Region:Asia

Author(s):Geetanshi

Product Code:KRAB5108

Pages:94

Published On:October 2025

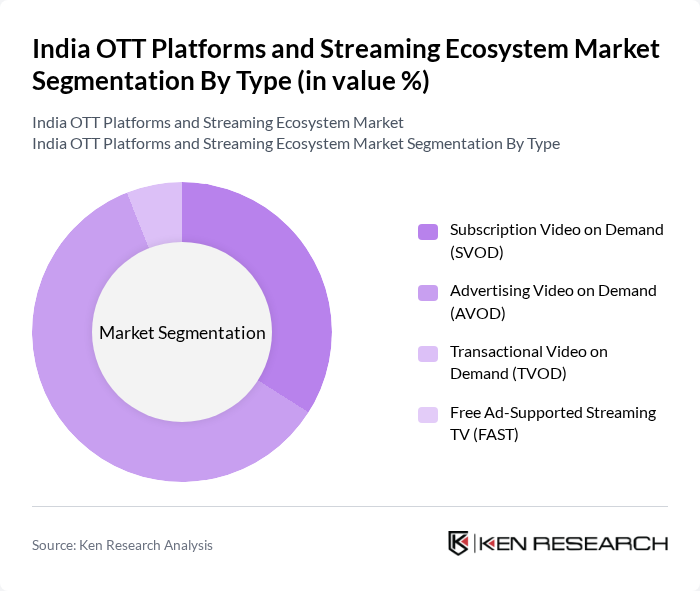

By Type:The market is segmented into four main types: Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), Transactional Video on Demand (TVOD), and Free Ad-Supported Streaming TV (FAST). Among these, SVOD has emerged as the leading segment, driven by the growing preference for ad-free viewing experiences and exclusive content offerings. Consumers are increasingly willing to pay for subscriptions to access high-quality original series and films, making SVOD a dominant force in the market. However, AVOD is also gaining significant traction due to its accessibility and the large user base preferring free content supported by advertisements .

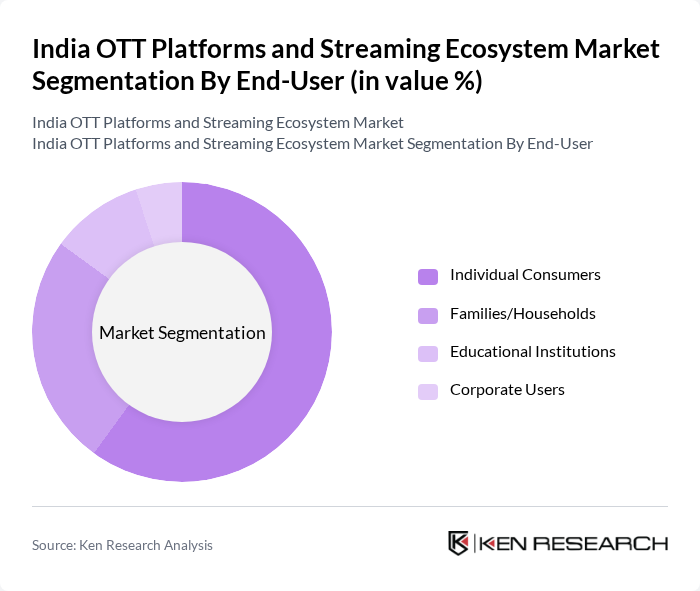

By End-User:The end-user segmentation includes Individual Consumers, Families/Households, Educational Institutions, and Corporate Users. Individual Consumers represent the largest segment, as the majority of OTT platform users are seeking personalized content experiences. The trend of binge-watching, the availability of diverse genres, and the increasing consumption of regional and youth-oriented content continue to make this segment a key driver of market growth .

The India OTT Platforms and Streaming Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Amazon Prime Video, Disney+ Hotstar, ZEE5, Sony LIV, Voot, MX Player, ALTBalaji, Eros Now, JioCinema, aha, Discovery+, Hoichoi, Sun NXT, Apple TV+, YouTube Premium, ShemarooMe, ManoramaMAX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India OTT market appears promising, driven by technological advancements and evolving consumer preferences. As 5G technology rolls out, streaming quality will improve, enhancing user experience. Furthermore, the increasing integration of AI in content recommendation systems will personalize viewing experiences, fostering user engagement. The rise of regional content will also cater to diverse audiences, ensuring platforms remain competitive and relevant in a rapidly changing landscape, ultimately driving growth in subscriptions and viewership.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Advertising Video on Demand (AVOD) Transactional Video on Demand (TVOD) Free Ad-Supported Streaming TV (FAST) |

| By End-User | Individual Consumers Families/Households Educational Institutions Corporate Users |

| By Region | North India South India East India West India |

| By Content Genre | Movies TV Shows & Web Series Documentaries Sports & Live Events Kids & Animation Music & Reality Shows |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-Per-View/Transactional Freemium |

| By Device Type | Smart TVs Mobile Devices (Smartphones/Tablets) Laptops and Desktops Streaming Devices (e.g., Fire TV Stick, Chromecast) Gaming Consoles |

| By Payment Method | Credit/Debit Cards Digital Wallets/UPI Bank Transfers/Net Banking Carrier Billing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Platform User Experience | 150 | Regular Users, Occasional Viewers |

| Content Production Insights | 100 | Producers, Directors, Scriptwriters |

| Advertising Effectiveness on OTT | 70 | Marketing Managers, Brand Strategists |

| Subscription Model Preferences | 110 | Consumers, Market Analysts |

| Impact of Regional Content | 90 | Content Curators, Regional Audience Representatives |

The India OTT Platforms and Streaming Ecosystem Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased smartphone penetration, affordable internet access, and a rising demand for on-demand content among consumers.