India Digital Athletic Apparel Market Overview

- The India Digital Athletic Apparel Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing health consciousness among consumers, the rise of fitness trends, and the growing popularity of athleisure wear. The market has seen a significant shift towards digital platforms for purchasing athletic apparel, further enhancing its growth trajectory.

- Key cities such as Mumbai, Delhi, and Bangalore dominate the market due to their large urban populations, higher disposable incomes, and a growing trend towards fitness and wellness. These metropolitan areas are also home to numerous gyms, fitness centers, and sports events, which contribute to the demand for athletic apparel.

- In 2023, the Indian government implemented the National Sports Policy, which aims to promote sports and physical fitness across the country. This policy includes initiatives to enhance sports infrastructure and encourage participation in sports, thereby indirectly boosting the demand for athletic apparel.

India Digital Athletic Apparel Market Segmentation

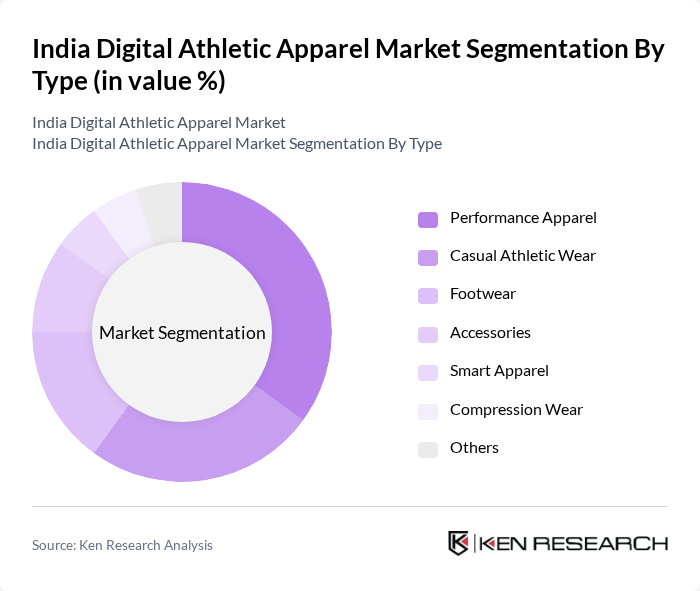

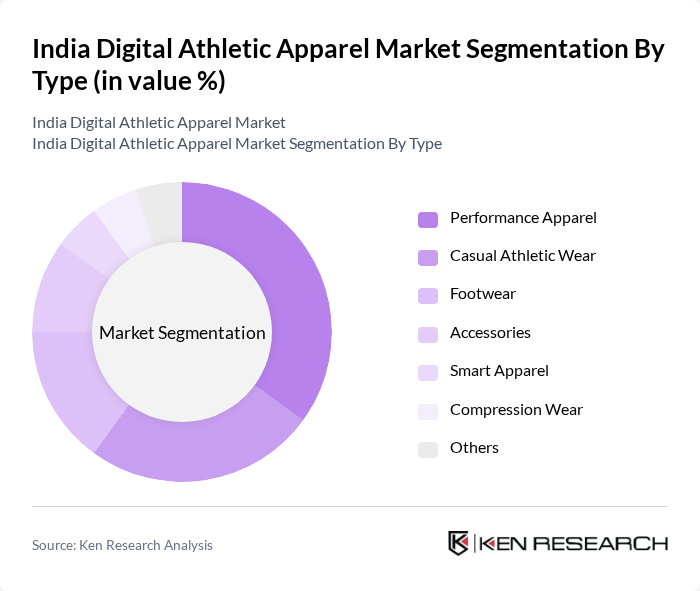

By Type:The digital athletic apparel market is segmented into various types, including Performance Apparel, Casual Athletic Wear, Footwear, Accessories, Smart Apparel, Compression Wear, and Others. Among these, Performance Apparel is currently the leading sub-segment, driven by the increasing participation in sports and fitness activities. Consumers are increasingly seeking high-quality, functional apparel that enhances performance during workouts and sports. Casual Athletic Wear is also gaining traction as athleisure becomes a lifestyle choice, appealing to a broader audience beyond just athletes.

