Region:Global

Author(s):Rebecca

Product Code:KRAA2945

Pages:95

Published On:August 2025

By Type:The AI in agriculture market is segmented into various types, including Crop Monitoring Solutions, Soil Management Tools, Pest Control Systems, Yield Prediction Software, Livestock Management Solutions, Farm Management Software, Agricultural Robotics & Automation, Weather Forecasting & Climate Analytics, and Others. Crop Monitoring Solutions hold the largest share, driven by their ability to provide real-time analytics from aerial imagery and multispectral sensors, enabling early detection of crop stress and accurate yield forecasting. The growing demand for precision agriculture and sustainable farming practices is accelerating the adoption of these solutions, with over 42% of use cases centered on crop monitoring .

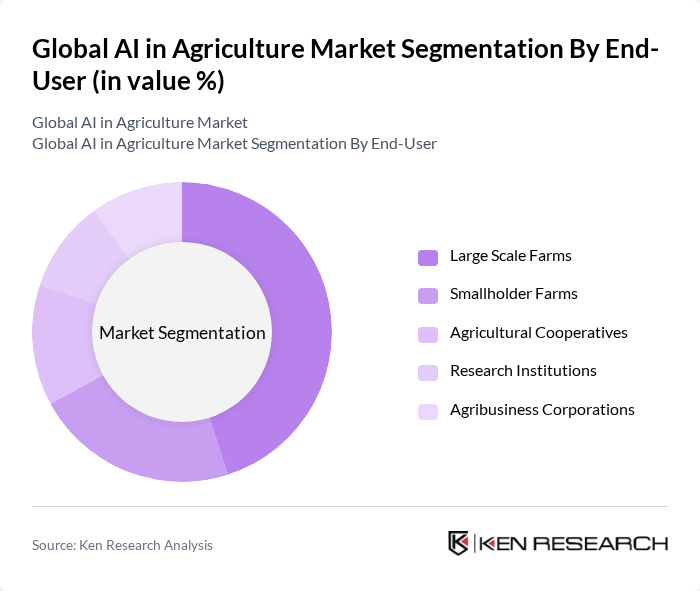

By End-User:The market is also segmented by end-user categories, which include Large Scale Farms, Smallholder Farms, Agricultural Cooperatives, Research Institutions, and Agribusiness Corporations. Large Scale Farms dominate this segment, accounting for the largest share due to their capacity to invest in advanced AI technologies and infrastructure. The trend toward automation and data-driven decision-making in large agricultural operations is propelling the growth of AI solutions tailored for these users, with significant adoption in North America and Europe .

The Global AI in Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Trimble Inc., AG Leader Technology, Bayer AG, John Deere, CNH Industrial N.V., BASF SE, Syngenta AG, Taranis, CropX Technologies, PrecisionHawk, Raven Industries, Farmers Edge Inc., AeroFarms, Granular (a Corteva Agriscience company), Prospera Technologies, FarmWise Labs Inc., Sentera, Climate LLC (a subsidiary of Bayer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in agriculture is poised for transformative growth, driven by technological advancements and increasing consumer demand for sustainable practices. As farmers adopt AI solutions, we can expect enhanced crop yields and resource efficiency. Additionally, the integration of AI with IoT devices will facilitate real-time monitoring and data analysis, further optimizing agricultural operations. The focus on sustainable agriculture will also lead to innovations that minimize environmental impact while maximizing productivity, ensuring a resilient agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Crop Monitoring Solutions Soil Management Tools Pest Control Systems Yield Prediction Software Livestock Management Solutions Farm Management Software Agricultural Robotics & Automation Weather Forecasting & Climate Analytics Others |

| By End-User | Large Scale Farms Smallholder Farms Agricultural Cooperatives Research Institutions Agribusiness Corporations |

| By Application | Crop Management Livestock Monitoring Supply Chain Management Market Forecasting Precision Irrigation Disease & Pest Detection Farm Resource Optimization |

| By Distribution Channel | Direct Sales Online Platforms Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investments Government Grants Venture Capital |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Research and Development Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Precision Agriculture Technologies | 120 | Agricultural Technologists, Farm Managers |

| AI-Driven Crop Monitoring Solutions | 100 | Crop Scientists, Data Analysts |

| Livestock Management AI Tools | 80 | Livestock Farmers, Veterinary Technicians |

| AI in Supply Chain Optimization | 60 | Supply Chain Managers, Logistics Coordinators |

| AI Adoption in Sustainable Farming Practices | 90 | Sustainability Officers, Agricultural Policy Makers |

The Global AI in Agriculture Market is valued at approximately USD 4.7 billion, driven by the increasing adoption of advanced technologies in farming practices, such as precision agriculture and AI-enabled crop monitoring, which enhance productivity and efficiency.