Region:Asia

Author(s):Geetanshi

Product Code:KRAA3241

Pages:97

Published On:September 2025

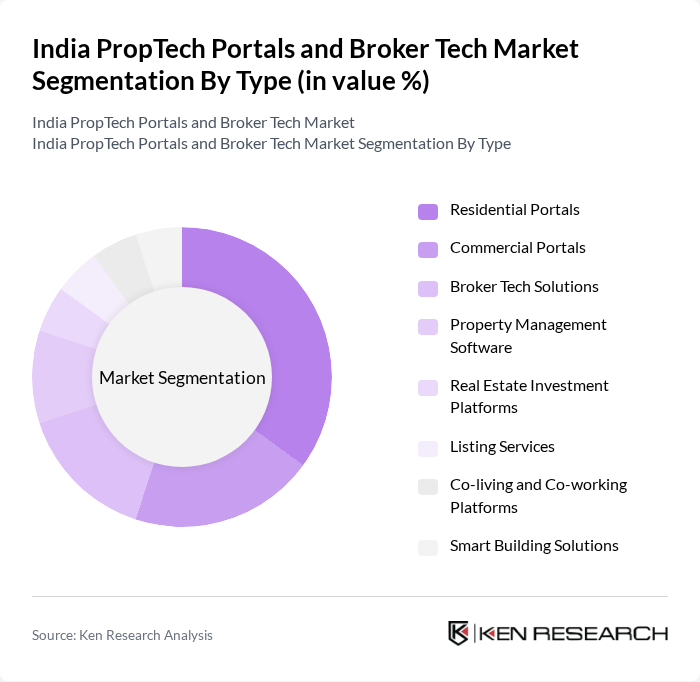

By Type:The market is segmented into various types, including Residential Portals, Commercial Portals, Broker Tech Solutions, Property Management Software, Real Estate Investment Platforms, Listing Services, Co-living and Co-working Platforms, and Smart Building Solutions. Among these, Residential Portals are currently leading the market due to the increasing demand for housing and the convenience offered by online platforms for property searches. The trend of urban migration and the growing middle-class population are significant factors driving the popularity of these portals. The adoption of virtual tours, AI-driven property recommendations, and secure online transactions is further strengthening the dominance of residential portals in the Indian PropTech landscape .

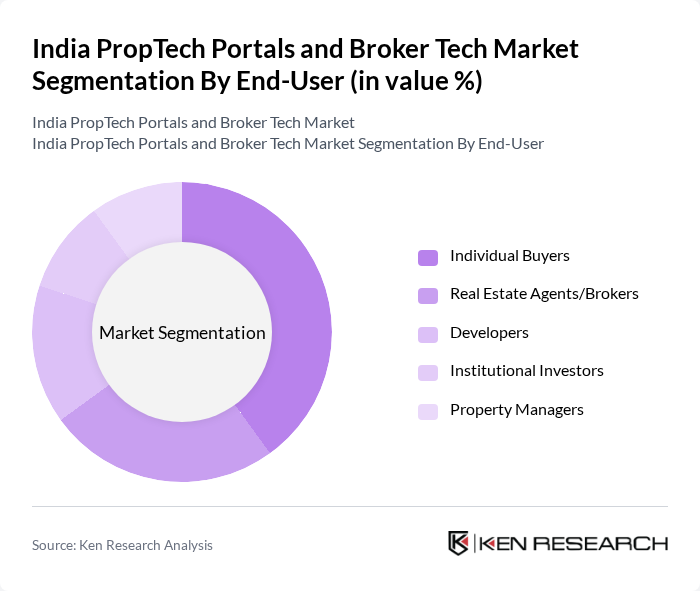

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents/Brokers, Developers, Institutional Investors, and Property Managers. Individual Buyers dominate the market, driven by the increasing trend of home ownership and the convenience of online property searches. The rise of digital literacy, widespread internet access, and the availability of various financing options have further empowered individual buyers, making them a significant force in the PropTech landscape. Enhanced user experiences through mobile apps, personalized property recommendations, and transparent transaction processes are also contributing to this trend .

The India PropTech Portals and Broker Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as MagicBricks, 99acres, Housing.com, NoBroker, PropTiger, Square Yards, NestAway, OYO Life, ANAROCK, RealtyNXT, Homigo, Zolo Stays, QuikrHomes, HousingMan, Propstack, Broker Network, CRE Matrix, Furlenco, Brick&Bolt, PropertyAngel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India PropTech market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for innovative real estate solutions will likely increase. Additionally, the integration of AI and big data analytics will enhance property management and customer engagement. The market is expected to witness a surge in collaboration between PropTech firms and traditional real estate players, fostering a more integrated approach to property transactions and management.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Broker Tech Solutions Property Management Software Real Estate Investment Platforms Listing Services Co-living and Co-working Platforms Smart Building Solutions |

| By End-User | Individual Buyers Real Estate Agents/Brokers Developers Institutional Investors Property Managers |

| By Region | North India South India East India West India |

| By Technology | Mobile Applications Web Portals CRM Solutions Data Analytics Tools AI & Machine Learning Platforms Blockchain Solutions |

| By Application | Property Listing Market Analysis Customer Relationship Management Transaction Management Rental Management Virtual Site Visits |

| By Investment Source | Private Equity Venture Capital Government Funding Crowdfunding |

| By Policy Support | Tax Incentives Subsidies for Startups Regulatory Support for Digital Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 120 | Real Estate Agents, Platform Users |

| Commercial Property Management Tools | 80 | Property Managers, Facility Managers |

| Real Estate Investment Analytics | 60 | Investment Analysts, Financial Advisors |

| Brokerage Technology Solutions | 90 | Brokerage Owners, Technology Officers |

| Smart Home Integration Services | 50 | Homeowners, Technology Enthusiasts |

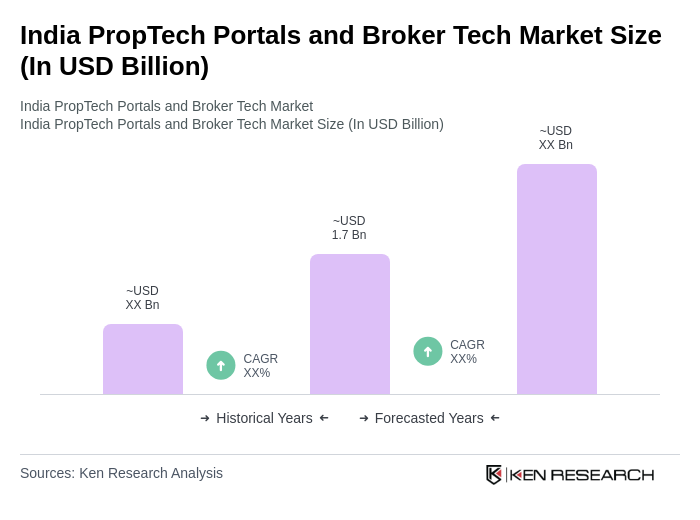

The India PropTech Portals and Broker Tech Market is valued at approximately USD 1.7 billion, driven by the increasing adoption of digital platforms for real estate transactions and enhanced consumer awareness.