Region:Asia

Author(s):Dev

Product Code:KRAC0471

Pages:86

Published On:August 2025

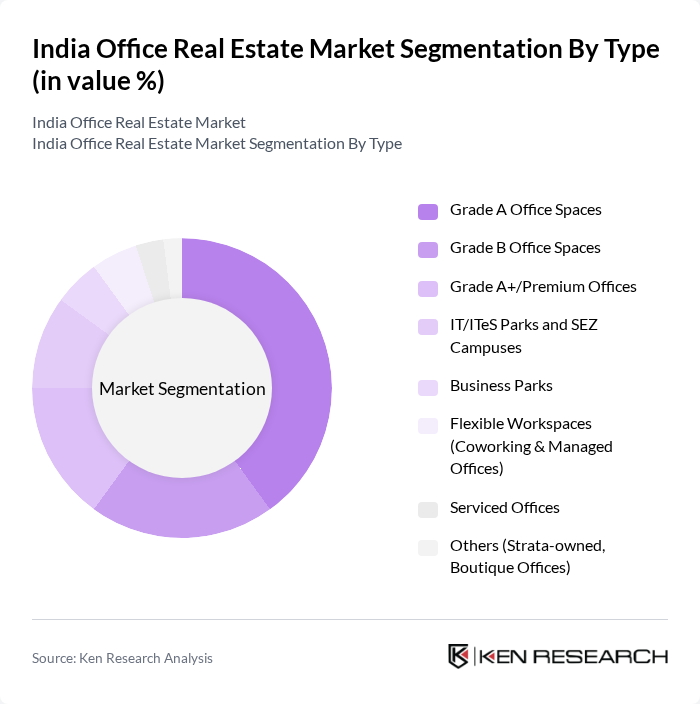

By Type:The office real estate market in India is segmented into various types, including Grade A Office Spaces, Grade B Office Spaces, Grade A+/Premium Offices, IT/ITeS Parks and SEZ Campuses, Business Parks, Flexible Workspaces (Coworking & Managed Offices), Serviced Offices, and Others (Strata-owned, Boutique Offices). Grade A Office Spaces dominate active leasing and institutional investment, driven by multinational corporations and GCCs prioritizing modern specifications, ESG-compliant buildings, wellness features, and transit-proximate locations; flexible workspaces have become a structural demand driver as enterprises use hybrid footprints and core-flex strategies within Grade A assets.

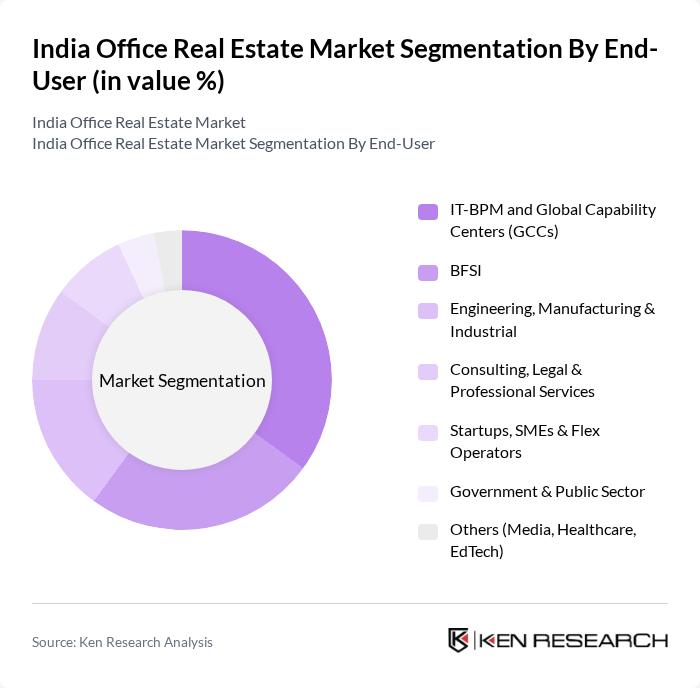

By End-User:The end-user segmentation of the office real estate market includes IT-BPM and Global Capability Centers (GCCs), BFSI, Engineering, Manufacturing & Industrial, Consulting, Legal & Professional Services, Startups, SMEs & Flex Operators, Government & Public Sector, and Others (Media, Healthcare, EdTech). IT-BPM and GCCs lead leasing activity, with material contributions from flex operators, engineering/manufacturing, and BFSI; this reflects occupier diversification and India’s role as a global talent hub for high-value services and product development.

The India Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DLF Limited, Godrej Properties Limited, Brigade Enterprises Limited, Oberoi Realty Limited, The Phoenix Mills Limited, K Raheja Corp (Mindspace Business Parks REIT), Prestige Estates Projects Limited, Embassy Group (Embassy REIT), Tata Realty and Infrastructure Limited, Indiabulls Real Estate Limited, Hiranandani Group, Sunteck Realty Limited, Mahindra Lifespace Developers Limited, Brookfield India Real Estate Trust (Brookfield Properties), Blackstone (Nexus Select Trust; commercial office portfolio) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India office real estate market appears promising, driven by ongoing urbanization and the increasing adoption of hybrid work models. As businesses continue to embrace flexible work arrangements, demand for adaptable office spaces is expected to rise. Additionally, advancements in smart building technologies will enhance operational efficiency and tenant satisfaction, further attracting investments. The market is likely to witness a shift towards sustainable office developments, aligning with global environmental standards and tenant preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Grade A Office Spaces Grade B Office Spaces Grade A+/Premium Offices IT/ITeS Parks and SEZ Campuses Business Parks Flexible Workspaces (Coworking & Managed Offices) Serviced Offices Others (Strata-owned, Boutique Offices) |

| By End-User | IT-BPM and Global Capability Centers (GCCs) BFSI Engineering, Manufacturing & Industrial Consulting, Legal & Professional Services Startups, SMEs & Flex Operators Government & Public Sector Others (Media, Healthcare, EdTech) |

| By Region/City Cluster | Bengaluru Delhi NCR (Gurugram, Noida) Mumbai Metropolitan Region (MMR) Hyderabad Pune Chennai Kolkata Tier-II Cities (Ahmedabad, Coimbatore, Kochi, Jaipur, etc.) |

| By Investment Source | Domestic Institutional/Developer Capital Foreign Direct Investment (FDI) REITs and REIT-aligned Platforms Private Equity and Credit Public-Private Partnerships (PPP) Government Schemes |

| By Sustainability & Wellness Certifications | IGBC/LEED/BREEAM Certified Net-Zero/Green Energy Enabled WELL/Health & Safety Focused Others |

| By Lease Structure | Long-term Leases (5–9 years) Short-term Leases (1–3 years) Flexible/Managed Leases Pre-commitments/Pre-leasing |

| By Building Age/Quality | New Completions (?5 years) Recently Refurbished (5–10 years) Legacy Stock (10+ years) Strata vs. Developer-held |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space in Tier 1 Cities | 120 | Real Estate Developers, Property Managers |

| Co-working Space Providers | 90 | Co-working Space Managers, Business Development Heads |

| Corporate Tenants in IT Sector | 80 | Facility Managers, Corporate Real Estate Executives |

| Investment Firms Focused on Real Estate | 70 | Investment Analysts, Portfolio Managers |

| Government Urban Development Officials | 60 | Urban Planners, Policy Makers |

The India Office Real Estate Market is valued at approximately USD 180190 billion, reflecting the significant scale of developed Grade A supply and investment depth across major Indian cities.