Region:Asia

Author(s):Geetanshi

Product Code:KRAA5056

Pages:89

Published On:September 2025

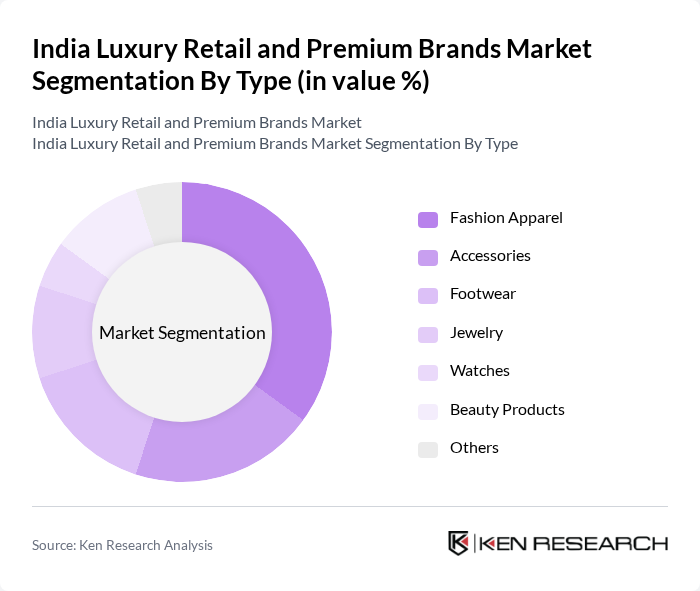

By Type:The luxury retail market is segmented into various types, including Fashion Apparel, Accessories, Footwear, Jewelry, Watches, Beauty Products, and Others. Among these, Fashion Apparel is the leading sub-segment, driven by the increasing demand for designer clothing and the influence of social media on fashion trends. Consumers are increasingly seeking unique and high-quality apparel, which has led to a surge in the availability of luxury fashion brands in the market.

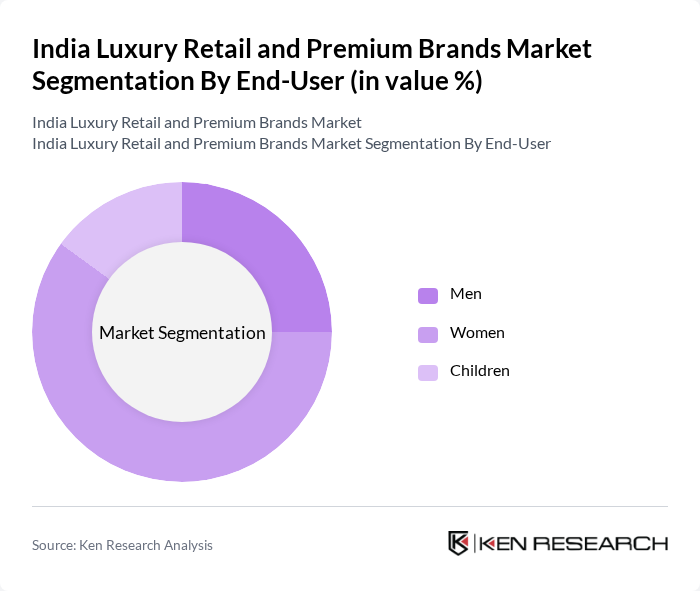

By End-User:The market is segmented by end-user demographics, including Men, Women, and Children. The Women segment dominates the market, driven by a growing interest in luxury fashion and beauty products among female consumers. Women are increasingly investing in premium brands for personal use and gifting, which has led to a significant rise in sales within this segment.

The India Luxury Retail and Premium Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Luxury Group, Aditya Birla Fashion & Retail Ltd., Reliance Brands Limited, Kering Group, LVMH Moët Hennessy Louis Vuitton, Burberry Group plc, Gucci, Prada S.p.A., Chanel S.A., Hermès International S.A., Michael Kors, Versace, Ralph Lauren Corporation, Hugo Boss AG, Montblanc International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury retail market in India appears promising, driven by evolving consumer preferences and technological advancements. As the affluent class expands, brands are likely to focus on personalization and experiential retail to enhance customer engagement. Additionally, the increasing emphasis on sustainability will shape product offerings, with consumers favoring brands that demonstrate environmental responsibility. The integration of digital technologies will further streamline operations and improve customer experiences, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Accessories Footwear Jewelry Watches Beauty Products Others |

| By End-User | Men Women Children |

| By Region | North India South India East India West India |

| By Sales Channel | Online Retail Offline Retail Luxury Boutiques |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Domestic Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retail | 150 | Brand Managers, Retail Executives |

| Premium Beauty Products | 100 | Marketing Directors, Product Managers |

| High-End Accessories | 80 | Store Managers, Sales Associates |

| Luxury Automotive Sales | 70 | Dealership Owners, Sales Managers |

| Fine Dining and Hospitality | 60 | Restaurant Managers, Hospitality Executives |

The India Luxury Retail and Premium Brands Market is valued at approximately INR 1,200 billion, driven by rising disposable incomes and changing consumer preferences towards premium products. This market has also seen a significant shift towards online shopping, enhancing accessibility to luxury goods.