Region:Asia

Author(s):Geetanshi

Product Code:KRAB3365

Pages:86

Published On:October 2025

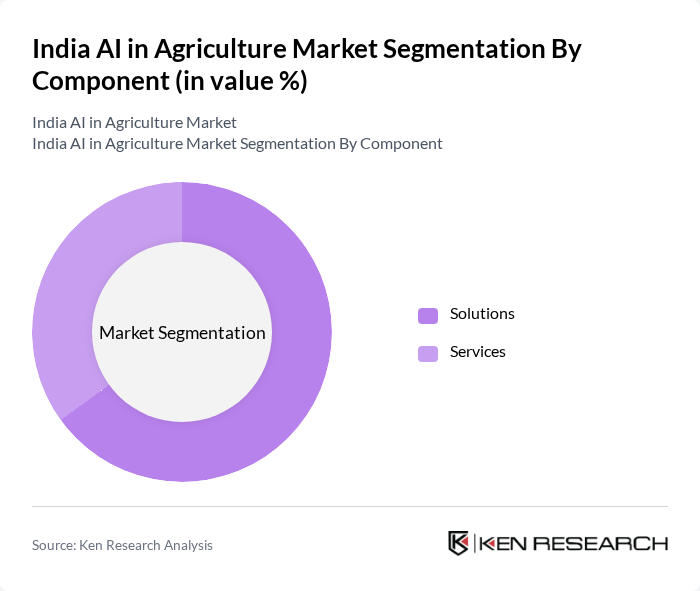

By Component:This segmentation includes two subsegments: Solutions and Services. The Solutions subsegment encompasses various AI-driven tools and software designed to enhance agricultural productivity, such as crop monitoring platforms, yield prediction models, and automated irrigation systems. The Services subsegment includes consulting, technical support, and training services that help farmers implement these technologies effectively. The Solutions subsegment is currently leading the market due to the increasing demand for innovative tools that provide real-time data, analytics, and actionable insights to farmers, enabling more precise and efficient farm management .

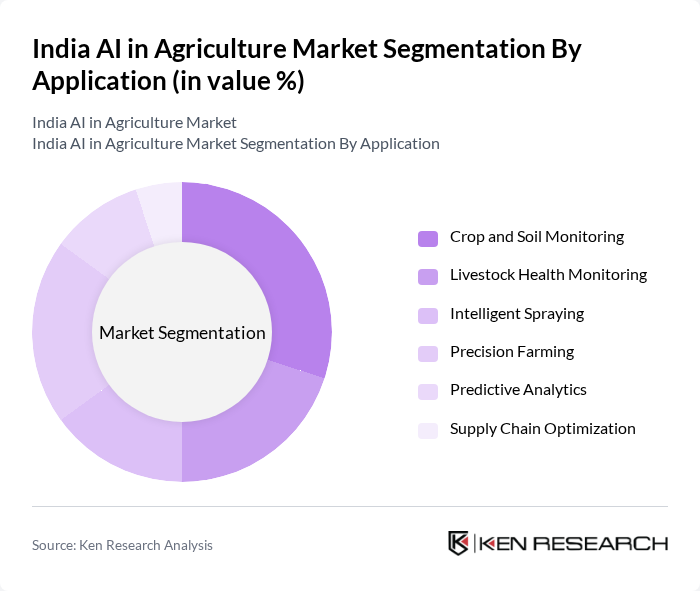

By Application:This segmentation includes Crop and Soil Monitoring, Livestock Health Monitoring, Intelligent Spraying, Precision Farming, Predictive Analytics, and Supply Chain Optimization. Among these, Crop and Soil Monitoring is the leading application, driven by the need for efficient resource management and enhanced crop yields. Farmers are increasingly utilizing AI technologies to monitor soil health, detect pest infestations, and assess crop conditions, which is crucial for sustainable agricultural practices. Precision Farming and Livestock Health Monitoring are also witnessing significant adoption due to their impact on input optimization and animal welfare .

The India AI in Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as CropIn Technology Solutions, AgroStar, Ninjacart, DeHaat, Intello Labs, Fasal, Skymet Weather Services, Aibono Smart Farming, Gramophone, Stellapps Technologies, Satsure Analytics, Eruvaka Technologies, Kisan Network, Cropin Technology, Agribazaar contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in agriculture in India appears promising, driven by technological advancements and increasing government support. As precision farming techniques gain traction, farmers are expected to adopt AI solutions more widely, enhancing productivity and sustainability. The integration of AI with IoT technologies will further streamline operations, enabling real-time data analysis. Additionally, collaborations between agricultural stakeholders and tech startups are likely to foster innovation, creating a more resilient agricultural ecosystem that can adapt to changing market demands and environmental challenges.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services |

| By Application | Crop and Soil Monitoring Livestock Health Monitoring Intelligent Spraying Precision Farming Predictive Analytics Supply Chain Optimization |

| By Technology | Machine Learning Computer Vision Natural Language Processing Robotics and Automation IoT Sensors |

| By Farm Size | Small and Marginal Farmers Medium Scale Farmers Large Scale Commercial Farms |

| By End-User | Individual Farmers Agricultural Cooperatives Agribusiness Companies Government Agencies |

| By Region | North India South India East India West India |

| By Deployment Mode | Cloud-based On-premise Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Adoption in Crop Management | 120 | Farmers, Agronomists, AI Solution Providers |

| Precision Agriculture Technologies | 90 | Agricultural Engineers, Technology Developers |

| AI in Livestock Management | 60 | Livestock Farmers, Veterinary Experts |

| Data Analytics for Yield Prediction | 50 | Data Scientists, Agricultural Analysts |

| Government Policy Impact on AI Adoption | 40 | Policy Makers, Agricultural Economists |

The India AI in Agriculture Market is valued at approximately USD 70 million, driven by the adoption of advanced technologies like AI-powered precision farming, drone analytics, and IoT-based crop monitoring, which enhance productivity and efficiency in farming practices.