Region:Middle East

Author(s):Dev

Product Code:KRAA8366

Pages:83

Published On:November 2025

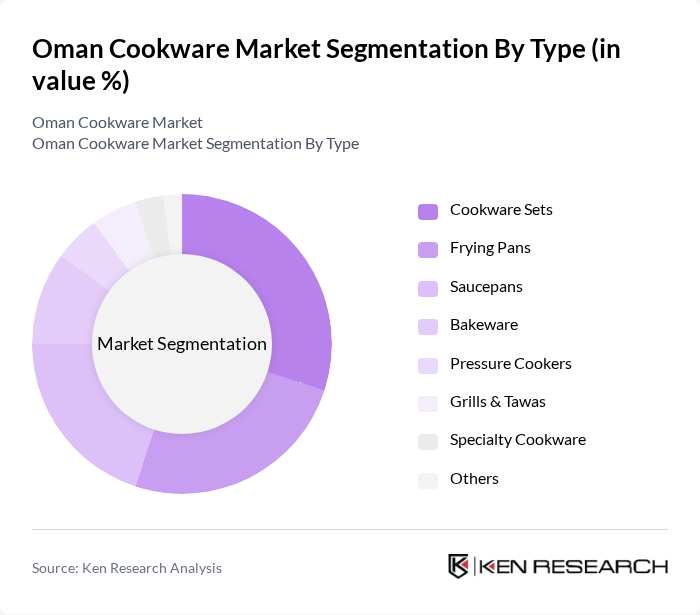

By Type:The cookware market is segmented into various types, including cookware sets, frying pans, saucepans, bakeware, pressure cookers, grills & tawas, specialty cookware, and others. Among these, cookware sets are particularly popular due to their convenience and value for money, appealing to both new and experienced cooks. Frying pans and saucepans also see significant demand as essential kitchen items for everyday cooking. The market is witnessing a growing trend towards induction-compatible and non-stick cookware, driven by consumer preferences for healthier and more efficient cooking solutions .

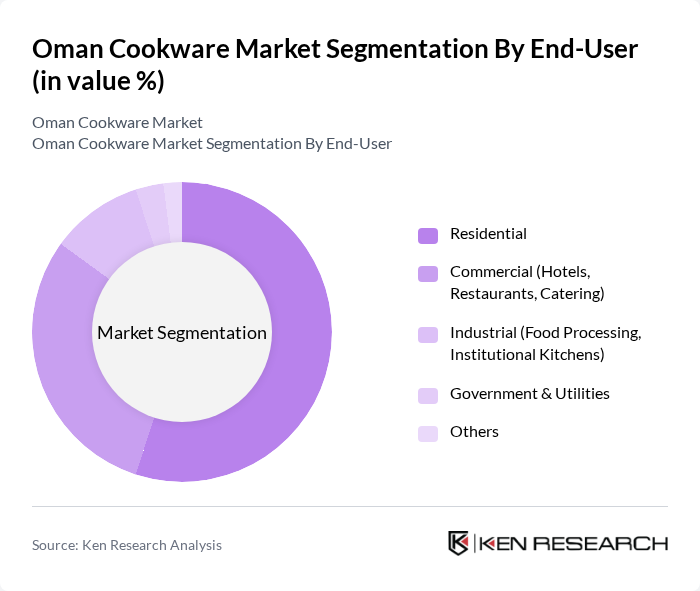

By End-User:The end-user segmentation includes residential, commercial (hotels, restaurants, catering), industrial (food processing, institutional kitchens), government & utilities, and others. The residential segment dominates the market, driven by the growing trend of home cooking and culinary exploration among consumers. Commercial establishments also contribute significantly, as they require durable and high-quality cookware for their operations. The industrial segment is expanding due to the growth of food processing and institutional catering services .

The Oman Cookware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal (Groupe SEB), Prestige (TTK Prestige Ltd.), Royalford (Western International Group), Pyrex (International Cookware), Le Creuset, Fissler, Tramontina, GreenPan (The Cookware Company), Vinod Cookware, Hawkins Cookers, Cuisinart, Scanpan, All-Clad, Royalford, Home Centre (Landmark Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman cookware market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious cooking practices gain traction, the demand for innovative cookware solutions is expected to rise. Additionally, the increasing penetration of e-commerce platforms will facilitate access to a broader range of products, enhancing consumer choice. The market is likely to witness a shift towards sustainable and smart cookware, aligning with global trends and consumer expectations for environmentally friendly and technologically advanced kitchen solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware Sets Frying Pans Saucepans Bakeware Pressure Cookers Grills & Tawas Specialty Cookware Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Catering) Industrial (Food Processing, Institutional Kitchens) Government & Utilities Others |

| By Material | Stainless Steel Non-Stick (PTFE, Ceramic Coated) Cast Iron & Enameled Cast Iron Aluminum Copper Ceramic Hard Anodized Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Supermarkets/Hypermarkets Specialty Stores (Cookware & Kitchenware) Direct Sales (Brand Outlets, Distributors) Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Usage Frequency | Daily Users Weekly Users Occasional Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cookware Sales | 100 | Store Managers, Sales Executives |

| Consumer Preferences Survey | 120 | Household Decision Makers, Cooking Enthusiasts |

| Manufacturer Insights | 60 | Production Managers, Quality Control Officers |

| Online Shopping Behavior | 80 | E-commerce Managers, Digital Marketing Specialists |

| Market Trend Analysis | 40 | Market Analysts, Industry Experts |

The Oman Cookware Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased consumer interest in home cooking, rising disposable incomes, and urbanization.