Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRO052

Pages:90

Published On:September 2025

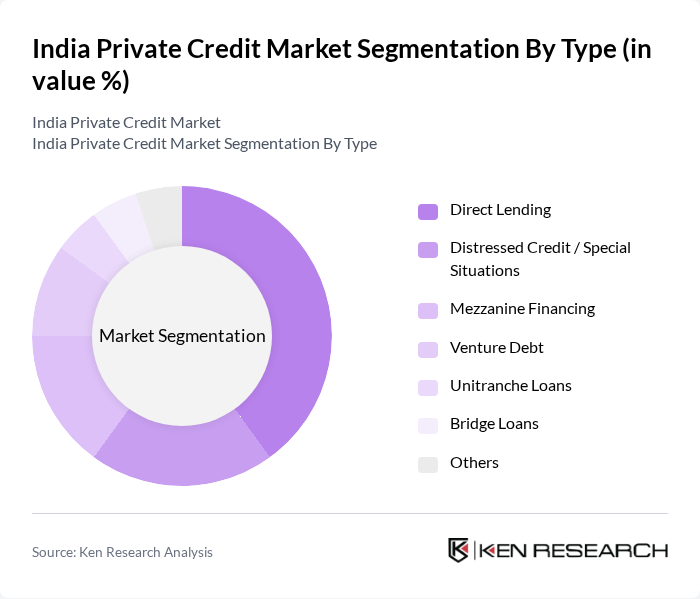

By Type:The India Private Credit Market can be segmented into various types, including Direct Lending, Distressed Credit / Special Situations, Mezzanine Financing, Venture Debt, Unitranche Loans, Bridge Loans, and Others. Each of these sub-segments caters to different financing needs and risk profiles. Direct Lending remains the most prominent, driven by the demand for flexible, non-dilutive capital and faster execution timelines. Distressed Credit and Special Situations have gained traction as investors seek opportunities in restructuring and turnaround scenarios, while Venture Debt is increasingly popular among high-growth startups.

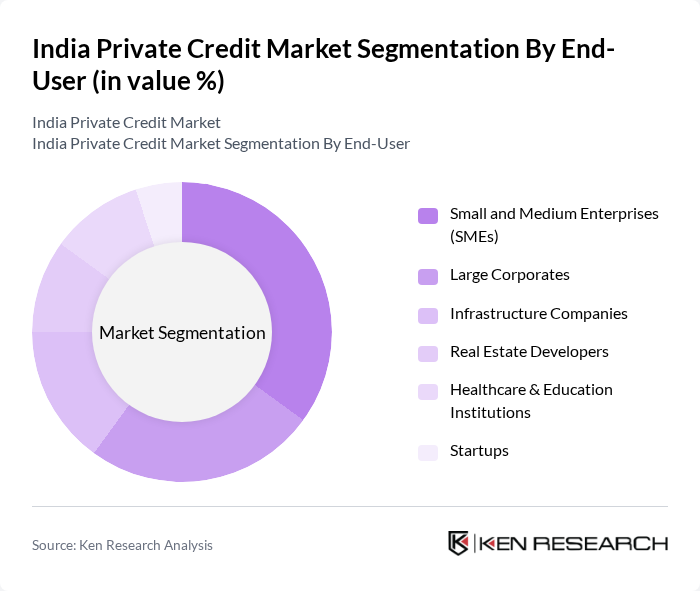

By End-User:The end-users of private credit include Small and Medium Enterprises (SMEs), Large Corporates, Infrastructure Companies, Real Estate Developers, Healthcare & Education Institutions, and Startups. SMEs are particularly significant in this market, as they often face challenges in accessing traditional bank financing, making private credit an attractive alternative for their growth and operational needs. Infrastructure and real estate sectors are also key recipients, reflecting the country’s ongoing development priorities and the need for long-term capital.

The India Private Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Edelweiss Alternative Asset Advisors, Kotak Investment Advisors, Piramal Capital & Housing Finance, IIFL Asset Management, and Avendus Finance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India private credit market appears promising, driven by technological advancements and evolving consumer preferences. The expansion of digital lending platforms is expected to enhance accessibility and streamline the borrowing process, while the increasing focus on impact investing will attract socially responsible investors. Additionally, strategic partnerships between traditional lenders and fintech companies are likely to foster innovation, creating tailored financial products that meet the diverse needs of borrowers in the evolving economic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Lending Distressed Credit / Special Situations Mezzanine Financing Venture Debt Unitranche Loans Bridge Loans Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporates Infrastructure Companies Real Estate Developers Healthcare & Education Institutions Startups |

| By Investment Source | Domestic Private Credit Funds Foreign Institutional Investors (FIIs) Alternative Investment Funds (AIFs) Private Equity Firms Family Offices |

| By Loan Purpose | Working Capital Acquisition Financing Expansion & Growth Capital Refinancing / Debt Restructuring Real Estate Financing Special Situation Financing |

| By Risk Profile | Performing Credit Distressed Credit Special Situations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Borrowers in Manufacturing | 100 | Business Owners, Financial Managers |

| Real Estate Development Financing | 75 | Project Managers, Financial Analysts |

| Consumer Goods Sector Loans | 60 | Marketing Directors, CFOs |

| Healthcare Sector Financing | 50 | Operations Managers, Financial Controllers |

| Technology Startups Funding | 65 | Founders, Venture Capital Analysts |

The India Private Credit Market is valued at approximately USD 12 billion, reflecting significant growth driven by the increasing demand for alternative financing solutions among businesses, particularly in sectors like real estate, infrastructure, and small and medium enterprises.