Region:Asia

Author(s):Geetanshi

Product Code:KRAA1242

Pages:93

Published On:August 2025

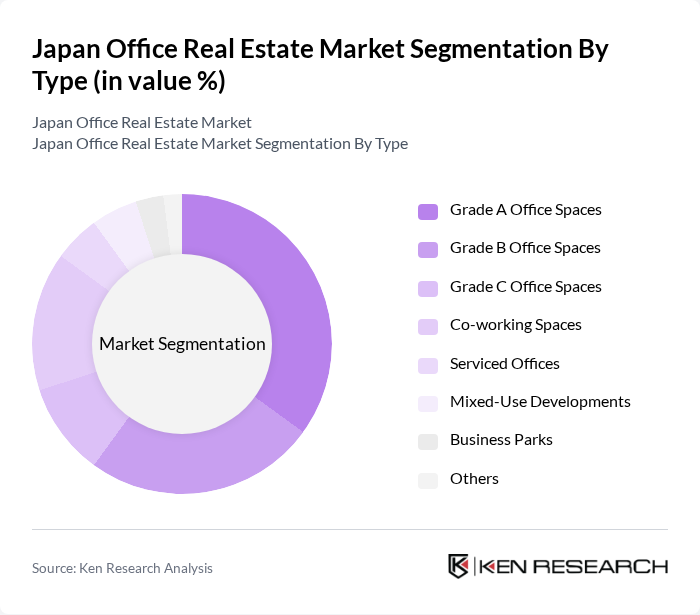

By Type:The office real estate market is segmented into Grade A, Grade B, Grade C office spaces, co-working spaces, serviced offices, mixed-use developments, business parks, and others. Grade A spaces typically attract high-end tenants due to their prime locations, superior amenities, and integration of smart building technologies. Grade B and C offices cater to cost-sensitive businesses, while co-working and serviced offices are favored by startups and SMEs seeking flexibility. Mixed-use developments and business parks offer integrated environments combining office, retail, and leisure facilities.

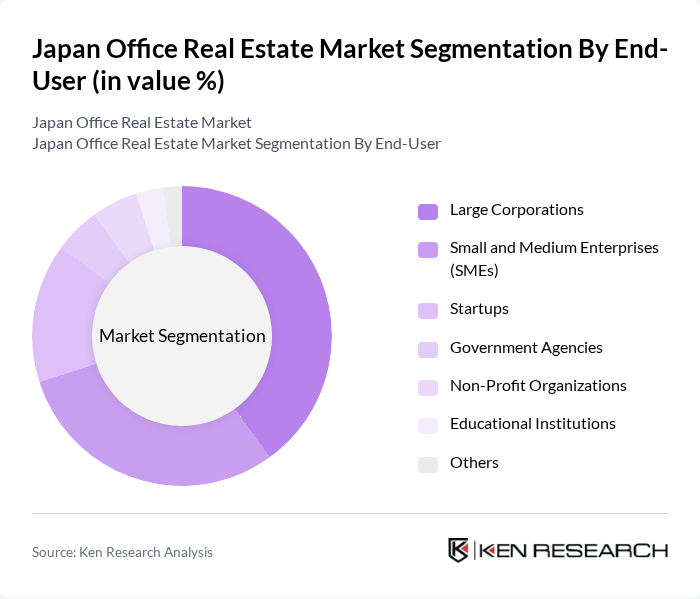

By End-User:The end-user segmentation includes large corporations, small and medium enterprises (SMEs), startups, government agencies, non-profit organizations, educational institutions, and others. Large corporations dominate the market due to their substantial office space requirements and preference for premium locations. SMEs and startups increasingly opt for flexible office solutions such as co-working and serviced offices, while government agencies, non-profit organizations, and educational institutions maintain steady demand for conventional office spaces.

The Japan Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Estate Co., Ltd., Mitsui Fudosan Co., Ltd., Sumitomo Realty & Development Co., Ltd., Tokyu Land Corporation, Daiwa House Industry Co., Ltd., Nomura Real Estate Holdings, Inc., Japan Real Estate Investment Corporation, ORIX Corporation, Hulic Co., Ltd., Tokyo Tatemono Co., Ltd., Mori Building Co., Ltd., Mori Trust Co., Ltd., Kenedix, Inc., Urban Renaissance Agency (UR), Japan Prime Realty Investment Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Japan office real estate market is poised for transformation as it adapts to evolving work patterns and sustainability demands. In future, the integration of smart technologies in office management is expected to enhance operational efficiency, while the focus on eco-friendly buildings will drive new developments. Additionally, the increasing popularity of mixed-use developments will cater to urban dwellers seeking convenience and community, positioning the market for growth despite existing challenges. The emphasis on employee wellness will also shape future office designs, creating healthier work environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Grade A Office Spaces Grade B Office Spaces Grade C Office Spaces Co-working Spaces Serviced Offices Mixed-Use Developments Business Parks Others |

| By End-User | Large Corporations Small and Medium Enterprises (SMEs) Startups Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Location | Central Business Districts (CBDs) Major Cities (Tokyo, Osaka, Nagoya, Fukuoka, Sapporo) Suburban Areas Emerging Business Hubs Industrial Zones Others |

| By Lease Type | Long-term Leases Short-term Leases Flexible Leasing Options Others |

| By Size | Small Offices (up to 100 sqm) Medium Offices (100 - 500 sqm) Large Offices (500 sqm and above) Others |

| By Investment Type | Direct Investments Real Estate Investment Trusts (REITs) Joint Ventures Private Equity Others |

| By Property Ownership | Owned Properties Leased Properties Managed Properties Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Space Users | 120 | Real Estate Managers, Facility Directors |

| Property Developers | 60 | Project Managers, Investment Analysts |

| Real Estate Brokers | 50 | Commercial Brokers, Leasing Agents |

| Co-working Space Operators | 40 | Operations Managers, Business Development Heads |

| Government Urban Planning Officials | 40 | Urban Planners, Policy Advisors |

The Japan Office Real Estate Market is valued at approximately USD 77 billion, driven by urbanization, capital expenditure, digital transformation, and a growing demand for flexible workspaces. Major cities like Tokyo, Osaka, and Nagoya are key contributors to this market.