Region:Asia

Author(s):Geetanshi

Product Code:KRAA0130

Pages:98

Published On:August 2025

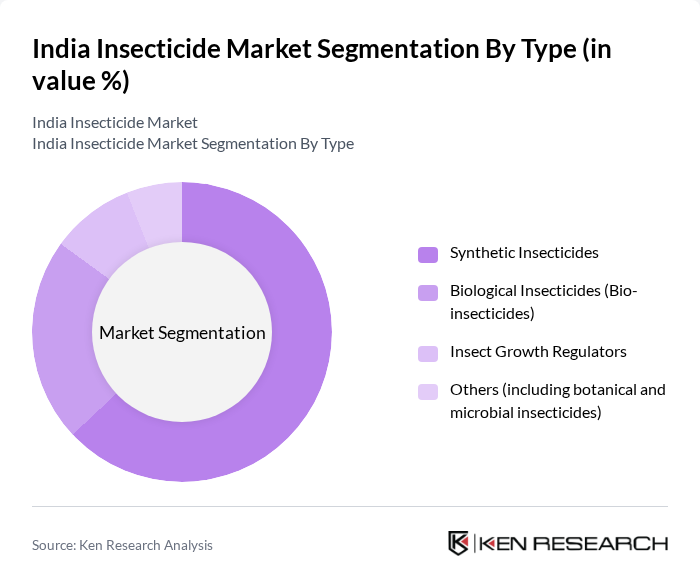

By Type:The market is segmented into Synthetic Insecticides, Biological Insecticides (Bio-insecticides), Insect Growth Regulators, and Others (including botanical and microbial insecticides). Synthetic Insecticides continue to dominate the market due to their rapid action and broad-spectrum efficacy, especially in large-scale agriculture. However, Biological Insecticides are gaining traction as environmentally friendly alternatives, supported by increasing regulatory encouragement and consumer demand for residue-free produce. Insect Growth Regulators and other botanical/microbial products are also witnessing gradual adoption, particularly in specialty and export-oriented crops .

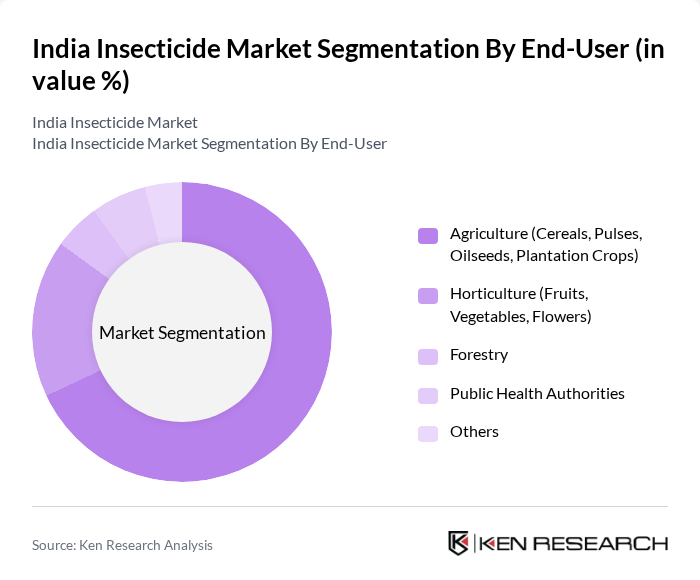

By End-User:The insecticide market is primarily segmented by end-users, including Agriculture (Cereals, Pulses, Oilseeds, Plantation Crops), Horticulture (Fruits, Vegetables, Flowers), Forestry, Public Health Authorities, and Others. The Agriculture segment holds the largest share, driven by the need for pest control in staple and cash crops. The increasing focus on food security, shrinking arable land, and rising population necessitate effective pest management solutions in agriculture, making it the dominant end-user segment. Horticulture is the next major segment, followed by public health and forestry applications .

The India Insecticide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience Ltd., Syngenta India Ltd., UPL Limited, BASF India Ltd., Rallis India Ltd., Adama India Pvt. Ltd., Dhanuka Agritech Ltd., Insecticides (India) Ltd., PI Industries Ltd., Sumitomo Chemical India Ltd., FMC India Pvt. Ltd., Mahindra Agri Solutions Ltd., Godrej Agrovet Ltd., Crystal Crop Protection Ltd., and Meghmani Organics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India insecticide market appears promising, driven by technological advancements and a growing emphasis on sustainable practices. As farmers increasingly adopt precision agriculture techniques, the demand for targeted insecticides is expected to rise. Additionally, the expansion of organic farming will create opportunities for biopesticides, aligning with consumer preferences for eco-friendly products. The market is likely to witness significant innovation, enhancing crop protection while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Insecticides Biological Insecticides (Bio-insecticides) Insect Growth Regulators Others (including botanical and microbial insecticides) |

| By End-User | Agriculture (Cereals, Pulses, Oilseeds, Plantation Crops) Horticulture (Fruits, Vegetables, Flowers) Forestry Public Health Authorities Others |

| By Region | North India (Uttar Pradesh, Punjab, Haryana, etc.) South India (Andhra Pradesh, Tamil Nadu, Karnataka, etc.) East India (West Bengal, Odisha, Bihar, etc.) West India (Maharashtra, Gujarat, Rajasthan, etc.) |

| By Application | Crop Protection Public Health (Vector Control) Stored Product Protection Others |

| By Formulation | Liquid Formulations Granular Formulations Powder/Dry Formulations Others (e.g., microencapsulated, suspension concentrates) |

| By Distribution Channel | Direct Sales (Company to Farmer/Institution) Retail (Agro-dealers, Input Shops) Online Sales Others (Cooperatives, Government Procurement) |

| By Policy Support | Subsidies Tax Exemptions Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Retailers | 100 | Store Managers, Sales Representatives |

| Farmers Using Insecticides | 150 | Crop Farmers, Agricultural Cooperatives |

| Distributors of Insecticides | 80 | Distribution Managers, Supply Chain Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 60 | Research Scientists, Agricultural Economists |

The India Insecticide Market is valued at approximately USD 1.7 billion, driven by increasing food security concerns, agricultural productivity, and the need for effective pest management solutions. This market is expected to grow further as advanced insecticides are adopted.