Region:Middle East

Author(s):Shubham

Product Code:KRAB7263

Pages:91

Published On:October 2025

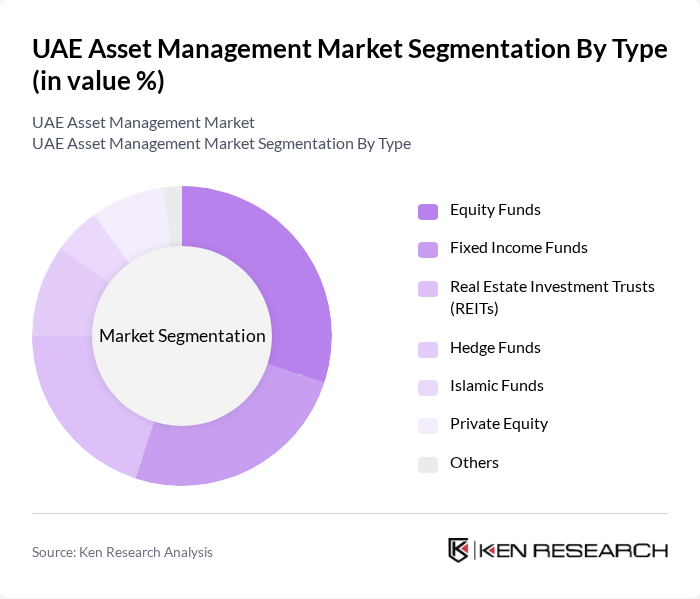

By Type:The asset management market can be segmented into various types, including Equity Funds, Fixed Income Funds, Real Estate Investment Trusts (REITs), Hedge Funds, Islamic Funds, Private Equity, and Others. Each of these subsegments caters to different investor preferences and risk appetites, with specific strategies and asset classes that appeal to a diverse clientele.

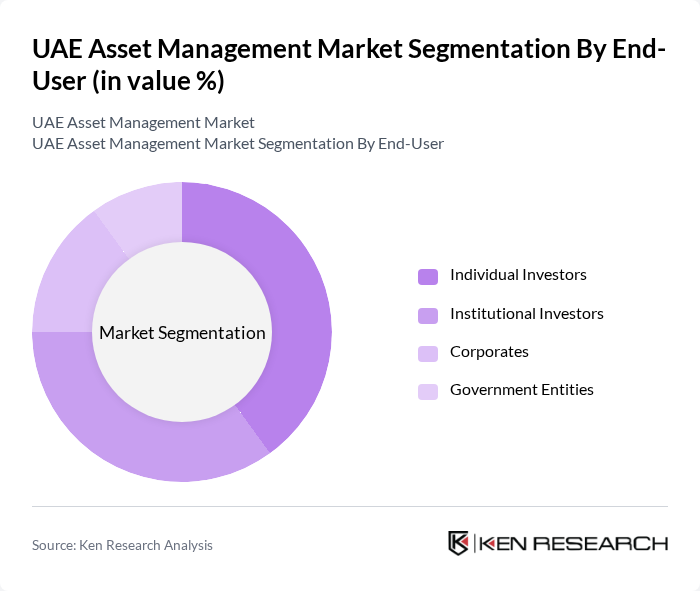

By End-User:The end-users of asset management services include Individual Investors, Institutional Investors, Corporates, and Government Entities. Each of these segments has unique investment needs and objectives, influencing the types of products and services offered by asset management firms.

The UAE Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD Asset Management, Abu Dhabi Investment Authority (ADIA), Dubai Investments, Al Hilal Bank, Qatar Investment Authority, National Bank of Abu Dhabi, First Abu Dhabi Bank, Sharjah Asset Management, RAK Investment Authority, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Noor Bank, Mashreq Bank, Invest AD, Daman Investments contribute to innovation, geographic expansion, and service delivery in this space.

The UAE asset management market is poised for significant growth, driven by increasing wealth management needs and regulatory reforms. As the economy stabilizes, the demand for innovative investment solutions will rise, particularly in sustainable and digital asset management. The integration of advanced technologies will enhance operational efficiencies, allowing firms to better serve their clients. Additionally, strategic partnerships with fintech companies will further drive innovation, positioning the UAE as a leading hub for asset management in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Funds Fixed Income Funds Real Estate Investment Trusts (REITs) Hedge Funds Islamic Funds Private Equity Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Asset Class | Equities Fixed Income Commodities Alternatives |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms Banks and Financial Institutions |

| By Geographic Focus | Domestic Investments Regional Investments Global Investments |

| By Client Type | High Net-Worth Individuals (HNWIs) Ultra High Net-Worth Individuals (UHNWIs) Retail Clients Institutional Clients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors | 150 | Portfolio Managers, Investment Analysts |

| High-Net-Worth Individuals | 100 | Wealth Managers, Financial Advisors |

| Asset Management Firms | 80 | CEOs, Chief Investment Officers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Financial Consultants | 70 | Consultants, Market Analysts |

The UAE Asset Management Market is valued at approximately USD 1.5 trillion, driven by increasing foreign investments, a robust financial services sector, and a growing number of high-net-worth individuals (HNWIs) in the region.