Region:Asia

Author(s):Shubham

Product Code:KRAC0743

Pages:100

Published On:August 2025

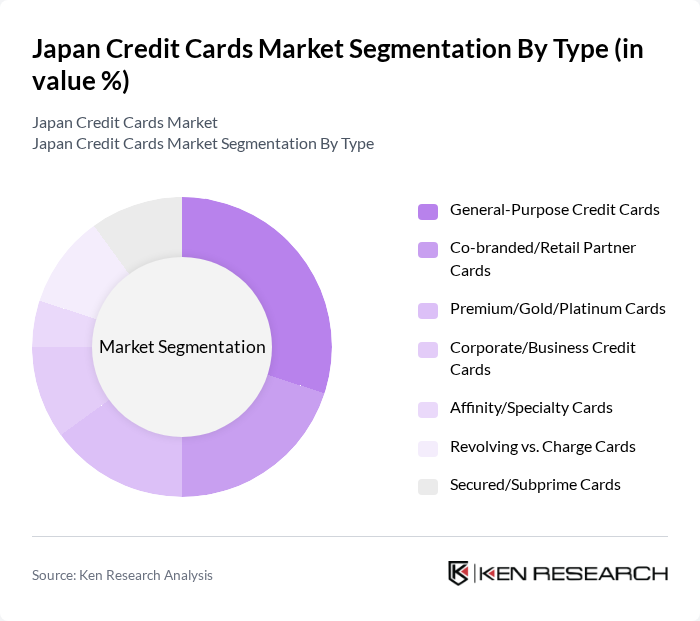

By Type:The credit card market can be segmented into various types, including general-purpose credit cards, co-branded/retail partner cards, premium/gold/platinum cards, corporate/business credit cards, affinity/specialty cards, revolving vs. charge cards, and secured/subprime cards. Each type serves different consumer needs and preferences, influencing market dynamics.

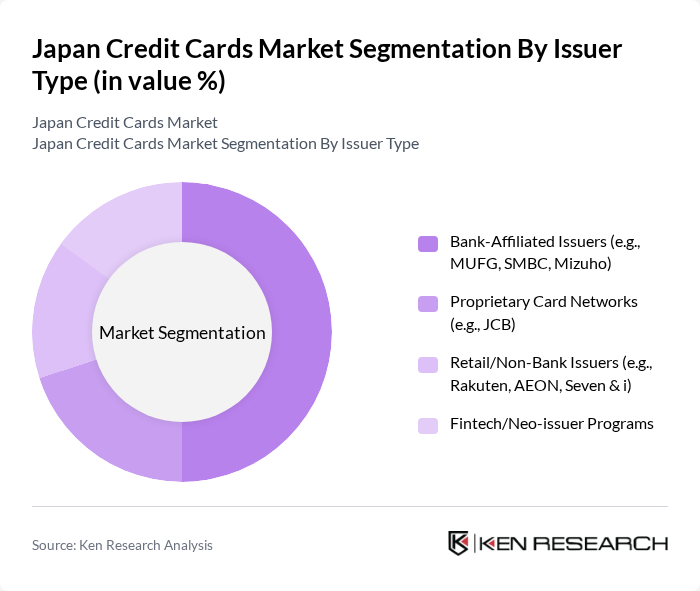

By Issuer Type:The market can also be segmented by issuer type, which includes bank-affiliated issuers, proprietary card networks, retail/non-bank issuers, and fintech/neo-issuer programs. Each issuer type plays a crucial role in the distribution and accessibility of credit cards to consumers.

The Japan Credit Cards Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi UFJ NICOS Co., Ltd., JCB Co., Ltd., Sumitomo Mitsui Card Co., Ltd., Rakuten Card Co., Ltd., AEON Credit Service Co., Ltd., Credit Saison Co., Ltd., Orico (Orient Corporation), Seven Card Service Co., Ltd., Mizuho Bank, Ltd. (Mizuho JCB/Mizuho Card Partnerships), Resona Card Co., Ltd., Shinsei Bank, Ltd. (Aplus Co., Ltd. Group), UC Card Co., Ltd. (SMBC Group), PayPay Card Corporation, Toyota Finance Corporation, View Card (East Japan Railway Company) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan credit card market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As mobile payment solutions gain traction, financial institutions will likely enhance their digital offerings to meet consumer demands for convenience and security. Additionally, the focus on sustainability will shape product development, with more issuers adopting eco-friendly practices. These trends indicate a dynamic market landscape, where innovation and consumer-centric strategies will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | General-Purpose Credit Cards Co-branded/Retail Partner Cards Premium/Gold/Platinum Cards Corporate/Business Credit Cards Affinity/Specialty Cards Revolving vs. Charge Cards Secured/Subprime Cards |

| By Issuer Type | Bank-Affiliated Issuers (e.g., MUFG, SMBC, Mizuho) Proprietary Card Networks (e.g., JCB) Retail/Non-Bank Issuers (e.g., Rakuten, AEON, Seven & i) Fintech/Neo-issuer Programs |

| By Application | Food & Groceries Health & Pharmacy Restaurants & Bars Consumer Electronics Media & Entertainment Travel & Tourism Other Applications |

| By Customer Segment | Mass Market Affluent/HNW SMEs Students/Young Adults |

| By Distribution Channel | Digital Onboarding (Web/App) Bank Branches Retail/Partner Stores Third-Party Brokers/Affiliates |

| By Technology | EMV Chip & PIN Contactless (NFC/Tap-to-Pay) Mobile Wallet Tokenization (Apple Pay/Google Pay/Osaifu-Keitai) D Secure & Strong Customer Authentication |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 120 | General Consumers, Young Professionals |

| Small Business Credit Card Adoption | 90 | Small Business Owners, Financial Managers |

| Corporate Credit Card Programs | 60 | Corporate Treasurers, Procurement Officers |

| Fintech Innovations in Credit Cards | 60 | Fintech Executives, Product Development Managers |

| Consumer Attitudes Towards Digital Payments | 100 | Tech-Savvy Consumers, Millennials |

The Japan Credit Cards Market is valued at approximately USD 650 billion, driven by the increasing adoption of cashless transactions, a shift towards digital payments, and the growth of e-commerce platforms.