Region:Asia

Author(s):Geetanshi

Product Code:KRAB5223

Pages:90

Published On:October 2025

By Type:The market is segmented into Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), Transactional Video on Demand (TVOD), Live Streaming Services, Free Ad-Supported Streaming TV (FAST), and Hybrid (SVOD + AVOD) Models. SVOD continues to lead, driven by the willingness of consumers to pay for premium, ad-free, and exclusive content. AVOD also holds a significant share, supported by the popularity of free content and the scale of digital advertising. The emergence of FAST and hybrid models reflects evolving monetization strategies and the growing demand for flexible viewing options .

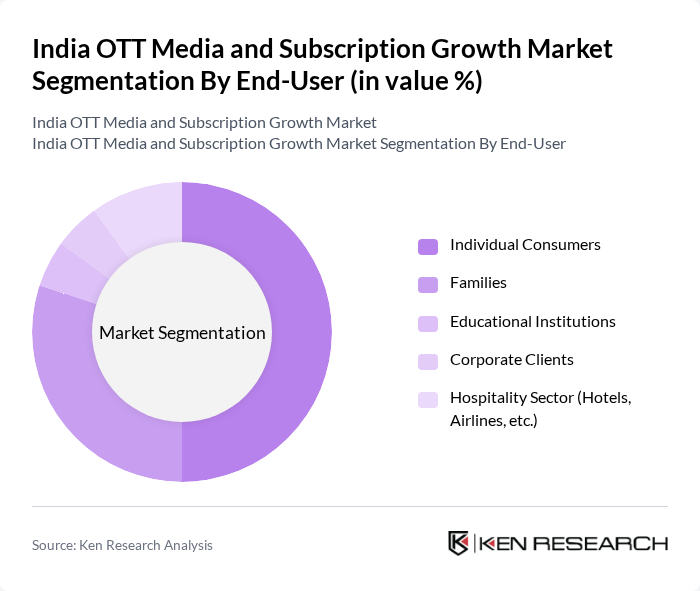

By End-User:The end-user segmentation includes Individual Consumers, Families, Educational Institutions, Corporate Clients, and the Hospitality Sector (Hotels, Airlines, etc.). Individual Consumers represent the largest segment, driven by mobile-first consumption patterns, personalized recommendations, and the convenience of on-the-go streaming. Families are increasingly subscribing to bundled plans for shared access, while educational and corporate users leverage OTT platforms for training and informational content .

The India OTT Media and Subscription Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Inc., Amazon Prime Video, Disney+ Hotstar, ZEE5, Sony LIV, Voot (Viacom18), MX Player, ALTBalaji, Eros Now, JioCinema, aha (Arha Media & Broadcasting Pvt. Ltd.), Discovery+, Apple TV+, HBO Max, Sun NXT, ShemarooMe, Hoichoi, ManoramaMAX, Chaupal, and JioTV contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India OTT media market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration and smartphone adoption continue to rise, platforms are likely to enhance user experiences through improved streaming technologies. Additionally, the increasing demand for localized content will encourage platforms to diversify their offerings, catering to regional tastes. This dynamic environment is expected to foster innovation and competition, ultimately benefiting consumers with a wider array of content choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Advertising Video on Demand (AVOD) Transactional Video on Demand (TVOD) Live Streaming Services Free Ad-Supported Streaming TV (FAST) Hybrid (SVOD + AVOD) Models |

| By End-User | Individual Consumers Families Educational Institutions Corporate Clients Hospitality Sector (Hotels, Airlines, etc.) |

| By Region | North India South India East India West India Central India Northeast India |

| By Content Genre | Drama Comedy Action Documentary Kids & Animation Sports Reality & Non-Fiction Others |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-Per-View Freemium |

| By Device Type | Mobile Devices Smart TVs Laptops and Desktops Streaming Devices (e.g., Fire TV Stick, Chromecast) Tablets |

| By Payment Method | Credit/Debit Cards Digital Wallets (Paytm, PhonePe, Google Pay, etc.) Net Banking UPI Carrier Billing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Platform Subscribers | 100 | Active Users, Recent Subscribers |

| Content Creators and Producers | 60 | Producers, Directors, Scriptwriters |

| Media Analysts and Experts | 50 | Market Analysts, Industry Consultants |

| Advertising Agencies | 40 | Media Buyers, Campaign Managers |

| Telecom Providers | 40 | Product Managers, Marketing Executives |

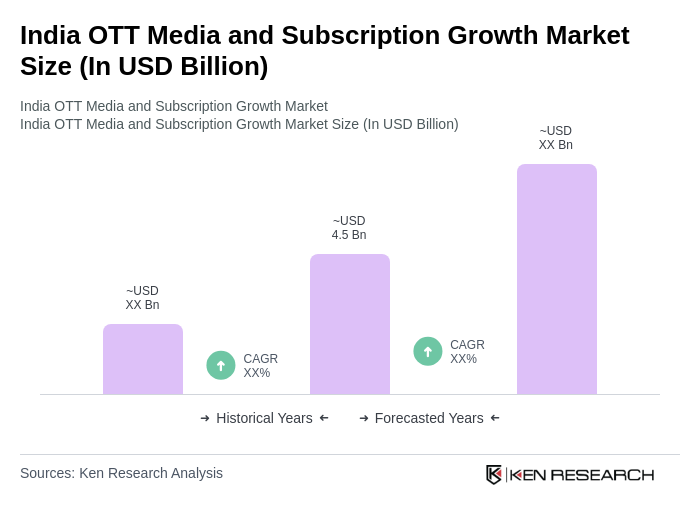

The India OTT Media and Subscription Growth Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased internet connectivity, smartphone adoption, and a shift towards on-demand content consumption.