Region:Middle East

Author(s):Dev

Product Code:KRAE0049

Pages:99

Published On:December 2025

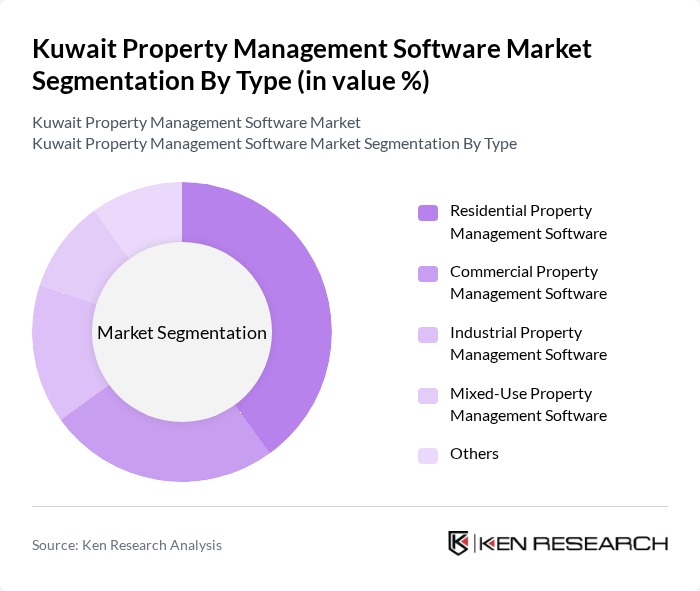

By Type:The property management software market can be segmented into various types, including Residential Property Management Software, Commercial Property Management Software, Industrial Property Management Software, Mixed-Use Property Management Software, and Others. Among these, Residential Property Management Software is currently the leading segment, driven by the increasing number of residential properties and the need for efficient tenant management solutions. The growing trend of smart homes and the integration of IoT technologies are also contributing to the demand for residential management solutions.

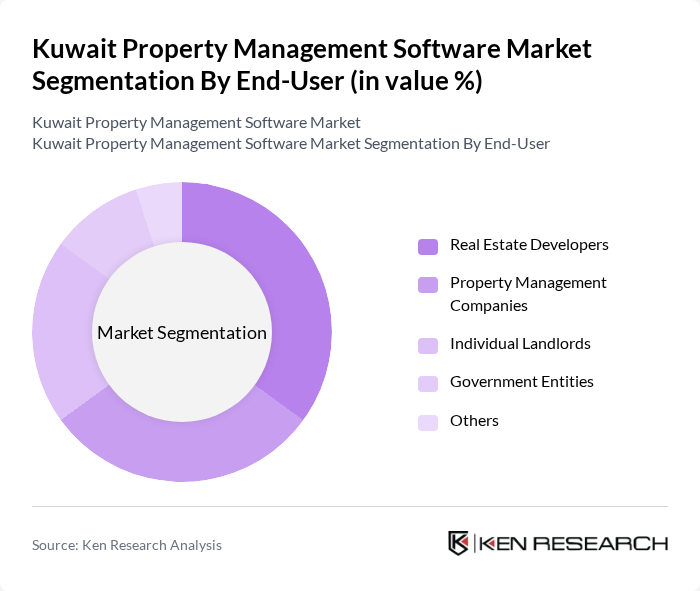

By End-User:The end-user segmentation includes Real Estate Developers, Property Management Companies, Individual Landlords, Government Entities, and Others. Real Estate Developers are the dominant end-user segment, as they require comprehensive software solutions to manage multiple properties efficiently. The increasing number of real estate projects and the need for effective project management tools are driving this segment's growth.

The Kuwait Property Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yardi Systems, AppFolio, Buildium, MRI Software, RealPage, Propertyware, Rentec Direct, TenantCloud, Zego, ResMan, Entrata, Rentec Direct, Cozy, SimplifyEm, HappyCo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the property management software market in Kuwait appears promising, driven by increasing digitalization and a shift towards smart city initiatives. As the government invests in infrastructure and technology, property management solutions will likely evolve to incorporate advanced features such as AI-driven analytics and mobile accessibility. This transformation will enhance operational efficiency and tenant satisfaction, positioning software as a critical component in the real estate sector's growth strategy.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Property Management Software Commercial Property Management Software Industrial Property Management Software Mixed-Use Property Management Software Others |

| By End-User | Real Estate Developers Property Management Companies Individual Landlords Government Entities Others |

| By Deployment Model | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions Others |

| By Functionality | Lease Management Maintenance Management Accounting and Financial Management Tenant and Lease Tracking Others |

| By Region | Kuwait City Hawalli Al Ahmadi Al Jahra Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Management | 100 | Property Managers, Real Estate Agents |

| Commercial Property Management | 80 | Facility Managers, Leasing Agents |

| Software Development for Property Management | 60 | Software Engineers, Product Managers |

| End-User Experience with Property Management Software | 75 | Property Owners, Tenants |

| Market Trends in Property Management Software | 90 | Industry Analysts, Market Researchers |

The Kuwait Property Management Software Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for efficient property management solutions and the rise in real estate investments in the region.