Region:Asia

Author(s):Geetanshi

Product Code:KRAA3248

Pages:94

Published On:September 2025

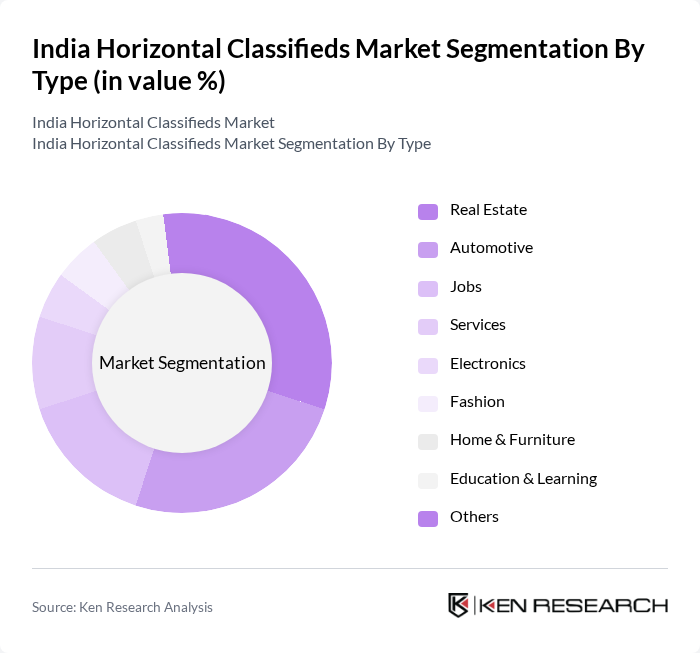

By Type:The market is segmented into Real Estate, Automotive, Jobs, Services, Electronics, Fashion, Home & Furniture, Education & Learning, and Others. Each segment addresses distinct consumer needs and preferences, with varying demand and growth potential.Real EstateandAutomotiveremain particularly prominent, driven by high-value transactions, frequent listings, and strong consumer interest. The Services and Jobs segments are also expanding rapidly, reflecting increased digital adoption among job seekers and service providers.

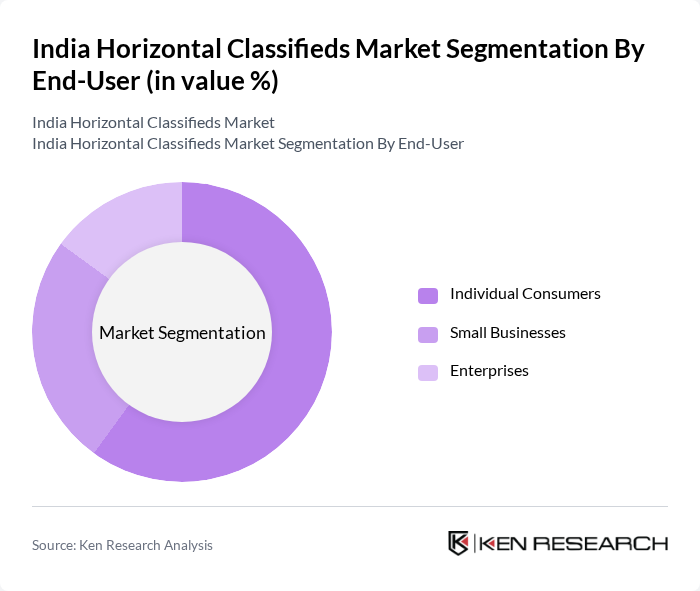

By End-User:The market is segmented by end-users into Individual Consumers, Small Businesses, and Enterprises.Individual consumersdominate the market, frequently engaging in buying and selling activities through classifieds platforms.Small businessesleverage these platforms for cost-effective advertising and customer acquisition, whileenterprisesutilize them for targeted recruitment and specialized services.

The India Horizontal Classifieds Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX India, Quikr, Sulekha, MagicBricks, 99acres, CarDekho, Housing.com, Justdial, NoBroker, IndiaMART, Snapdeal, Flipkart, Amazon India, Facebook Marketplace, and Locanto India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India horizontal classifieds market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms will likely enhance their user interfaces and integrate advanced features like AI-driven recommendations. Additionally, the increasing focus on hyperlocal services will cater to the growing demand for localized offerings. Companies that adapt to these trends and prioritize user experience will be well-positioned to capture market share in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Jobs Services Electronics Fashion Home & Furniture Education & Learning Others |

| By End-User | Individual Consumers Small Businesses Enterprises |

| By Region | North India South India East India West India |

| By Application | Online Listings (Web Portals) Mobile Applications Social Media Integrated Platforms |

| By Sales Channel | Direct Sales (Self-Serve) Affiliate & Partner Networks Agency/Reseller Channels |

| By Pricing Model | Free Listings Paid Listings (Premium/Featured) Subscription-Based Transaction/Commission-Based |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 80 | Car Dealership Owners, Sales Managers |

| Job Portals and Recruitment | 60 | HR Managers, Recruitment Consultants |

| Consumer Goods Marketplace | 90 | Small Business Owners, E-commerce Managers |

| Service Providers Listings | 70 | Service Business Owners, Marketing Directors |

The India Horizontal Classifieds Market is valued at approximately USD 2.7 billion, driven by increased internet penetration, smartphone usage, and a growing preference for online platforms for buying and selling goods and services.