India Luxury Goods and Jewelry Retail Market Overview

- The India Luxury Goods and Jewelry Retail Market is valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, changing consumer preferences towards luxury products, and an increasing number of affluent consumers. The market has seen a significant uptick in demand for high-end jewelry and luxury goods, reflecting a shift in consumer behavior towards premium products.

- Key cities such as Mumbai, Delhi, and Bengaluru dominate the luxury goods and jewelry market due to their status as economic hubs with a high concentration of wealthy individuals. These cities are characterized by a vibrant retail environment, a growing number of luxury brands, and a strong cultural inclination towards jewelry and luxury goods, making them focal points for market growth.

- In 2023, the Indian government implemented the Goods and Services Tax (GST) on luxury goods, which standardizes tax rates across states and aims to simplify the tax structure. This regulation is designed to enhance compliance and transparency in the luxury goods sector, ultimately benefiting both consumers and businesses by reducing tax evasion and promoting fair competition.

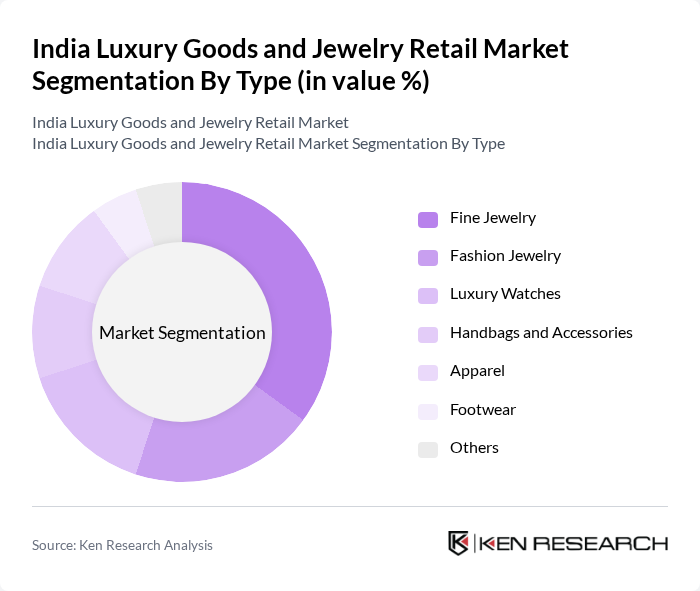

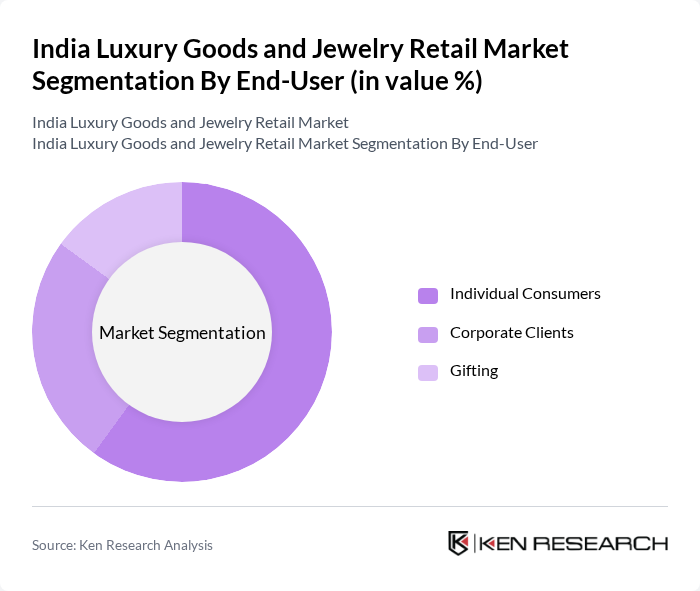

India Luxury Goods and Jewelry Retail Market Segmentation

By Type:The luxury goods and jewelry market can be segmented into various types, including Fine Jewelry, Fashion Jewelry, Luxury Watches, Handbags and Accessories, Apparel, Footwear, and Others. Among these, Fine Jewelry is the leading sub-segment, driven by consumer preferences for high-quality, handcrafted pieces that symbolize status and wealth. The demand for unique and personalized jewelry has surged, particularly among millennials and affluent consumers, who are increasingly seeking distinctive designs and premium materials.