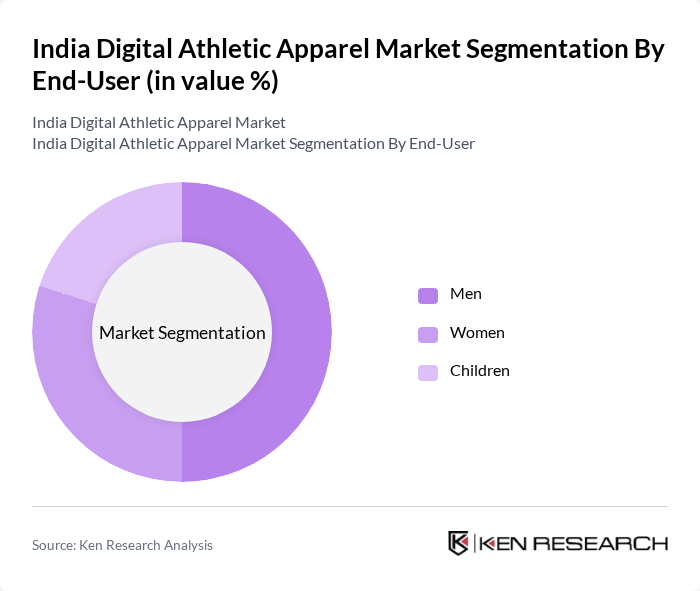

By End-User:The market is segmented by end-user into Men, Women, and Children. The Men’s segment is currently the largest, driven by a growing interest in fitness and sports among male consumers. Women’s athletic apparel is also witnessing significant growth, fueled by the increasing participation of women in sports and fitness activities. The Children’s segment is expanding as parents are becoming more health-conscious and encouraging their children to engage in physical activities.

India Digital Athletic Apparel Market Competitive Landscape

The India Digital Athletic Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Reebok International Ltd., Decathlon S.A., ASICS Corporation, New Balance Athletics, Inc., Lululemon Athletica Inc., Columbia Sportswear Company, Gymshark Ltd., Fabletics, Inc., Alcis Sports Pvt. Ltd., Wildcraft India Pvt. Ltd., HRX by Hrithik Roshan contribute to innovation, geographic expansion, and service delivery in this space.

India Digital Athletic Apparel Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Indian population is increasingly prioritizing health, with the fitness industry projected to reach ?9,000 crore in future. This surge in health awareness is driving demand for digital athletic apparel, as consumers seek high-quality, performance-oriented clothing. The World Health Organization reported that 60% of Indians are now engaging in regular physical activity, further fueling the market for specialized athletic wear that supports their fitness goals.

- Rise of E-commerce Platforms:E-commerce in India is expected to grow to ?7.5 trillion in future, significantly impacting the digital athletic apparel market. Online platforms provide consumers with easy access to a wide range of products, enhancing convenience and choice. According to the India Brand Equity Foundation, online sales of apparel have increased by 30% annually, indicating a robust shift towards digital shopping, which is crucial for the growth of athletic apparel brands.

- Technological Advancements in Fabric:Innovations in fabric technology are transforming the athletic apparel landscape, with the market for smart textiles projected to reach ?1,500 crore in future. These advancements include moisture-wicking, breathability, and durability, appealing to performance-driven consumers. The Indian textile industry is investing heavily in R&D, with over ?500 crore allocated to developing advanced materials, thus enhancing the appeal of digital athletic apparel.

Market Challenges

- Intense Competition:The Indian digital athletic apparel market is characterized by fierce competition, with over 200 brands vying for market share. Major players like Nike and Adidas dominate, but local brands are rapidly emerging. This saturation leads to price wars, reducing profit margins. According to a recent industry report, the average market share of top brands has decreased by 15% over the past two years, intensifying the challenge for new entrants.

- Price Sensitivity Among Consumers:Indian consumers exhibit significant price sensitivity, with 70% preferring affordable options over premium brands. The average spending on athletic apparel is around ?2,500 per person annually, limiting the market for high-end products. Economic factors, such as inflation rates projected at 5% in future, further constrain consumer spending, making it challenging for brands to maintain profitability while appealing to budget-conscious shoppers.

India Digital Athletic Apparel Market Future Outlook

The future of the India digital athletic apparel market appears promising, driven by a growing emphasis on health and fitness among consumers. As e-commerce continues to expand, brands will increasingly leverage digital platforms to reach a broader audience. Additionally, the integration of sustainable practices and innovative technologies will likely shape product offerings, catering to environmentally conscious consumers. The market is expected to evolve with a focus on personalization and inclusivity, aligning with changing consumer preferences and lifestyle trends.

Market Opportunities

- Expansion of Online Retail:The rapid growth of online retail presents a significant opportunity for digital athletic apparel brands. With e-commerce projected to account for 30% of total apparel sales in future, companies can capitalize on this trend by enhancing their online presence and optimizing user experience, potentially increasing sales by up to ?1,000 crore annually.

- Collaborations with Fitness Influencers:Partnering with fitness influencers can amplify brand visibility and credibility. With over 50 million fitness enthusiasts following influencers on social media, targeted campaigns can drive engagement and sales. Brands that effectively leverage influencer marketing could see a revenue increase of approximately ?500 crore, tapping into the growing fitness community in India.