Oman Diabetes Devices Market Overview

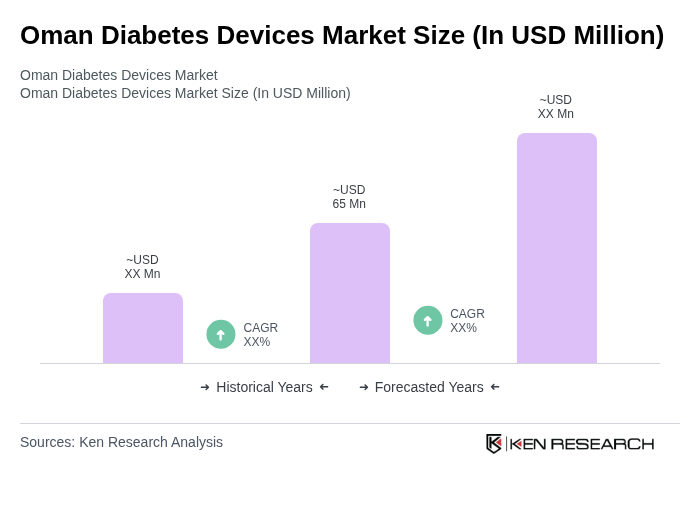

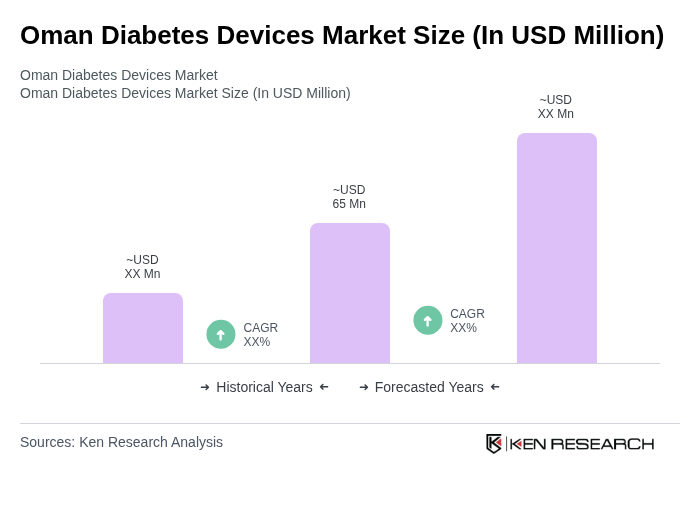

- The Oman Diabetes Devices Market is valued at USD 65 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of diabetes in the region, with over 10% of the Omani population affected, alongside rising awareness about diabetes management and advancements in medical technology. The demand for innovative diabetes devices, such as continuous glucose monitors and insulin delivery systems, has significantly contributed to the market's expansion. The adoption of digital and remote monitoring solutions is also accelerating, as patients and providers seek real-time data and improved disease management .

- Muscat and Dhofar are the dominant regions in the Oman Diabetes Devices Market due to their higher population density and better healthcare infrastructure. The presence of specialized diabetes clinics and hospitals in these areas facilitates access to advanced diabetes management solutions, making them key players in the market. Additionally, the growing urbanization and lifestyle changes in these cities have led to an increase in diabetes cases, further driving demand. Muscat, in particular, leads the market, followed by other urban centers such as Sohar, with rural areas showing growth due to improved healthcare access and awareness initiatives .

- The National Diabetes Strategy 2021–2025, issued by the Ministry of Health, Oman, sets forth comprehensive regulations and operational guidelines for diabetes care and management. This strategy promotes the use of advanced diabetes devices and technologies, mandates the distribution of diabetes control devices nationwide, and requires compliance with updated standards for diabetes care delivery. The government is also focusing on public awareness campaigns and improved access to diabetes management solutions as part of this regulatory framework .

