Region:Asia

Author(s):Dev

Product Code:KRAB0429

Pages:89

Published On:August 2025

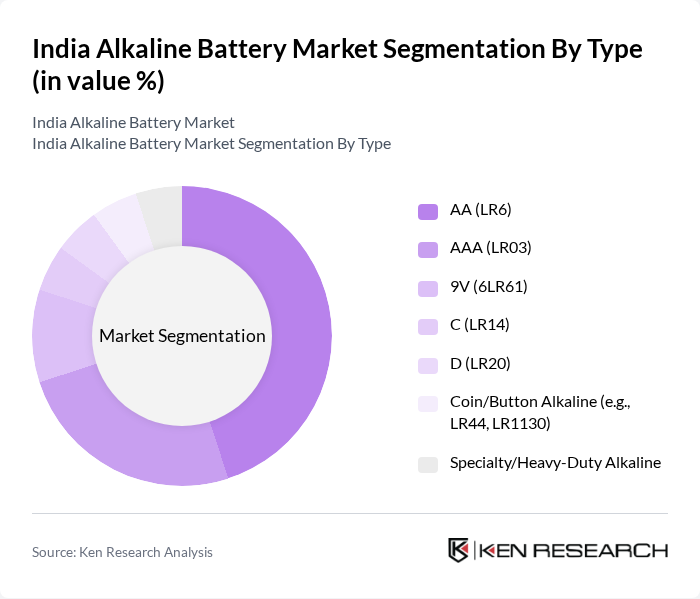

By Type:The alkaline battery market can be segmented into various types, including AA (LR6), AAA (LR03), 9V (6LR61), C (LR14), D (LR20), Coin/Button Alkaline (e.g., LR44, LR1130), and Specialty/Heavy-Duty Alkaline. Among these, AA batteries dominate the market due to their widespread use in consumer electronics and household devices; AA/AAA formats are the primary sizes for remotes, toys, flashlights, clocks, and small appliances in India, reflecting global usage patterns for primary alkaline cells.

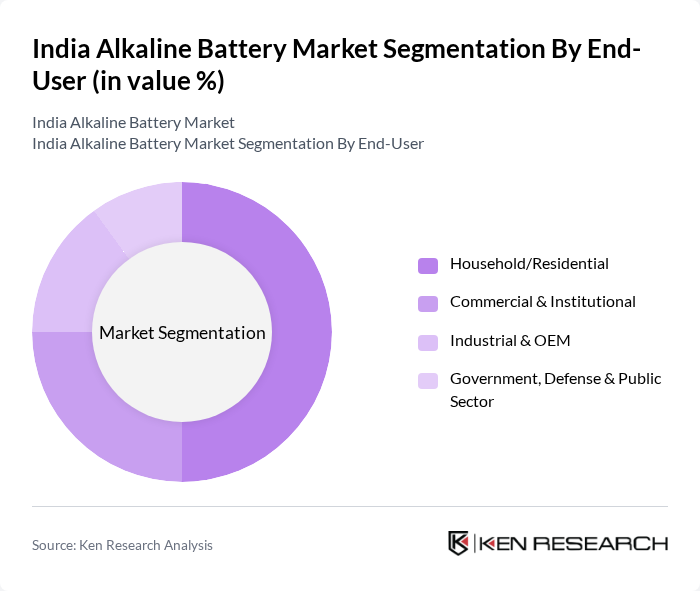

By End-User:The end-user segmentation includes Household/Residential, Commercial & Institutional (offices, education, healthcare), Industrial & OEM, and Government, Defense & Public Sector. The Household/Residential segment leads the market, driven by high consumption of primary alkaline batteries in remotes, toys, flashlights/torches, clocks, and small consumer electronics; continued urbanization and device proliferation sustain household-led demand.

The India Alkaline Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Duracell Inc., Energizer Holdings, Inc., Panasonic Energy India Co. Ltd. (Panasonic Group), Eveready Industries India Ltd., Indo National Limited (Nippo Batteries), GP Batteries International Limited, VARTA AG, Toshiba Lifestyle Electronics & Trading Corporation, Amara Raja Energy & Mobility Ltd. (consumer battery brands), Sony Corporation (legacy alkaline; brand-licensed lines), ACDelco (licensed consumer alkaline), Uniross Batteries, Maxell, Ltd. (Hitachi Maxell), Rayovac (Energizer brand family), Zebronics India Pvt. Ltd. (private label alkaline) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India alkaline battery market appears promising, driven by technological advancements and a shift towards sustainable energy solutions. As manufacturers invest in innovative battery technologies, the efficiency and lifespan of alkaline batteries are expected to improve significantly. Additionally, the increasing integration of alkaline batteries in electric vehicles and renewable energy systems will further enhance their market presence, aligning with India's commitment to a greener economy and sustainable development goals.

| Segment | Sub-Segments |

|---|---|

| By Type | AA (LR6) AAA (LR03) V (6LR61) C (LR14) D (LR20) Coin/Button Alkaline (e.g., LR44, LR1130) Specialty/Heavy-Duty Alkaline |

| By End-User | Household/Residential Commercial & Institutional (offices, education, healthcare) Industrial & OEM Government, Defense & Public Sector |

| By Region | North India South India East India West India |

| By Application | Consumer Electronics & Accessories (remotes, clocks, flashlights) Toys, Gaming & Smart Home Devices Medical & Healthcare Devices (glucometers, BP monitors) Professional/Industrial Devices (measuring instruments, safety devices) |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Compliance with Battery Waste Management Rules, 2022 GST & Customs Duty Incentives/Exemptions Extended Producer Responsibility (EPR) Mechanisms |

| By Distribution Channel | Online Marketplaces (Amazon, Flipkart, brand D2C) Modern Trade & Electronics Chains General Trade/Kirana & Pharmacies Institutional/B2B & Wholesale |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, R&D Heads |

| Automotive Battery Suppliers | 80 | Supply Chain Managers, Procurement Officers |

| Industrial Equipment Users | 70 | Operations Managers, Facility Managers |

| Retail Battery Distributors | 90 | Sales Managers, Marketing Directors |

| Renewable Energy Sector Stakeholders | 60 | Project Managers, Sustainability Officers |

The India Alkaline Battery Market is valued at approximately INR 110 billion, driven by the increasing demand for portable electronic devices, consumer electronics, and smart home devices, along with the advantages of alkaline batteries over traditional options.