Region:Global

Author(s):Rebecca

Product Code:KRAA2917

Pages:91

Published On:August 2025

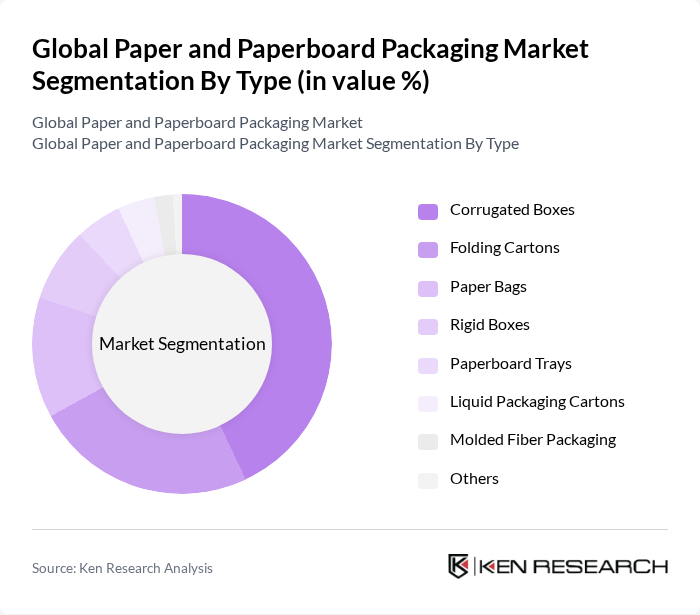

By Type:The market is segmented into various types of packaging solutions, including corrugated boxes, folding cartons, paper bags, rigid boxes, paperboard trays, liquid packaging cartons, molded fiber packaging, and others. Among these, corrugated boxes and folding cartons are the most prominent due to their versatility, strength, and widespread use in shipping, logistics, and retail. The demand for eco-friendly packaging options has further propelled the growth of these segments, as businesses seek to align with consumer preferences for sustainable products and comply with regulations on single-use plastics .

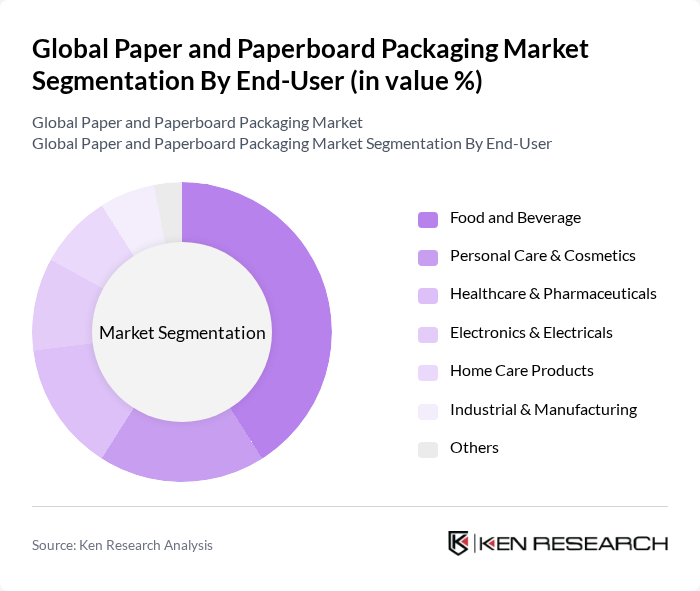

By End-User:The end-user segmentation includes food and beverage, personal care & cosmetics, healthcare & pharmaceuticals, electronics & electricals, home care products, industrial & manufacturing, and others. The food and beverage sector is the largest consumer of paper and paperboard packaging, driven by the increasing demand for packaged food products, beverages, and ready-to-eat meals. Growth in this segment is further supported by the rapid expansion of online food delivery services and heightened consumer demand for sustainable, recyclable packaging .

The Global Paper and Paperboard Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith Plc, Stora Enso Oyj, Packaging Corporation of America, Nippon Paper Industries Co., Ltd., Sappi Limited, Georgia-Pacific LLC, Sonoco Products Company, Huhtamaki Oyj, Oji Holdings Corporation, Clearwater Paper Corporation, Cascades Inc., UPM-Kymmene Corporation, Nine Dragons Paper (Holdings) Limited, Mayr-Melnhof Karton AG, Klabin S.A., Rengo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the paper and paperboard packaging market appears promising, driven by increasing consumer demand for sustainable solutions and technological advancements. As companies invest in innovative materials and smart packaging technologies, the market is likely to witness significant transformations. Additionally, the ongoing expansion of e-commerce will further fuel demand, creating opportunities for manufacturers to develop tailored packaging solutions that meet the evolving needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Corrugated Boxes Folding Cartons Paper Bags Rigid Boxes Paperboard Trays Liquid Packaging Cartons Molded Fiber Packaging Others |

| By End-User | Food and Beverage Personal Care & Cosmetics Healthcare & Pharmaceuticals Electronics & Electricals Home Care Products Industrial & Manufacturing Others |

| By Application | Retail Packaging Industrial Packaging Food Packaging E-commerce Packaging Beverage Packaging Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Material Type | Recycled Paper Virgin Paper Coated Paper & Paperboard Uncoated Paper & Paperboard Kraft Paper Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Supply Chain Coordinators |

| Pharmaceutical Packaging Solutions | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging Trends | 100 | Product Managers, Marketing Directors |

| Sustainable Packaging Initiatives | 60 | Sustainability Managers, Corporate Social Responsibility Officers |

| Recycling and Waste Management Practices | 70 | Environmental Compliance Officers, Operations Managers |

The Global Paper and Paperboard Packaging Market is valued at approximately USD 417 billion, driven by the increasing demand for sustainable packaging solutions and the growth of e-commerce and retail sectors.