Region:Asia

Author(s):Shubham

Product Code:KRAD0749

Pages:95

Published On:August 2025

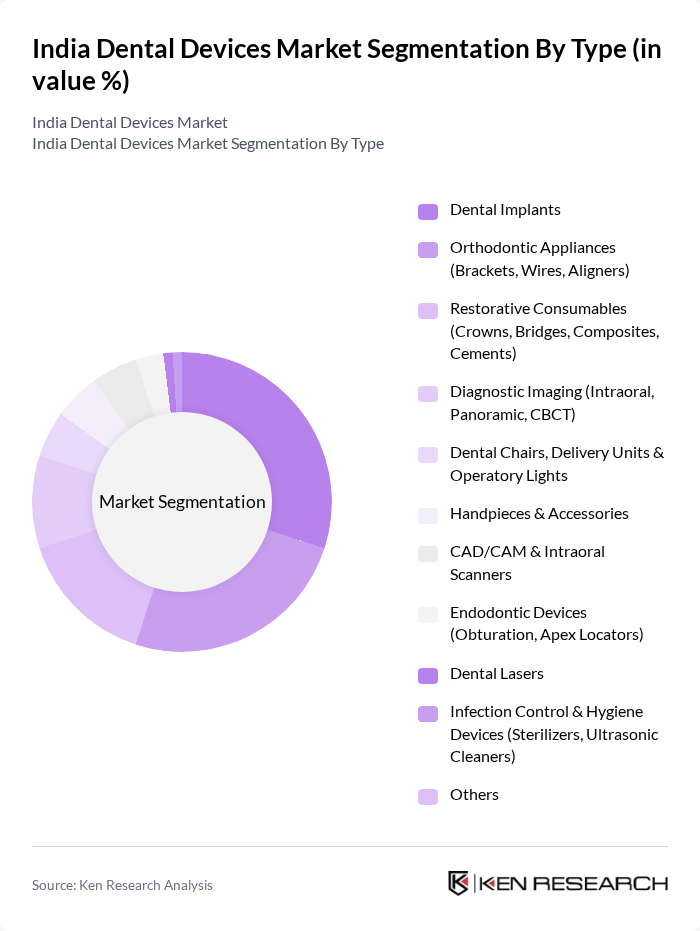

By Type:The market is segmented into various types of dental devices, including dental implants, orthodontic appliances, restorative consumables, diagnostic imaging, dental chairs, handpieces, CAD/CAM systems, endodontic devices, dental lasers, infection control devices, and others. Among these, dental implants and orthodontic appliances are particularly prominent due to the increasing demand for cosmetic dentistry and orthodontic treatments, alongside accelerated adoption of digital imaging and chairside CAD/CAM in clinics .

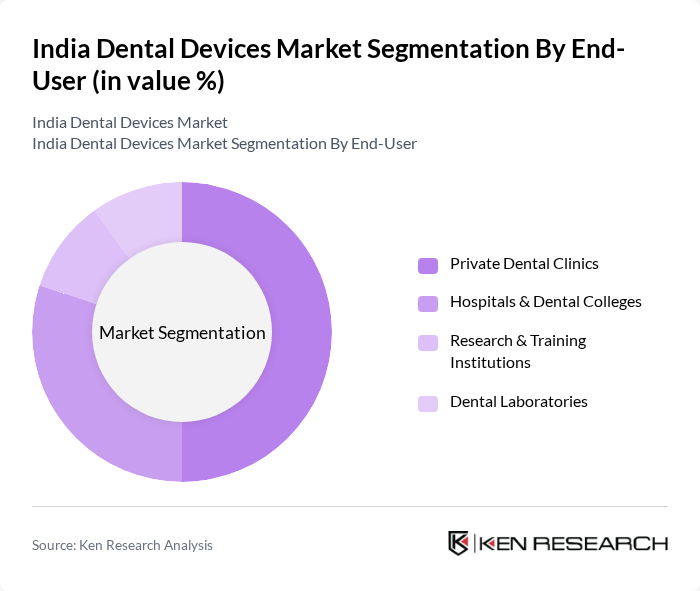

By End-User:The end-user segmentation includes private dental clinics, hospitals and dental colleges, research and training institutions, and dental laboratories. Private dental clinics are the leading segment, driven by the increasing number of dental practitioners, rapid adoption of digital equipment in multi-chair practices, and the growing trend of private healthcare services in metropolitan and tier-2 cities .

