Region:Asia

Author(s):Geetanshi

Product Code:KRAA1175

Pages:81

Published On:August 2025

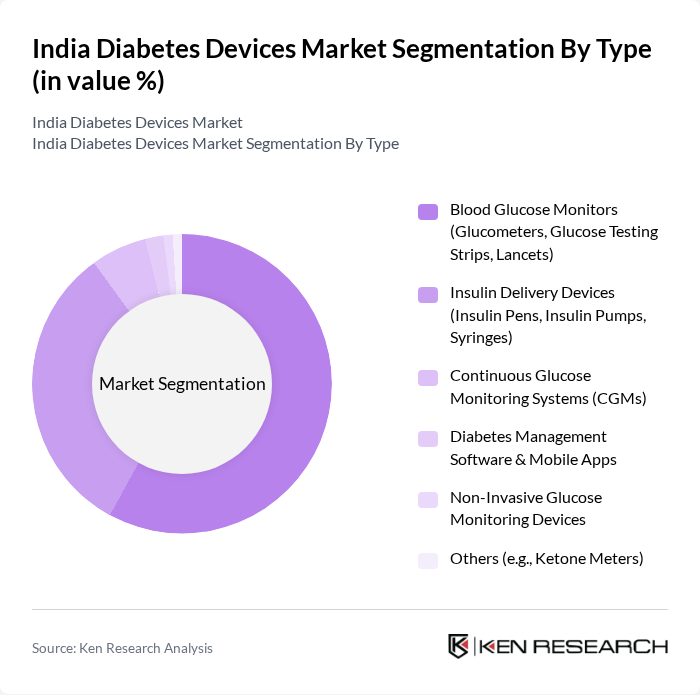

By Type:The market is segmented into various types of diabetes devices, including Blood Glucose Monitors, Insulin Delivery Devices, Continuous Glucose Monitoring Systems, Diabetes Management Software & Mobile Apps, Non-Invasive Glucose Monitoring Devices, and Others. Among these, Blood Glucose Monitors and Continuous Glucose Monitoring Systems are the most widely used due to their affordability, ease of use, and integration with mobile applications, making them a preferred choice for both healthcare professionals and patients. Insulin Delivery Devices are also gaining traction as they provide more precise and convenient insulin administration options.

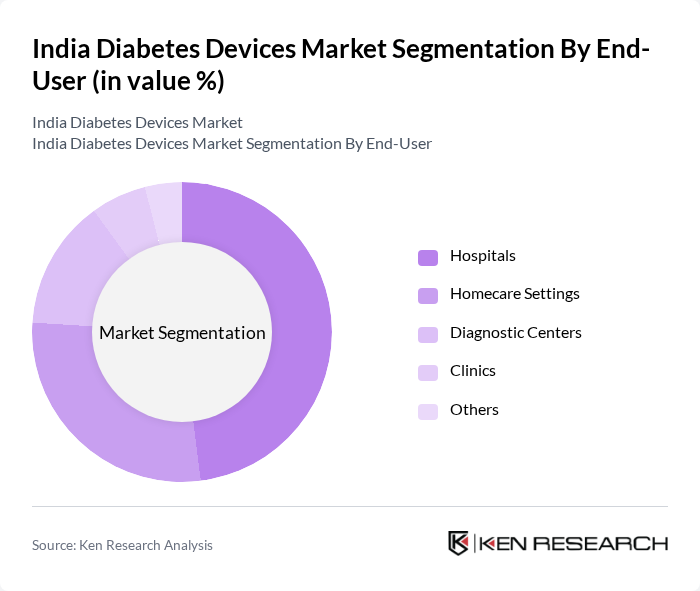

By End-User:The end-user segmentation includes Hospitals, Homecare Settings, Diagnostic Centers, Clinics, and Others. Hospitals are the leading end-users due to their comprehensive diabetes care services and the availability of advanced medical technologies. Homecare settings are also witnessing significant growth as patients prefer managing their diabetes at home with the help of user-friendly devices. The trend toward home-based and personalized diabetes management is particularly notable among younger, tech-savvy populations.

The India Diabetes Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic plc, Roche Diabetes Care (F. Hoffmann-La Roche AG), Johnson & Johnson (LifeScan, Inc.), Sanofi, Bayer AG, Dexcom, Inc., Ascensia Diabetes Care, Insulet Corporation, Ypsomed AG, B. Braun Melsungen AG, Novo Nordisk A/S, Terumo Corporation, Glooko, Inc., Tandem Diabetes Care, Inc., BeatO, Sugar.fit, BlueSemi, Morepen Laboratories Ltd., Glenmark Pharmaceuticals, Lupin Ltd., Zyla Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diabetes devices market in India appears promising, driven by increasing technological integration and a focus on personalized healthcare solutions. The rise of telemedicine and remote monitoring is expected to enhance patient engagement and adherence to treatment plans. Additionally, the growing emphasis on preventive healthcare measures will likely lead to innovative product developments, ensuring that diabetes management becomes more accessible and effective for the Indian population.

| Segment | Sub-Segments |

|---|---|

| By Type | Blood Glucose Monitors (Glucometers, Glucose Testing Strips, Lancets) Insulin Delivery Devices (Insulin Pens, Insulin Pumps, Syringes) Continuous Glucose Monitoring Systems (CGMs) Diabetes Management Software & Mobile Apps Non-Invasive Glucose Monitoring Devices Others (e.g., Ketone Meters) |

| By End-User | Hospitals Homecare Settings Diagnostic Centers Clinics Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Pharmacies & Chemists Hospital Procurement Direct Sales (Company Representatives) Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Brand | Established Brands (e.g., Accu-Chek, OneTouch, FreeStyle) Emerging Brands (e.g., BeatO, Sugar.fit, BlueSemi) Private Labels |

| By Application | Diabetes Type 1 Management Diabetes Type 2 Management Gestational Diabetes Management |

| By Technology | Smart Diabetes Devices (IoT-enabled, AI-integrated) Traditional Diabetes Devices Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Endocrinologists, Diabetes Educators |

| Device Manufacturers | 80 | Product Managers, Sales Directors |

| Patients Using Diabetes Devices | 150 | Type 1 and Type 2 Diabetes Patients |

| Pharmacy and Retail Sector | 70 | Pharmacy Owners, Medical Device Retailers |

| Health Insurance Providers | 60 | Policy Analysts, Claims Managers |

The India Diabetes Devices Market is valued at approximately USD 1.05 billion, driven by the increasing prevalence of diabetes, rising healthcare expenditure, and advancements in technology that enhance patient monitoring and management.