Region:Asia

Author(s):Rebecca

Product Code:KRAC0177

Pages:85

Published On:August 2025

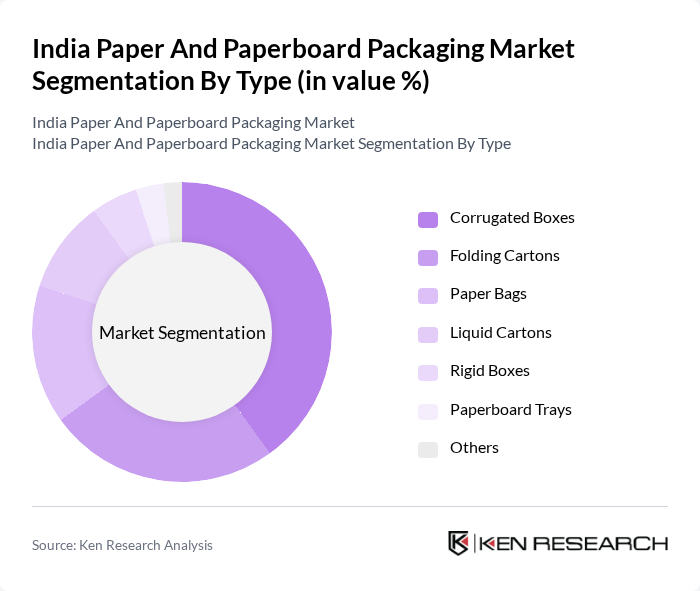

By Type:The market is segmented into various types of packaging solutions, including Corrugated Boxes, Folding Cartons, Paper Bags, Liquid Cartons, Rigid Boxes, Paperboard Trays, and Others. Among these, corrugated boxes are the most dominant due to their versatility, strength, and cost-effectiveness, making them ideal for shipping and storage. The increasing trend of online shopping and organized retail has further boosted the demand for corrugated packaging, as it provides excellent protection for products during transit and supports branding initiatives. Folding cartons are widely used in food, personal care, and pharmaceutical sectors, while paper bags are gaining traction due to bans on plastic bags in several states .

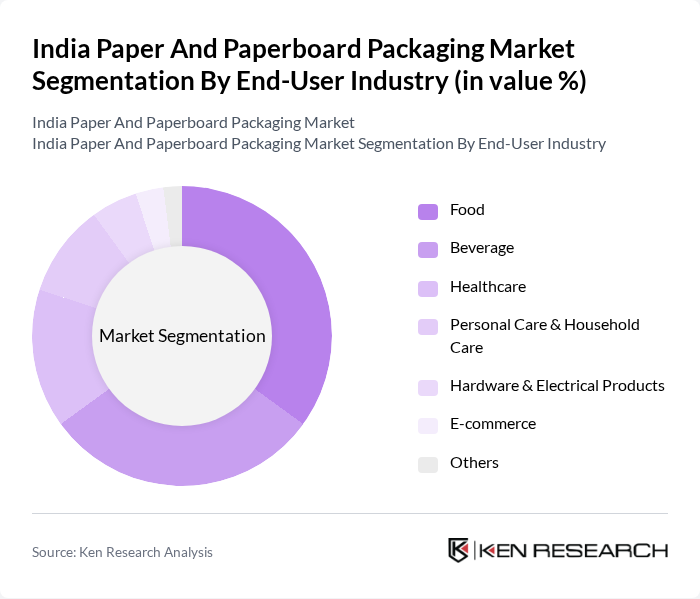

By End-User Industry:The end-user industries for paper and paperboard packaging include Food, Beverage, Healthcare, Personal Care & Household Care, Hardware & Electrical Products, E-commerce, and Others. The food and beverage sectors are the largest consumers of paper packaging due to the increasing demand for ready-to-eat meals, packaged foods, and beverages, which require efficient and sustainable packaging solutions. The rise of health-conscious consumers and regulatory pressures have also led to a surge in demand for eco-friendly packaging in these sectors. E-commerce and organized retail continue to drive demand for corrugated and folding carton packaging, while the healthcare sector increasingly utilizes paper-based solutions for pharmaceuticals and medical devices .

The India Paper And Paperboard Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as ITC Limited, West Coast Paper Mills Ltd., Ballarpur Industries Limited, JK Paper Ltd., Orient Paper & Industries Ltd., Seshasayee Paper and Boards Ltd., Emami Paper Mills Ltd., Andhra Paper Limited, Huhtamaki PPL Ltd., Tetra Pak India Pvt. Ltd., Parksons Packaging Ltd., TCPL Packaging Limited, International Paper APPM Ltd., Ruchira Papers Ltd., Sona Papers Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India paper and paperboard packaging market appears promising, driven by increasing consumer awareness of sustainability and the ongoing digital transformation in supply chain management. As companies invest in innovative packaging technologies, the market is expected to witness significant advancements. Additionally, the rise of smart packaging solutions will enhance product tracking and consumer engagement, further solidifying the market's growth potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Corrugated Boxes Folding Cartons Paper Bags Liquid Cartons Rigid Boxes Paperboard Trays Others |

| By End-User Industry | Food Beverage Healthcare Personal Care & Household Care Hardware & Electrical Products E-commerce Others |

| By Region | North India South India East India West India |

| By Application | Retail Packaging Industrial Packaging Food Packaging Healthcare Packaging Beverage Packaging Electronics Packaging |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Price Range | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corrugated Packaging Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Folding Carton Producers | 80 | Sales Directors, Product Development Managers |

| Paper Bag Manufacturers | 60 | Operations Managers, Supply Chain Coordinators |

| End-Users in E-commerce | 70 | Logistics Managers, Packaging Engineers |

| Food and Beverage Packaging | 65 | Procurement Officers, Marketing Managers |

The India Paper and Paperboard Packaging Market is valued at approximately USD 19 billion, driven by the demand for sustainable packaging solutions, the growth of e-commerce, and the food and beverage sector's need for eco-friendly packaging options.