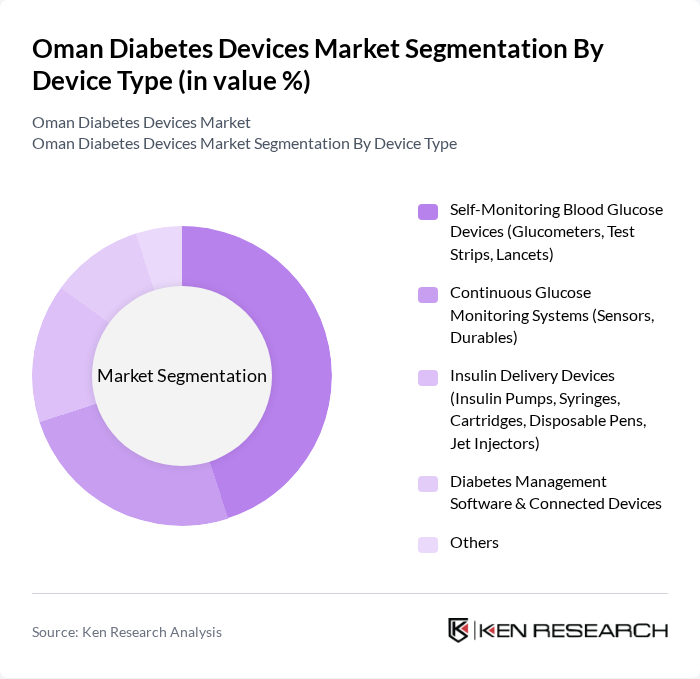

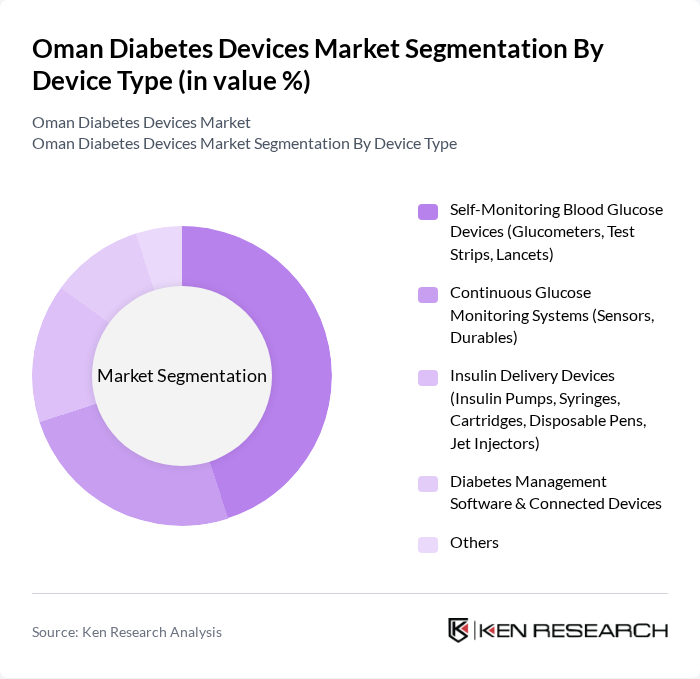

Oman Diabetes Devices Market Segmentation

By Device Type:The market is segmented into various device types, including Self-Monitoring Blood Glucose Devices, Continuous Glucose Monitoring Systems, Insulin Delivery Devices, Diabetes Management Software & Connected Devices, and Others. Among these, Self-Monitoring Blood Glucose Devices are the most widely used due to their affordability, accessibility, and essential role in daily diabetes management. Continuous Glucose Monitoring Systems are gaining traction as they provide real-time data and improved glycemic control, enhancing patient management. The increasing adoption of telehealth, digital solutions, and minimally invasive technologies is driving the growth of these segments .

