Region:Asia

Author(s):Rebecca

Product Code:KRAA4580

Pages:86

Published On:September 2025

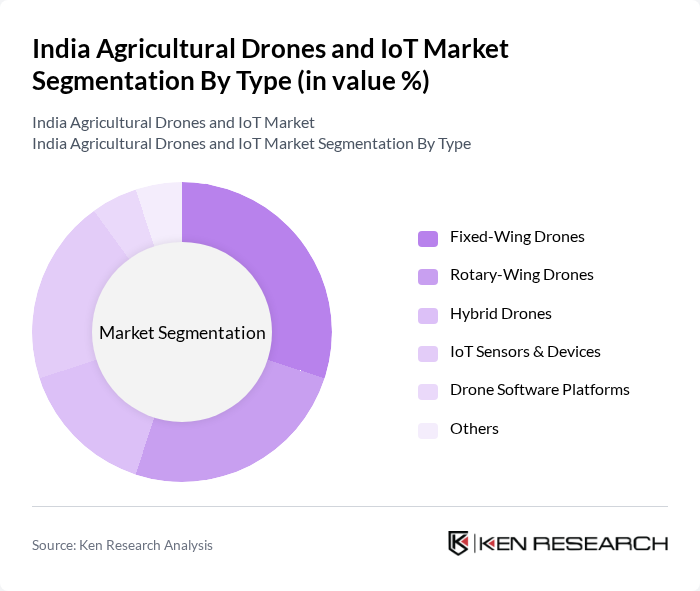

By Type:The market is segmented into Fixed-Wing Drones, Rotary-Wing Drones, Hybrid Drones, IoT Sensors & Devices, Drone Software Platforms, and Others. Among these,Fixed-Wing Dronesare gaining traction due to their ability to cover large areas efficiently, making them ideal for extensive agricultural fields.Rotary-Wing Dronesare preferred for their maneuverability and versatility in smaller plots. The demand forIoT Sensors & Devicesis rising, as they provide critical data for precision farming, including real-time soil health, moisture, and crop status. Drone Software Platforms are increasingly used for data analytics, mapping, and decision support, while Hybrid Drones and other solutions address specialized operational needs .

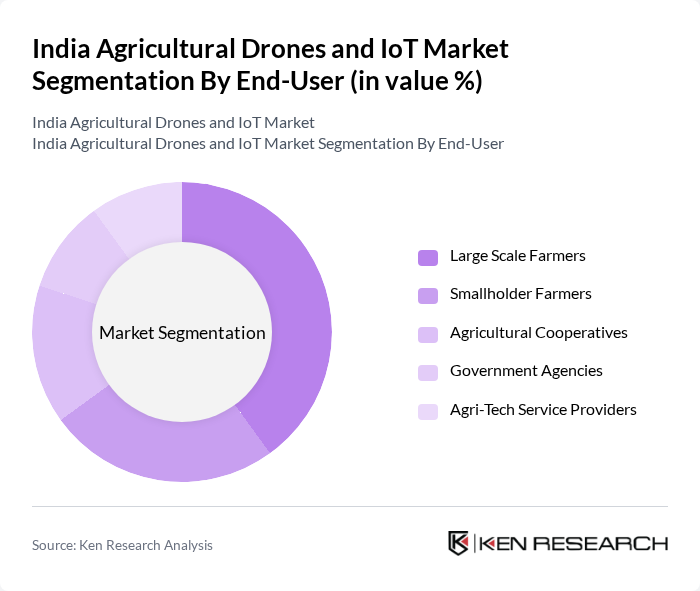

By End-User:The end-user segmentation includes Large Scale Farmers, Smallholder Farmers, Agricultural Cooperatives, Government Agencies, and Agri-Tech Service Providers.Large Scale Farmersdominate the market due to their capacity to invest in advanced technologies and the need for efficient resource management.Smallholder Farmersare increasingly adopting these technologies as costs decrease and awareness grows, supported by affordable IoT devices and government initiatives.Agricultural Cooperativesplay a significant role in facilitating access to drones and IoT solutions for smaller farmers, while Government Agencies and Agri-Tech Service Providers drive adoption through policy support and technology deployment .

The India Agricultural Drones and IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garuda Aerospace Pvt. Ltd., IoTechWorld Avigation Pvt. Ltd., Marut Drones, General Aeronautics Pvt. Ltd., Omnipresent Robot Tech Pvt. Ltd., Roter Precision Instruments Pvt. Ltd., Aarav Unmanned Systems Pvt. Ltd. (AUS), Thanos Technologies Pvt. Ltd., Skylark Drones Pvt. Ltd., Senseacre Labs Pvt. Ltd., Farmonaut Technologies Pvt. Ltd., AgriGator Technologies Pvt. Ltd., Fuselage Innovations Pvt. Ltd., BharatRohan Airborne Innovations Pvt. Ltd., Amber Wings (IIT Madras Spin-off) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India agricultural drones and IoT market appears promising, driven by technological advancements and increasing government support. In future, the integration of AI and machine learning into agricultural practices is expected to enhance operational efficiency and decision-making. Furthermore, as awareness of sustainable farming practices grows, farmers are likely to adopt these technologies to optimize resource use and minimize environmental impact, paving the way for a more resilient agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Rotary-Wing Drones Hybrid Drones IoT Sensors & Devices Drone Software Platforms Others |

| By End-User | Large Scale Farmers Smallholder Farmers Agricultural Cooperatives Government Agencies Agri-Tech Service Providers |

| By Region | North India South India East India West India Central India |

| By Technology | Remote Sensing Technology Data Analytics Platforms Cloud Computing Solutions Artificial Intelligence & Machine Learning Others |

| By Application | Crop Monitoring & Health Assessment Precision Spraying (Fertilizers/Herbicides/Pesticides) Soil Analysis & Nutrient Mapping Livestock Monitoring Automated Survey & Field Mapping Pest & Disease Detection |

| By Investment Source | Private Investments Government Grants International Funding Corporate/Strategic Investments Others |

| By Policy Support | Subsidies for Drone Purchases Tax Incentives for Agri-Tech Investments Research and Development Grants Pilot Project Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Users | 80 | Farmers, Agronomists, Agricultural Technologists |

| IoT Solutions in Agriculture | 70 | IoT Solution Providers, Farm Managers, Data Analysts |

| Government Agricultural Policy Makers | 40 | Policy Advisors, Agricultural Officers, Regulatory Experts |

| Research Institutions and Universities | 50 | Researchers, Professors, Agricultural Scientists |

| Agri-tech Startups | 40 | Startup Founders, Product Managers, Business Development Executives |

The India Agricultural Drones and IoT Market is valued at approximately USD 2.5 billion, driven by the adoption of precision agriculture techniques that enhance crop yield and reduce resource wastage.