Region:Asia

Author(s):Shubham

Product Code:KRAA4957

Pages:86

Published On:September 2025

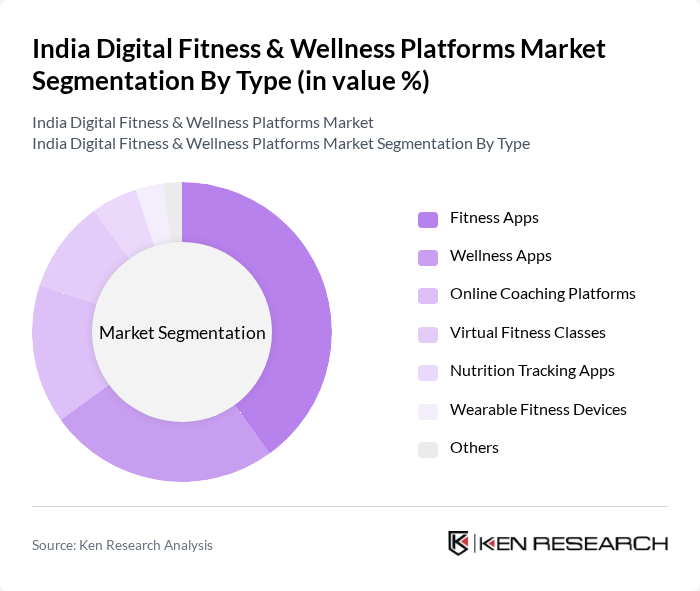

By Type:The market is segmented into various types, including fitness apps, wellness apps, online coaching platforms, virtual fitness classes, nutrition tracking apps, wearable fitness devices, and others. Among these, fitness apps are currently leading the market due to their user-friendly interfaces and the growing trend of self-directed fitness regimes. The increasing number of fitness enthusiasts and the rise of social media influencers promoting fitness apps have significantly contributed to their popularity.

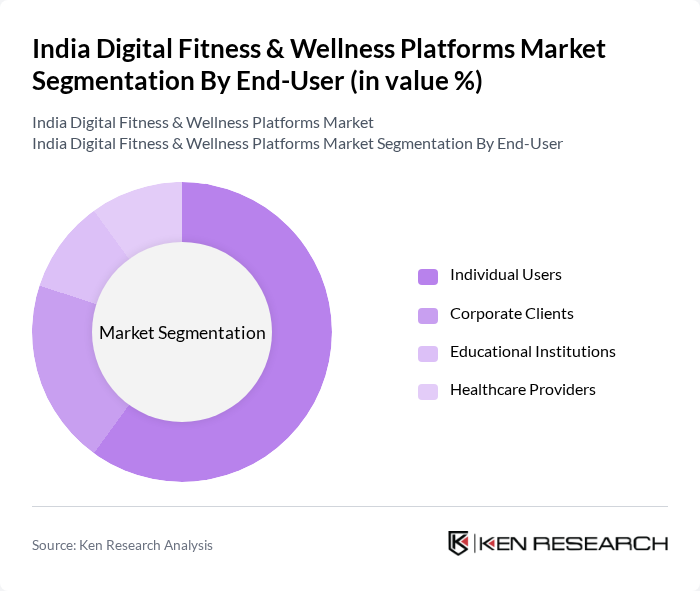

By End-User:The end-user segmentation includes individual users, corporate clients, educational institutions, and healthcare providers. Individual users dominate the market, driven by the increasing focus on personal health and fitness. The rise of remote work and the need for flexible fitness solutions have further accelerated the adoption of digital fitness platforms among individuals seeking to maintain their health and wellness.

The India Digital Fitness & Wellness Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cure.fit, HealthifyMe, Fittr, MyFitnessPal, Gympik, Zumba, Cult.fit, 1mg, Practo, Fitbit, Nike Training Club, Strava, Sworkit, Aaptiv, Daily Burn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital fitness and wellness market in India appears promising, driven by technological advancements and evolving consumer preferences. As more users seek personalized fitness solutions, platforms that leverage AI and machine learning for tailored experiences are likely to thrive. Additionally, the increasing integration of mental wellness into fitness offerings will attract a broader audience, enhancing user engagement and satisfaction. The market is poised for significant growth as it adapts to these emerging trends and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Apps Wellness Apps Online Coaching Platforms Virtual Fitness Classes Nutrition Tracking Apps Wearable Fitness Devices Others |

| By End-User | Individual Users Corporate Clients Educational Institutions Healthcare Providers |

| By Region | North India South India East India West India |

| By Technology | Mobile Applications Web Platforms Wearable Technology Virtual Reality Fitness |

| By Application | Personal Training Group Classes Nutrition and Diet Planning Mental Wellness Programs |

| By Investment Source | Venture Capital Angel Investors Government Grants Crowdfunding |

| By Policy Support | Subsidies for Health Startups Tax Exemptions for Wellness Programs Grants for Digital Health Initiatives Support for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness App Users | 150 | Regular Users, Casual Users, Fitness Enthusiasts |

| Wellness Coaching Clients | 100 | Clients of Online Coaches, Wellness Program Participants |

| Digital Fitness Platform Executives | 80 | CEOs, Product Managers, Marketing Directors |

| Fitness Trainers | 70 | Freelance Trainers, Gym Trainers, Online Coaches |

| Health and Fitness Influencers | 60 | Social Media Influencers, Bloggers, Content Creators |

The India Digital Fitness & Wellness Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased smartphone adoption, health consciousness, and internet accessibility across urban and rural areas.