Region:Middle East

Author(s):Dev

Product Code:KRAD1806

Pages:80

Published On:November 2025

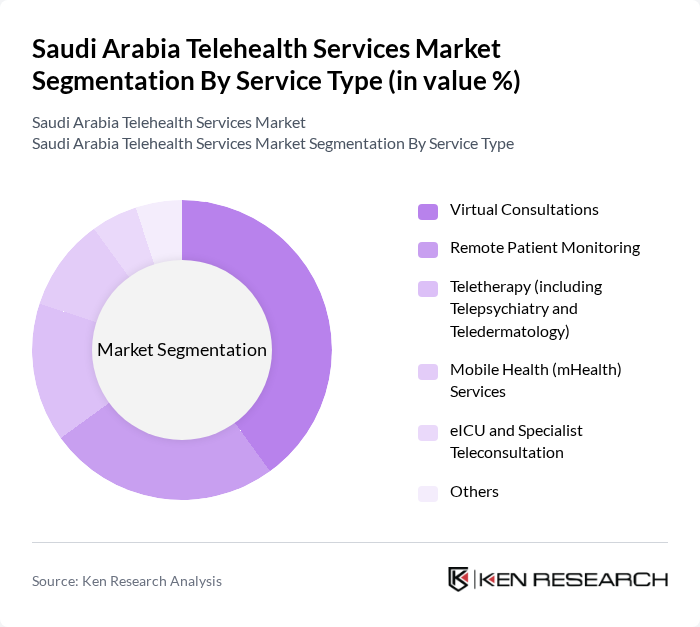

By Service Type:The service type segmentation includes various subsegments that cater to different healthcare needs. The dominant subsegment in this category is Virtual Consultations, which has gained immense popularity due to its convenience and accessibility. Patients prefer virtual consultations for routine check-ups and follow-ups, as they save time and reduce the need for travel. Other notable subsegments include Remote Patient Monitoring and Teletherapy, which are also witnessing significant growth as healthcare providers increasingly adopt technology to enhance patient care.

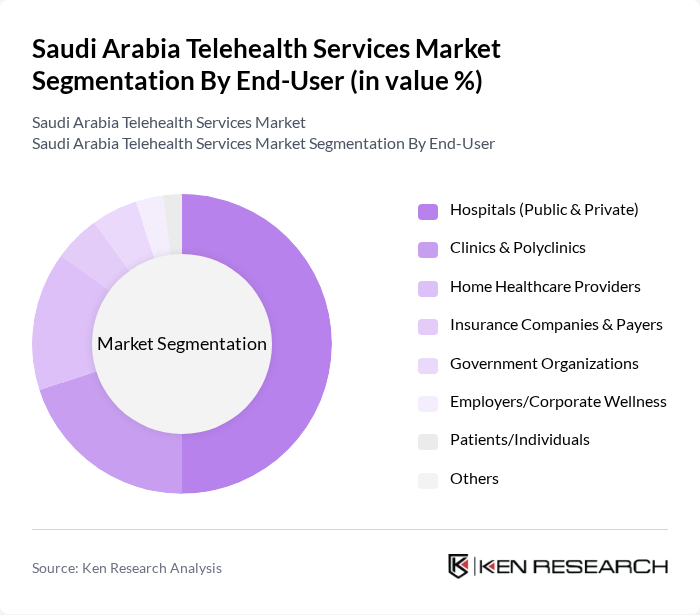

By End-User:The end-user segmentation encompasses various healthcare providers and consumers utilizing telehealth services. Hospitals, both public and private, represent the largest segment, as they are increasingly integrating telehealth solutions into their operations to improve patient care and operational efficiency. Clinics and polyclinics also play a significant role, particularly in urban areas where access to healthcare is critical. Home healthcare providers are gaining traction as well, driven by the growing demand for at-home care services.

The Saudi Arabia Telehealth Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seha Virtual Hospital, Altibbi, Vezeeta, Okadoc, Mawid (Ministry of Health), Cura, Altibbi Saudi Arabia, Medisense, Shifa, AltibbiCare, GE Healthcare Saudi Arabia, Philips Healthcare Saudi Arabia, Siemens Healthineers Saudi Arabia, Teladoc Health (Saudi Operations), American Well (Amwell) Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of telehealth services in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning into telehealth platforms is expected to enhance patient engagement and improve health outcomes. Additionally, the expansion of telehealth services into rural areas will address healthcare disparities, ensuring broader access to essential medical services. As the government continues to support digital health initiatives, the telehealth landscape is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Virtual Consultations Remote Patient Monitoring Teletherapy Mobile Health (mHealth) Services eICU and Specialist Teleconsultation Others |

| By End-User | Hospitals Clinics & Polyclinics Home Healthcare Providers Insurance Companies & Payers Government Organizations Employers/Corporate Wellness Patients/Individuals Others |

| By Demographics | Age Groups Gender Socioeconomic Status Urban vs Rural Population Others |

| By Technology Used | Video Conferencing Platforms Mobile Applications Cloud-Based Solutions AI-Enabled Diagnostic Tools Wearable Devices Integration Others |

| By Geographic Coverage | Central Region Western Region Eastern Region Southern Region Northern Region Urban Areas Rural Areas Others |

| By Payment Model | Subscription-Based Pay-Per-Use Insurance-Reimbursed Government-Funded Others |

| By Regulatory Compliance | Licensed Providers Non-Licensed Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Utilizing Telehealth | 150 | Telehealth Users, Chronic Disease Patients, General Public |

| Technology Providers | 100 | Product Managers, IT Directors, Business Development Executives |

| Regulatory Bodies | 50 | Policy Makers, Health Administrators, Compliance Officers |

| Insurance Companies | 80 | Underwriters, Claims Managers, Healthcare Analysts |

The Saudi Arabia Telehealth Services Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health technologies and the increasing demand for accessible medical services, particularly in remote areas.