The India Dental Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona, Straumann Group, 3M Company, Henry Schein, Inc., Align Technology, Inc., Nobel Biocare Services AG (Envista Holdings), Patterson Companies, Inc., Carestream Dental LLC, Ivoclar Vivadent AG, GC Corporation, Kuraray Noritake Dental Inc., COLTENE Holding AG, VATECH Co., Ltd., Bisco, Inc., Zhermack S.p.A., Planmeca Oy, 3Shape A/S, W&H Dentalwerk Bürmoos GmbH, KaVo Kerr (Envista Holdings), Septodont, Shofu Inc., Prevest DenPro Limited, Mani, Inc., A-dec, Inc., Osstem Implant Co., Ltd., Mindray Medical India (Imaging auxiliaries), FONA Dental, Dental Imaging Technologies Corp. (Dexis), Dolphin Imaging & Management Solutions, Angelalign Technology Inc. (Angel Aligner) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India dental devices market appears promising, driven by increasing dental awareness and technological innovations. As the population ages, the demand for dental care will likely rise, particularly among the geriatric demographic. Additionally, the expansion of dental clinics into underserved areas will enhance accessibility. The integration of tele-dentistry services is expected to revolutionize patient consultations, making dental care more convenient and efficient, thus fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dental Implants Orthodontic Appliances (Brackets, Wires, Aligners) Restorative Consumables (Crowns, Bridges, Composites, Cements) Diagnostic Imaging (Intraoral, Panoramic, CBCT) Dental Chairs, Delivery Units & Operatory Lights Handpieces & Accessories CAD/CAM & Intraoral Scanners Endodontic Devices (Obturation, Apex Locators) Dental Lasers Infection Control & Hygiene Devices (Sterilizers, Ultrasonic Cleaners) Others |

| By End-User | Private Dental Clinics Hospitals & Dental Colleges Research & Training Institutions Dental Laboratories |

| By Region | North India South India East India West India |

| By Application | Preventive Dentistry Restorative & Prosthodontics Cosmetic & Aesthetic Dentistry Orthodontics Endodontics Periodontics |

| By Distribution Channel | Direct Sales Online & E-commerce Authorized Distributors/Dealers |

| By Price Range | Budget Mid-Range Premium |

| By Technology | Digital Dentistry (CAD/CAM, Scanners, 3D Printing) Conventional/Analog Laser Dentistry Imaging (2D/3D Radiology) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 120 | Dentists, Clinic Managers |

| Dental Device Manufacturers | 90 | Product Managers, Sales Directors |

| Dental Distributors | 80 | Distribution Managers, Supply Chain Coordinators |

| Dental Equipment Retailers | 70 | Store Managers, Sales Representatives |

| Dental Research Institutions | 60 | Research Scientists, Academic Professors |

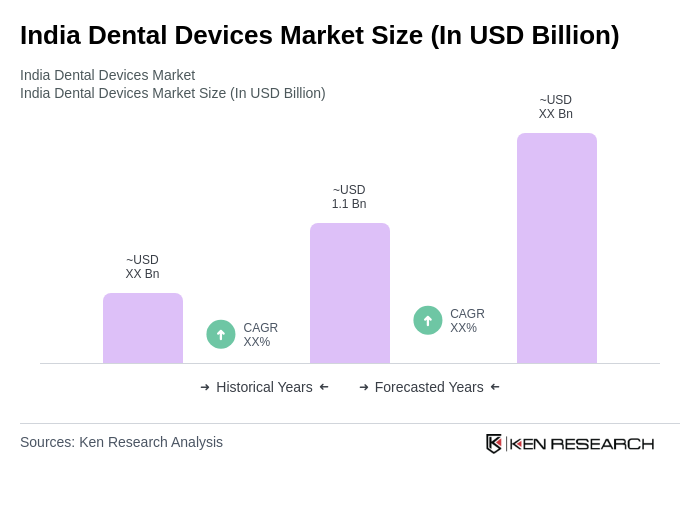

The India Dental Devices Market is valued at approximately USD 1.1 billion, reflecting a consolidated demand across various categories, including consumables and equipment, based on a five-year historical analysis.