Thailand Luxury Goods and Jewelry Retail Market Overview

- The Thailand Luxury Goods and Jewelry Retail Market is valued at USD 8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising affluent class, and a growing interest in luxury brands among consumers. The market has seen a significant uptick in demand for high-end products, particularly in urban areas, as consumers seek to express their status and lifestyle through luxury goods.

- Key cities such as Bangkok, Phuket, and Chiang Mai dominate the luxury goods market due to their status as major tourist destinations and economic hubs. Bangkok, in particular, is a focal point for luxury shopping, attracting both local and international consumers. The presence of high-end shopping malls and luxury boutiques in these cities further enhances their appeal, making them prime locations for luxury retail.

- In 2023, the Thai government implemented regulations aimed at enhancing consumer protection in the luxury goods sector. This includes stricter guidelines on product authenticity and labeling, ensuring that consumers are well-informed about the products they purchase. The initiative aims to bolster consumer confidence and promote fair trade practices within the luxury market.

Thailand Luxury Goods and Jewelry Retail Market Segmentation

By Type:The luxury goods and jewelry retail market is segmented into various types, including Fine Jewelry, Luxury Watches, Designer Handbags, High-End Fashion Apparel, Luxury Footwear, Fragrances and Cosmetics, and Others. Among these, Fine Jewelry has emerged as the leading sub-segment, driven by consumer preferences for unique and high-quality pieces. The demand for personalized and bespoke jewelry has surged, reflecting a trend towards individuality and self-expression in luxury purchases.

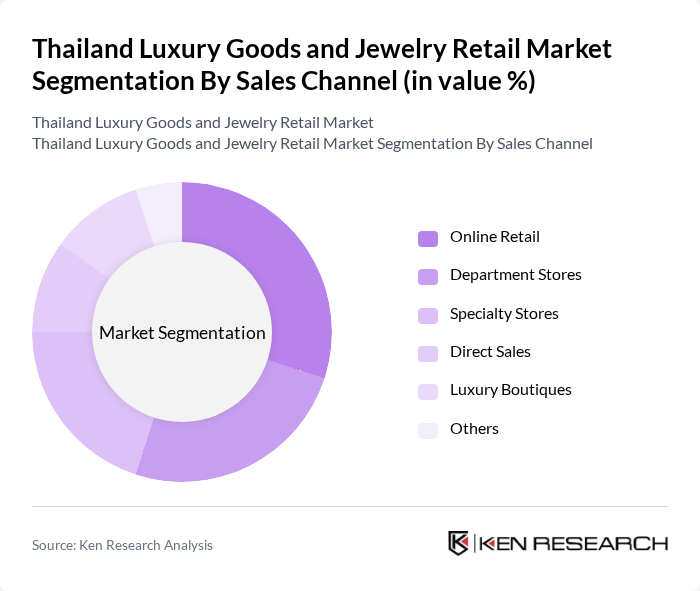

By Sales Channel:The market is also segmented by sales channels, including Online Retail, Department Stores, Specialty Stores, Direct Sales, Luxury Boutiques, and Others. Online Retail has gained significant traction, especially post-pandemic, as consumers increasingly prefer the convenience of shopping from home. This shift has led to a rise in e-commerce platforms dedicated to luxury goods, enhancing accessibility and variety for consumers.

Thailand Luxury Goods and Jewelry Retail Market Competitive Landscape

The Thailand Luxury Goods and Jewelry Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chopard, Cartier, Tiffany & Co., Bulgari, Van Cleef & Arpels, Graff, Harry Winston, Piaget, Boucheron, Louis Vuitton, Gucci, Prada, Hermès, Fendi, and Dior contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Luxury Goods and Jewelry Retail Market Industry Analysis

Growth Drivers

- Rising Disposable Income:Thailand's GDP per capita is projected to reach approximately $8,000 in future, reflecting a steady increase in disposable income. This growth enables consumers to allocate more funds towards luxury goods and jewelry, with the affluent segment expected to expand by 5% annually. As a result, the luxury market is likely to benefit from increased spending power, particularly among urban populations in Bangkok and other major cities, driving demand for high-end products.

- Increasing Tourism:In future, Thailand anticipates welcoming over 42 million international tourists, contributing significantly to the luxury goods market. Tourists, particularly from China, spend an average of $1,300 per visit on luxury items. This influx not only boosts sales in luxury retail but also enhances brand visibility and market penetration, as tourists often seek unique, high-quality products that reflect local craftsmanship and culture, further stimulating the sector's growth.

- Expansion of E-commerce Platforms:The e-commerce sector in Thailand is projected to reach $35 billion in future, with luxury goods accounting for a growing share. Online platforms are increasingly becoming the preferred shopping method for consumers, especially younger demographics. This shift is supported by improved internet penetration, which is expected to exceed 85% in urban areas, facilitating access to luxury brands and enhancing customer engagement through digital marketing strategies and personalized shopping experiences.

Market Challenges

- Economic Fluctuations:Thailand's economy faces potential volatility due to global economic conditions, with GDP growth projected at 4% in future. Such fluctuations can impact consumer confidence and spending behavior, particularly in the luxury segment. Economic uncertainties, including inflation rates expected to hover around 3%, may lead to reduced discretionary spending, posing a challenge for luxury retailers aiming to maintain sales momentum in a competitive market.

- Intense Competition:The luxury goods market in Thailand is characterized by fierce competition, with over 250 international brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, which can erode profit margins. Additionally, local brands are increasingly gaining traction, leveraging cultural authenticity and unique designs to attract consumers. As a result, established players must innovate continuously to differentiate themselves and retain customer loyalty in this dynamic environment.

Thailand Luxury Goods and Jewelry Retail Market Future Outlook

The Thailand luxury goods and jewelry retail market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to gain a competitive edge. Furthermore, the integration of augmented reality and artificial intelligence in retail experiences will enhance customer engagement, making shopping more interactive and personalized. These trends indicate a shift towards a more digitally-driven and socially responsible luxury market landscape in the coming years.

Market Opportunities

- Collaborations with Local Artisans:Partnering with local artisans can create unique luxury products that resonate with both domestic and international consumers. This strategy not only supports local economies but also enhances brand authenticity, appealing to consumers seeking exclusive, culturally rich items. Such collaborations can lead to increased brand loyalty and higher sales, particularly among tourists looking for distinctive souvenirs.

- Sustainable and Ethical Luxury Products:The demand for sustainable luxury goods is on the rise, with consumers increasingly prioritizing ethical sourcing and production practices. Brands that invest in sustainable materials and transparent supply chains can tap into this growing market segment. In future, the sustainable luxury market is expected to grow by 12%, presenting a lucrative opportunity for retailers to align with consumer values and enhance their brand image.