Region:Asia

Author(s):Rebecca

Product Code:KRAA4853

Pages:99

Published On:September 2025

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in addressing specific security challenges faced by e-commerce businesses.

The leading subsegment in this category is Network Security, which is crucial for protecting the integrity and confidentiality of data transmitted over networks. As e-commerce transactions increasingly move online, the demand for robust network security solutions has surged. Businesses are prioritizing investments in firewalls, intrusion detection systems, and secure VPNs to mitigate risks associated with cyber threats. This trend is driven by the need to comply with regulatory requirements and to maintain consumer trust in digital transactions.

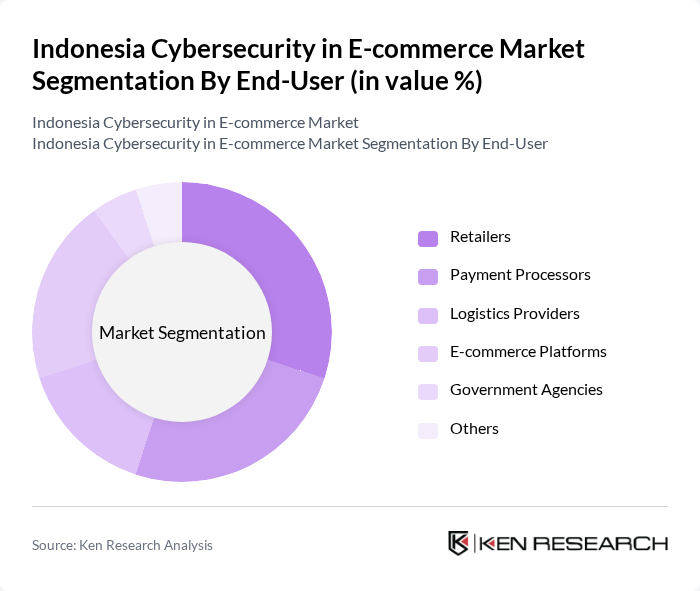

By End-User:The market is segmented by end-users, including Retailers, Payment Processors, Logistics Providers, E-commerce Platforms, Government Agencies, and Others. Each end-user category has unique cybersecurity needs based on their operational requirements and the nature of their transactions.

Retailers represent the dominant subsegment in the end-user category, driven by the rapid growth of online shopping and the increasing volume of transactions. As retailers expand their digital presence, they face heightened risks of cyberattacks, making cybersecurity a top priority. The need to protect customer data, payment information, and brand reputation has led retailers to invest significantly in comprehensive cybersecurity solutions tailored to their specific operational challenges.

The Indonesia Cybersecurity in E-commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Cyberindo Aditama, PT. Vaksincom, PT. Dwi Tunggal Putra, PT. Mitra Integrasi Informatika, PT. Indosat Tbk, PT. Telkom Indonesia, PT. Cyber Security Indonesia, PT. Synnex Metrodata Indonesia, PT. Aplikanusa Lintasarta, PT. Cipta Sangkala, PT. Solusi247, PT. Infinys System Indonesia, PT. Daya Cipta Mandiri, PT. Bhinneka Mentari Dimensi, PT. Metranet contribute to innovation, geographic expansion, and service delivery in this space.

As Indonesia's e-commerce sector continues to expand, the demand for cybersecurity solutions is expected to grow significantly. The increasing frequency of cyberattacks and the government's commitment to enhancing cybersecurity infrastructure will drive investments in advanced technologies. Additionally, the rise of digital payment systems and the collaboration between local firms and international cybersecurity experts will further strengthen the market. Overall, the future of cybersecurity in Indonesia's e-commerce landscape appears promising, with substantial growth opportunities on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Retailers Payment Processors Logistics Providers E-commerce Platforms Government Agencies Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Retail Financial Services Healthcare Telecommunications Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Compliance Standards | ISO 27001 PCI DSS GDPR Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small to Medium E-commerce Businesses | 100 | Owners, IT Managers |

| Large E-commerce Platforms | 80 | Chief Information Security Officers, IT Directors |

| Cybersecurity Solution Providers | 60 | Product Managers, Sales Directors |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Compliance Officers |

| Cybersecurity Consultants | 40 | Consultants, Analysts |

The Indonesia Cybersecurity in E-commerce Market is valued at approximately USD 1.2 billion, driven by the rapid growth of e-commerce platforms, increased internet penetration, and heightened awareness of cybersecurity threats among businesses and consumers.