Region:Asia

Author(s):Dev

Product Code:KRAA1577

Pages:84

Published On:August 2025

By Type:The cookware market is segmented into various types, including pots and pans, pressure cookers, cookware sets, bakeware, cooking tools and racks, specialty/traditional cookware, and others. Among these, pots and pans, particularly kadai and tawa, dominate the market due to their versatility and essential role in Indian cooking. The increasing trend of home cooking has led to a surge in demand for these products, as they are fundamental for preparing a wide range of traditional dishes.

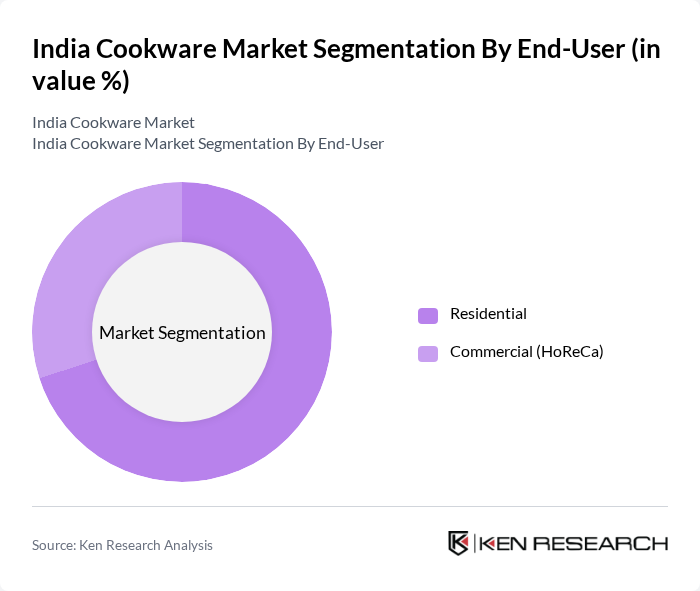

By End-User:The market is segmented into residential and commercial (HoReCa) end-users. The residential segment holds a significant share, driven by the increasing number of households and the growing trend of home cooking. Consumers are investing in quality cookware to enhance their cooking experience, leading to a rise in demand for various cookware products tailored for home use. The commercial segment, while smaller, is also growing as restaurants and hotels seek durable and efficient cookware solutions.

The India Cookware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal India (Groupe SEB India), TTK Prestige Limited, Hawkins Cookers Limited, Stovekraft Limited (Pigeon, Gilma), Milton (Hamilton Housewares Pvt. Ltd.), Cello World Ltd. (Cello Cookware), Wonderchef Home Appliances Pvt. Ltd., Borosil Limited (Borosil Cookware & Kitchenware), Vinod Intelligent Cookware (Sunraj Industries), Butterfly Gandhimathi Appliances Ltd., Anjali Kitchenware (Anjali) Pvt. Ltd., Meyer Housewares India (Circulon, Anolon), Futura (Hawkins Futura Non-stick), Neelam Stainless Steel (Neelam Cookware), Tupperware India Pvt. Ltd., Nirlep Appliances Pvt. Ltd. (Nirlep Cookware), Bergner India (Bergner, MasterPro), Alda India (Alda Triply Cookware), Pristine Kitchenware (Triply/SS Cookware), Stahl (Taashee Stainless Steel Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The India cookware market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. The rise of smart cookware, which integrates IoT technology, is expected to attract tech-savvy consumers. Additionally, the growing trend of health-conscious cooking will likely lead to increased demand for non-toxic, eco-friendly cookware options. As consumers become more aware of sustainability, brands that prioritize environmentally friendly practices will gain a competitive edge in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Pots & Pans (Kadai, Tawa, Saucepan, Casseroles) Pressure Cookers Cookware Sets Bakeware Cooking Tools & Racks Specialty/Traditional (Idli, Appam, Dosa, Paniyaram, Handi) Others |

| By End-User | Residential Commercial (HoReCa) |

| By Sales Channel | E-commerce Marketplaces Modern Trade (Hypermarkets/Supermarkets) Exclusive Brand Outlets & Company Webstores General Trade (Independent Retailers/Distributors) |

| By Material | Stainless Steel Aluminum (Hard Anodized, Triply) Non-stick Coated (PTFE/Ceramic) Cast Iron & Carbon Steel Copper & Tri-ply/5-ply Clad Glass/Ceramic/Stoneware & Others |

| By Price Range | Budget (Mass) Mid-range Premium (Aspirational/Imported) |

| By Brand Positioning | Mass/Value Bridge to Premium Premium/Luxury |

| By Compatibility/Features | Induction-Compatible Gas/Electric Compatible Dishwasher/Oven Safe Non-toxic/Coating-free |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Cookware | 150 | Homeowners, Cooking Enthusiasts |

| Retail Insights on Cookware Sales | 100 | Store Managers, Sales Executives |

| Manufacturing Trends in Cookware | 80 | Production Managers, Quality Control Officers |

| Distribution Channel Effectiveness | 70 | Logistics Coordinators, Supply Chain Analysts |

| Market Entry Strategies for New Brands | 60 | Brand Managers, Marketing Directors |

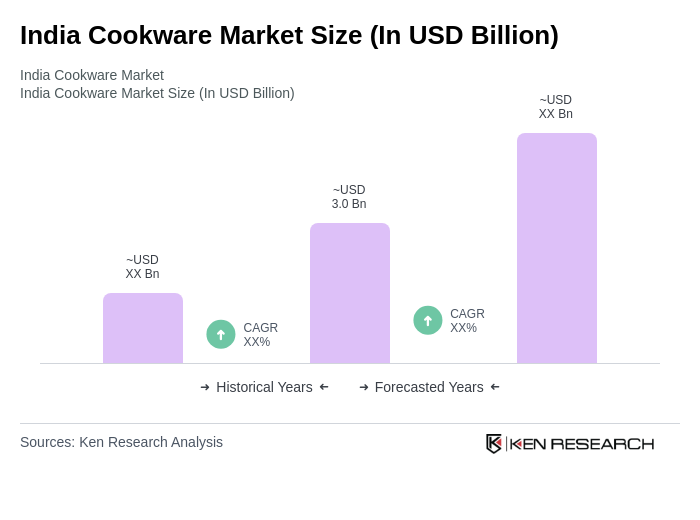

The India Cookware Market is valued at approximately USD 3.0 billion, driven by factors such as urbanization, rising disposable incomes, and a growing preference for home cooking and durable cookware options.