Region:North America

Author(s):Shubham

Product Code:KRAB0693

Pages:92

Published On:August 2025

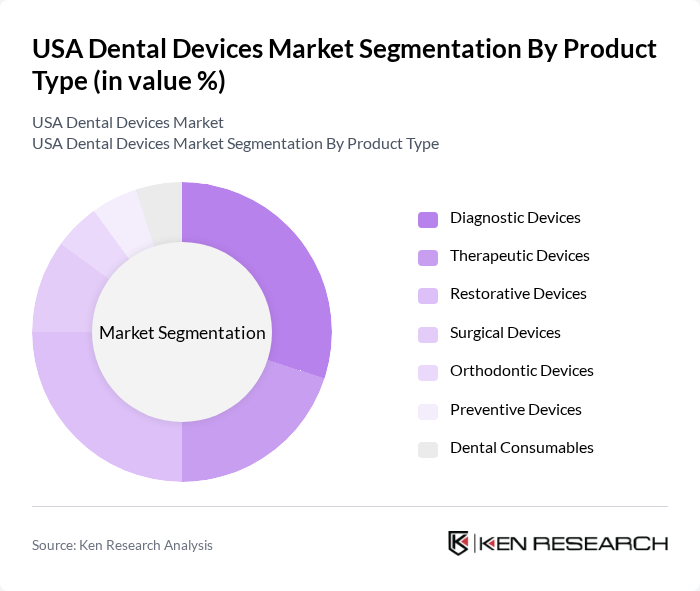

By Product Type:The product type segmentation includes various categories such as diagnostic devices, therapeutic devices, restorative devices, surgical devices, orthodontic devices, preventive devices, and dental consumables. Among these, diagnostic devices are currently leading the market due to the increasing adoption of advanced imaging technologies, intraoral scanners, and AI-enhanced digital radiography, which enhance diagnostic accuracy and patient outcomes. The growing trend towards preventive care and early diagnosis further supports the dominance of this segment .

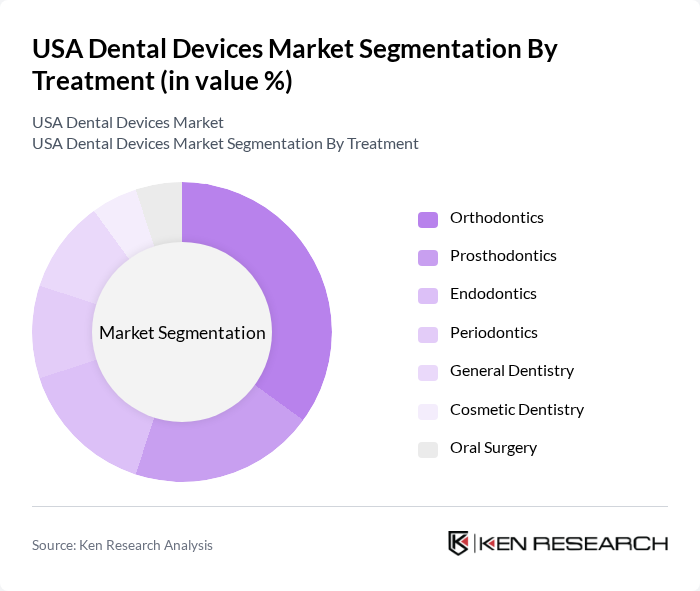

By Treatment:The treatment segmentation encompasses orthodontics, prosthodontics, endodontics, periodontics, general dentistry, cosmetic dentistry, and oral surgery. The orthodontics segment is currently the most significant due to the rising demand for aesthetic dental solutions, such as clear aligners and braces. This trend is driven by increasing consumer awareness of dental aesthetics, the growing popularity of orthodontic treatments among adults and adolescents, and the expansion of cosmetic dentistry services in the USA .

The USA Dental Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona, Align Technology, Inc., Henry Schein, Inc., Patterson Companies, Inc., 3M Company, Straumann Group, Nobel Biocare Services AG, KaVo Kerr, Ivoclar Vivadent AG, GC Corporation, Zimmer Biomet Holdings, Inc., COLTENE Holding AG, Carestream Dental LLC, Benco Dental Supply Co., BIOLASE, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The USA dental devices market is poised for significant transformation driven by technological innovations and changing consumer preferences. The integration of artificial intelligence in diagnostics and the rise of teledentistry are expected to reshape service delivery models. Additionally, as the population ages, the demand for preventive care will likely increase, prompting dental practices to adopt more advanced devices. Sustainability initiatives will also play a crucial role in shaping future practices, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic Devices (e.g., intraoral scanners, radiology equipment) Therapeutic Devices (e.g., dental lasers, surgical instruments) Restorative Devices (e.g., dental implants, crowns, bridges) Surgical Devices (e.g., milling units, chairside sintering furnaces) Orthodontic Devices (e.g., clear aligners, brackets) Preventive Devices (e.g., sealants, fluoride trays) Dental Consumables (e.g., biomaterials, cements, impression materials) |

| By Treatment | Orthodontics Prosthodontics Endodontics Periodontics General Dentistry Cosmetic Dentistry Oral Surgery |

| By End-User | Dental Clinics Hospitals Dental Laboratories Research Institutions Home Care Settings |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers |

| By Material | Metal Polymer Ceramic Composite |

| By Price Range | Low-End Mid-Range High-End |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthodontic Devices | 60 | Orthodontists, Dental Assistants |

| Dental Implants | 50 | Oral Surgeons, Periodontists |

| Preventive Care Products | 70 | General Dentists, Dental Hygienists |

| Restorative Dental Devices | 55 | Prosthodontists, Dental Technicians |

| Dental Equipment Suppliers | 40 | Sales Representatives, Product Managers |

The USA Dental Devices Market is valued at approximately USD 8.3 billion, reflecting a significant growth driven by the increasing prevalence of dental diseases, advancements in dental technology, and rising consumer awareness about oral hygiene.