Region:Asia

Author(s):Shubham

Product Code:KRAB1043

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, and Others. Each of these segments plays a crucial role in safeguarding e-commerce platforms from cyber threats. Network Security and Cloud Security are particularly prominent due to the surge in cloud adoption and remote work, while Application Security and Identity and Access Management are increasingly prioritized to address vulnerabilities in digital payment systems and user authentication .

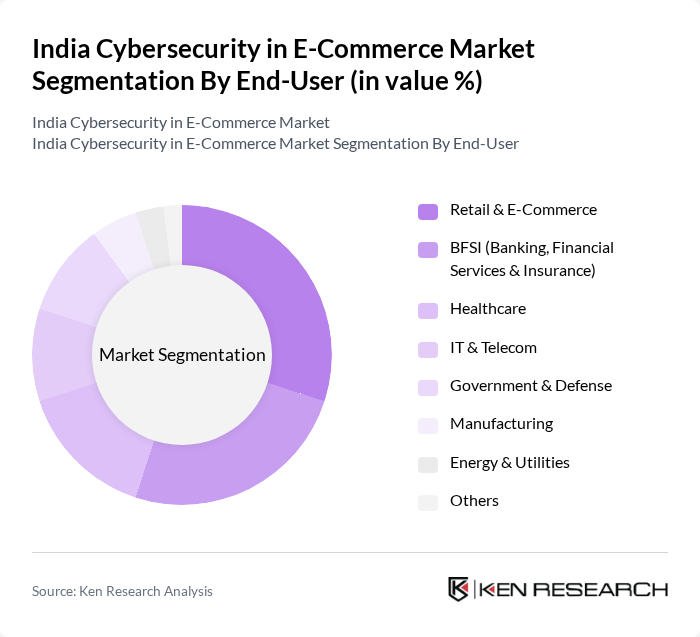

By End-User:The end-user segmentation includes Retail & E-Commerce, BFSI (Banking, Financial Services & Insurance), Healthcare, IT & Telecom, Government & Defense, Manufacturing, Energy & Utilities, and Others. Each sector has unique cybersecurity needs based on the nature of their operations and the sensitivity of the data they handle. Retail & E-Commerce and BFSI are the largest segments, reflecting the high volume of digital transactions and the critical importance of data protection in these industries. Healthcare and IT & Telecom are also experiencing increased cybersecurity investments due to the digitization of health records and the expansion of digital infrastructure .

The India Cybersecurity in E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services, Infosys Limited, Wipro Limited, HCL Technologies, Tech Mahindra, Paladion Networks, Quick Heal Technologies, McAfee India, Symantec India, Kaspersky Lab India, Check Point Software Technologies India, Trend Micro India, Cisco Systems India, Fortinet India, Palo Alto Networks India, Sophos India, IBM India, SecureLayer7, SISA Information Security, Lucideus (now Safe Security) contribute to innovation, geographic expansion, and service delivery in this space.

The future of cybersecurity in India's e-commerce market looks promising, driven by technological advancements and increasing regulatory pressures. As businesses adopt artificial intelligence and machine learning for threat detection, the landscape will evolve significantly. Additionally, the emphasis on data privacy and compliance with emerging regulations will shape the market. Companies that proactively invest in cybersecurity will not only protect their assets but also enhance consumer trust, positioning themselves favorably in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Others |

| By End-User | Retail & E-Commerce BFSI (Banking, Financial Services & Insurance) Healthcare IT & Telecom Government & Defense Manufacturing Energy & Utilities Others |

| By Region | North India South India East India West India |

| By Application | Payment Security Customer Data Protection Fraud Detection & Prevention Compliance Management Secure Digital Identity Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity in E-commerce Platforms | 150 | IT Security Managers, CTOs |

| Consumer Perceptions of Online Security | 120 | Online Shoppers, Digital Consumers |

| Regulatory Compliance in E-commerce | 100 | Compliance Officers, Legal Advisors |

| Investment Trends in Cybersecurity Solutions | 80 | Finance Managers, Procurement Heads |

| Impact of Cyber Threats on E-commerce | 60 | Risk Management Professionals, Business Analysts |

The India Cybersecurity in E-Commerce Market is valued at approximately USD 10 billion, driven by increasing online transactions, digitalization, and the rising sophistication of cyber threats. This growth reflects the urgent need for robust cybersecurity solutions across various sectors.