By End-User:The market can be segmented based on end-users into Individual Consumers, Corporate Clients, and Gifting. Individual Consumers dominate the market, as they are the primary purchasers of luxury goods and jewelry, driven by personal desires for status and self-expression. The trend of gifting luxury items for special occasions has also gained traction, particularly during festivals and weddings, further boosting the market for individual consumers.

India Luxury Goods and Jewelry Retail Market Competitive Landscape

The India Luxury Goods and Jewelry Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Titan Company Limited, Tanishq, Malabar Gold and Diamonds, Kalyan Jewellers, PC Jeweller, Gitanjali Gems, Joyalukkas, Senco Gold and Diamonds, Forevermark, Swarovski, Chopard, Cartier, Van Cleef & Arpels, Bvlgari, Harry Winston contribute to innovation, geographic expansion, and service delivery in this space.

India Luxury Goods and Jewelry Retail Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The average disposable income in India is projected to reach approximately ?1,80,000 per annum in future, reflecting a significant increase from ?1,50,000 in 2020. This rise in disposable income is driving consumer spending on luxury goods, including jewelry, as more individuals can afford premium products. The affluent class, which is expected to grow by 10% annually, is increasingly investing in luxury items, further propelling market growth.

- Increasing Urbanization:Urbanization in India is accelerating, with the urban population expected to reach 700 million in future, up from 600 million in 2020. This shift is leading to a higher concentration of wealth and a growing demand for luxury goods. Urban consumers are more exposed to global trends and luxury brands, which enhances their purchasing power and willingness to invest in high-end jewelry and luxury items.

- Expansion of E-commerce Platforms:The e-commerce sector in India is projected to grow to ?10 trillion in future, up from ?8 trillion in 2020. This growth is facilitating easier access to luxury goods and jewelry for consumers across the country. Online platforms are increasingly offering exclusive collections and personalized shopping experiences, which cater to the evolving preferences of tech-savvy consumers, thus driving sales in the luxury segment.

Market Challenges

- High Import Duties:India imposes import duties of up to 12.5% on luxury goods, including jewelry, which significantly raises retail prices. This high taxation can deter potential buyers and limit market growth. In future, the government is expected to maintain these duties, impacting the affordability of imported luxury items and creating a competitive disadvantage for foreign brands in the Indian market.

- Intense Competition:The luxury goods market in India is characterized by fierce competition, with over 250 international and domestic brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, which can erode profit margins. In future, brands will need to differentiate themselves through unique offerings and superior customer experiences to maintain their market position amidst this competitive landscape.

India Luxury Goods and Jewelry Retail Market Future Outlook

The future of the India luxury goods and jewelry retail market appears promising, driven by evolving consumer preferences and technological advancements. As the market adapts to the increasing demand for personalized experiences and sustainable products, brands that embrace innovation and ethical sourcing will likely thrive. Additionally, the expansion into tier 2 and tier 3 cities presents significant growth potential, as these regions are witnessing rising disposable incomes and changing lifestyles, further enhancing market dynamics.

Market Opportunities

- Growth of Online Retail:The online retail segment is expected to capture a larger share of the luxury market, with e-commerce sales projected to account for 35% of total luxury sales in future. This shift presents an opportunity for brands to enhance their digital presence and engage with consumers through targeted online marketing strategies, ultimately driving sales and brand loyalty.

- Demand for Sustainable Products:The growing consumer awareness regarding sustainability is creating a demand for ethically sourced luxury goods. In future, it is estimated that 50% of luxury consumers will prioritize sustainability in their purchasing decisions. Brands that adopt sustainable practices and transparently communicate their efforts can tap into this emerging market segment, enhancing their appeal and market share.