By End-User:The end-user segmentation includes Hospitals, Specialized Diabetes Clinics, Homecare Settings, Diagnostic Centers, and Others. Hospitals are the leading end-users due to their comprehensive diabetes care services, access to advanced medical technologies, and ability to provide integrated care. Specialized diabetes clinics are also significant as they offer tailored management plans and focused patient education. The trend towards homecare settings is growing, driven by the increasing preference for self-management, telemonitoring, and digital health platforms among patients .

Oman Diabetes Devices Market Competitive Landscape

The Oman Diabetes Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diabetes Care, Abbott Diabetes Care, Medtronic PLC, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Ascensia Diabetes Care, Dexcom Inc., Insulet Corporation, Ypsomed AG, B. Braun Melsungen AG, A. Menarini Diagnostics, LifeScan Inc., Glooko Inc., BD (Becton, Dickinson and Company) contribute to innovation, geographic expansion, and service delivery in this space .

Oman Diabetes Devices Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Diabetes:The prevalence of diabetes in Oman has reached approximately 15.4% of the adult population, translating to around 500,000 individuals affected. This alarming statistic is driven by lifestyle changes and an aging population. The World Health Organization (WHO) projects that by in future, the number of diabetes cases in Oman could rise to 1.5 million, necessitating advanced diabetes management solutions and devices to cater to this growing patient base.

- Technological Advancements in Diabetes Management:The diabetes devices market in Oman is witnessing rapid technological advancements, with innovations such as continuous glucose monitoring (CGM) systems and insulin pumps becoming more prevalent. In future, the market for these advanced devices is expected to grow significantly, with an estimated 30% increase in adoption rates. This shift is driven by the demand for more effective and user-friendly diabetes management solutions, enhancing patient outcomes and quality of life.

- Government Initiatives for Healthcare Improvement:The Omani government has committed to enhancing healthcare infrastructure, allocating approximately OMR 1.3 billion (USD 3.4 billion) for health sector improvements in future. This investment aims to increase access to diabetes care and management devices, particularly in underserved areas. Initiatives include public health campaigns and subsidies for diabetes devices, which are expected to significantly boost market growth and accessibility for patients.

Market Challenges

- High Cost of Advanced Diabetes Devices:The high cost of advanced diabetes management devices poses a significant barrier to market growth in Oman. For instance, insulin pumps can range from OMR 1,000 to OMR 2,500 (USD 2,600 to USD 6,500), making them unaffordable for many patients. This financial burden limits access to essential technologies, particularly among lower-income populations, hindering effective diabetes management and care.

- Limited Access to Healthcare Facilities in Rural Areas:Approximately 28% of Oman's population resides in rural areas, where access to healthcare facilities is severely limited. Many rural regions lack specialized diabetes care centers, resulting in inadequate management of diabetes. This geographical disparity creates challenges in device distribution and patient education, ultimately affecting the overall effectiveness of diabetes management strategies in these communities.

Oman Diabetes Devices Market Future Outlook

The future of the Oman diabetes devices market appears promising, driven by increasing healthcare investments and technological innovations. As the government continues to enhance healthcare infrastructure, the accessibility of diabetes management devices is expected to improve significantly. Additionally, the integration of telemedicine and mobile health applications will facilitate better patient engagement and monitoring, leading to improved health outcomes. These trends indicate a robust growth trajectory for the diabetes devices market in Oman, addressing both current and future healthcare needs.

Market Opportunities

- Expansion of Telemedicine for Diabetes Management:The rise of telemedicine presents a significant opportunity for diabetes management in Oman. With an estimated approximately 95% of the population having access to mobile cellular subscriptions, telehealth services can enhance patient monitoring and education. This shift can lead to improved adherence to treatment protocols and better health outcomes, particularly in remote areas where traditional healthcare access is limited.

- Development of Affordable Diabetes Devices:There is a growing demand for affordable diabetes management devices in Oman, particularly among low-income populations. By focusing on the development of cost-effective solutions, manufacturers can tap into a substantial market segment. This approach not only addresses financial barriers but also promotes widespread adoption of diabetes management technologies, ultimately improving patient care and health outcomes.