Region:Asia

Author(s):Rebecca

Product Code:KRAA4599

Pages:82

Published On:September 2025

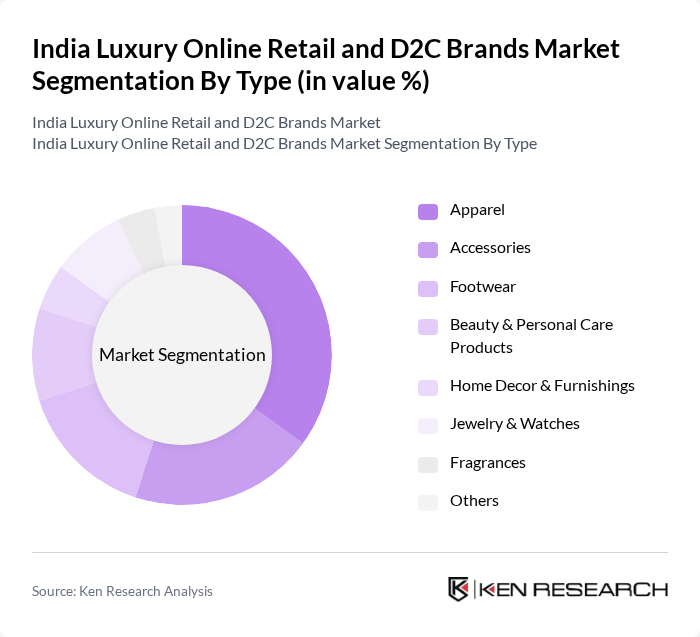

By Type:The market is segmented into various types, including Apparel, Accessories, Footwear, Beauty & Personal Care Products, Home Decor & Furnishings, Jewelry & Watches, Fragrances, and Others. Among these, Apparel is the leading segment, driven by fashion trends and consumer preferences for branded clothing. Accessories and Footwear also hold significant market shares, appealing to consumers looking for complete luxury outfits. Jewelry & Watches are also prominent, reflecting cultural preferences and the importance of gold and diamond jewelry in India.

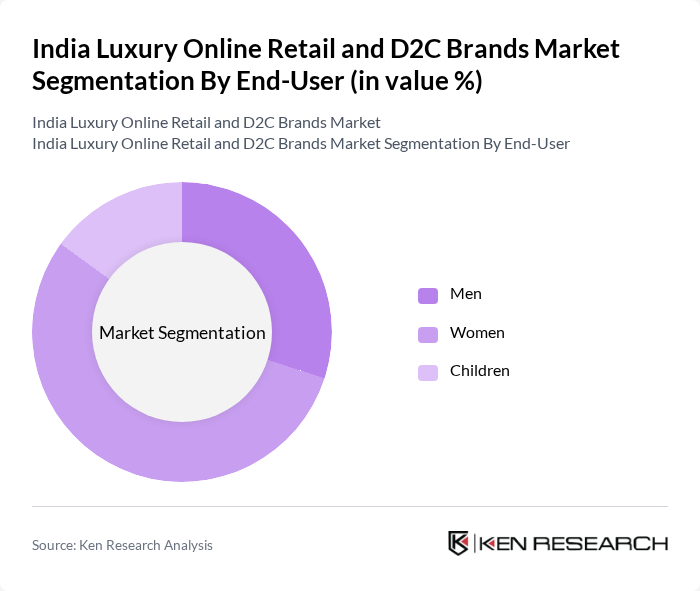

By End-User:The market is segmented by end-user demographics, including Men, Women, and Children. The Women segment dominates the market, driven by a higher inclination towards luxury fashion and beauty products. Men’s luxury fashion is also growing, but the overall spending by women remains higher, reflecting their significant role in luxury consumption.

The India Luxury Online Retail and D2C Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata CLiQ Luxury, Nykaa Fashion, Myntra Luxe, Ajio Luxe, Amazon India (Luxury Beauty & Fashion), Flipkart (Premium & Luxury Brands), The Collective, Pernia's Pop-Up Shop, Luxepolis, Darveys, Zivame, Fynd, Chumbak, The Label Life, H&M India, Zara India, Michael Kors India, Coach India, Armani Exchange India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury online retail market in India appears promising, driven by technological advancements and evolving consumer behaviors. As digital payment solutions become more widespread, the ease of online transactions will likely enhance consumer confidence. Furthermore, the integration of augmented reality and virtual try-ons is expected to revolutionize the shopping experience, making it more interactive. Brands that adapt to these trends and invest in innovative technologies will be well-positioned to capture a larger share of the growing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Accessories Footwear Beauty & Personal Care Products Home Decor & Furnishings Jewelry & Watches Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Direct-to-Consumer (D2C) Brand Websites Online Marketplaces (Luxury-focused) Omnichannel Retail (Online + Offline) |

| By Price Range | Premium Affordable Luxury Super Premium Luxury |

| By Product Origin | Domestic Luxury Brands International Luxury Brands |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Tier I, II, III Cities |

| By Marketing Strategy | Influencer Marketing Social Media Campaigns Experiential Marketing Traditional Advertising |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Purchases | 100 | Affluent Consumers, Fashion Enthusiasts |

| Beauty and Personal Care Products | 80 | Beauty Influencers, Regular Buyers |

| Home Decor and Furnishings | 60 | Interior Designers, Homeowners |

| Luxury Travel Experiences | 40 | Frequent Travelers, Luxury Service Providers |

| Online Shopping Behavior | 90 | eCommerce Shoppers, Digital Natives |

The India Luxury Online Retail and D2C Brands Market is valued at approximately USD 10 billion, driven by increasing disposable income, a shift towards online shopping, and rising demand for premium products among affluent consumers.