Region:Asia

Author(s):Shubham

Product Code:KRAB5577

Pages:90

Published On:October 2025

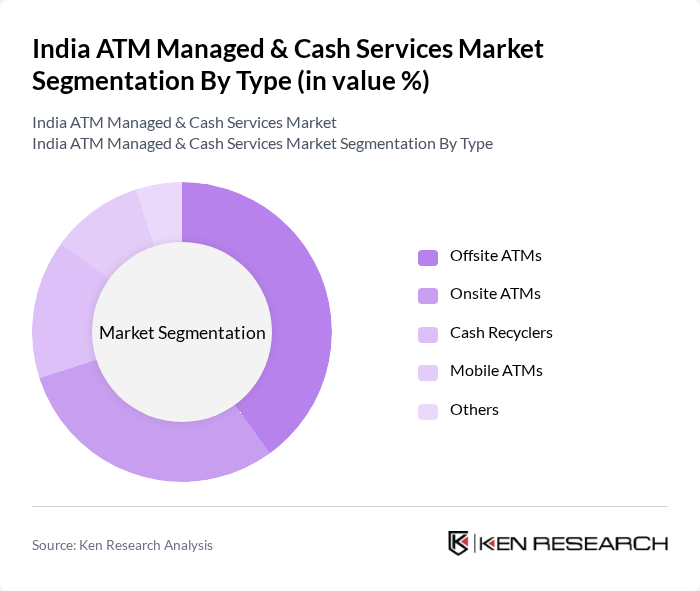

By Type:The market is segmented into various types, including Offsite ATMs, Onsite ATMs, Cash Recyclers, Mobile ATMs, and Others. Offsite ATMs are typically located in standalone locations, while Onsite ATMs are situated within bank branches or retail outlets. Cash Recyclers are gaining traction due to their ability to optimize cash management, and Mobile ATMs are increasingly used in events and remote areas. Each type serves distinct consumer needs and operational efficiencies.

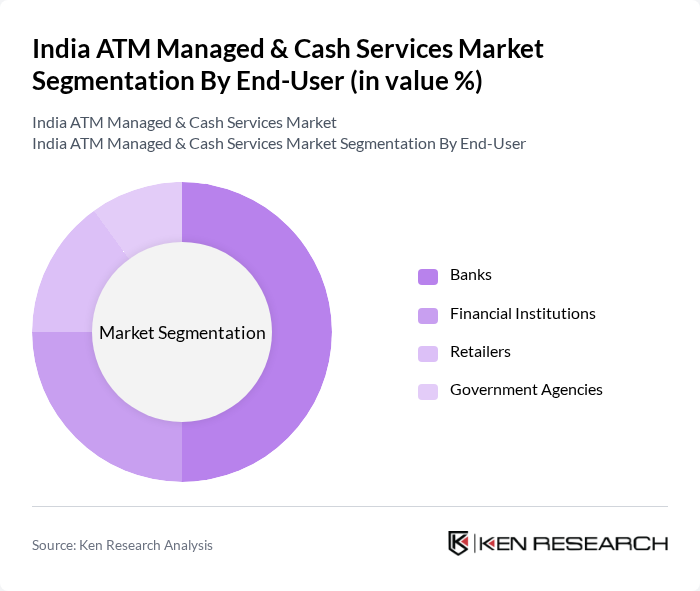

By End-User:The end-user segmentation includes Banks, Financial Institutions, Retailers, and Government Agencies. Banks are the primary users of ATM managed services, leveraging them to enhance customer service and operational efficiency. Financial institutions also utilize these services to manage cash flow effectively. Retailers benefit from ATMs to provide convenient cash access to customers, while government agencies use them for disbursing welfare payments and other services.

The India ATM Managed & Cash Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, AGS Transact Technologies Ltd., Euronet Worldwide, Inc., Hitachi Payment Services Pvt. Ltd., FSS (Financial Software and Systems), SREI Infrastructure Finance Ltd., CMS Info Systems Ltd., PayPoint India Network Pvt. Ltd., Avenues India Pvt. Ltd., Muthoot Finance Ltd., SBI Payment Services Pvt. Ltd., IndusInd Bank Ltd., Axis Bank Ltd., HDFC Bank Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India ATM managed and cash services market appears promising, driven by ongoing digital transformation and the integration of advanced technologies. As cash transactions remain prevalent, the demand for ATMs will persist, particularly in rural areas. Additionally, the collaboration between banks and fintech companies is expected to enhance service delivery, while the adoption of AI and data analytics will optimize cash management and improve customer experiences, ensuring the sector's resilience and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Offsite ATMs Onsite ATMs Cash Recyclers Mobile ATMs Others |

| By End-User | Banks Financial Institutions Retailers Government Agencies |

| By Region | North India South India East India West India |

| By Application | Cash Withdrawal Balance Inquiry Fund Transfer Bill Payments |

| By Service Type | Managed Services Cash Services Maintenance Services Others |

| By Payment Method | Debit Cards Credit Cards Mobile Payments Others |

| By Customer Segment | Individual Customers Small Businesses Corporates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban ATM Deployment | 150 | ATM Operations Managers, Bank Branch Managers |

| Rural Cash Services | 100 | Regional Managers, Cash Logistics Coordinators |

| Cash Management Solutions | 80 | Finance Officers, Treasury Managers |

| ATM Technology Providers | 70 | Product Development Managers, Technical Support Leads |

| Consumer ATM Usage Patterns | 120 | Retail Banking Customers, Financial Service Users |

The India ATM Managed & Cash Services Market is valued at approximately INR 305 billion, reflecting significant growth driven by increased demand for cash withdrawal services and the expansion of banking networks across urban and rural areas.