towards mobile wallets will further streamline payment processes. Additionally, as consumers increasingly seek personalized financial products, credit card issuers will likely focus on tailored offerings to meet diverse customer needs, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Card Type | General Purpose Credit Cards Specialty & Other Credit Cards |

| By Application | Food & Groceries Health & Pharmacy Restaurants & Bars Consumer Electronics Media & Entertainment Travel & Tourism Other Applications |

| By Provider | Visa MasterCard Other Providers |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Pricing Strategy | Low-Interest Rate Cards High-Reward Cards No Annual Fee Cards |

| By Customer Segment | Millennials Gen X Baby Boomers Gen Z |

| By Distribution Channel | Online Applications Bank Branches Financial Advisors Digital Wallet/FinTech Platforms |

| By Loyalty Programs | Cashback Programs Points-Based Rewards Travel Miles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Consumer Credit Card Usage | 120 | Cardholders aged 18-65, diverse income levels |

| High-Value Transaction Users | 60 | Frequent travelers, premium cardholders |

| Small Business Credit Card Holders | 40 | Small business owners, financial decision-makers |

| Millennial and Gen Z Users | 80 | Young professionals, tech-savvy consumers |

| Financial Advisors and Experts | 40 | Financial planners, investment consultants |

The Hong Kong Credit Cards Market is valued at approximately USD 112 billion, driven by increased consumer spending, the adoption of digital payment solutions, and a growing trend towards cashless transactions, particularly in online shopping and e-commerce.