Region:Asia

Author(s):Shubham

Product Code:KRAC0892

Pages:83

Published On:August 2025

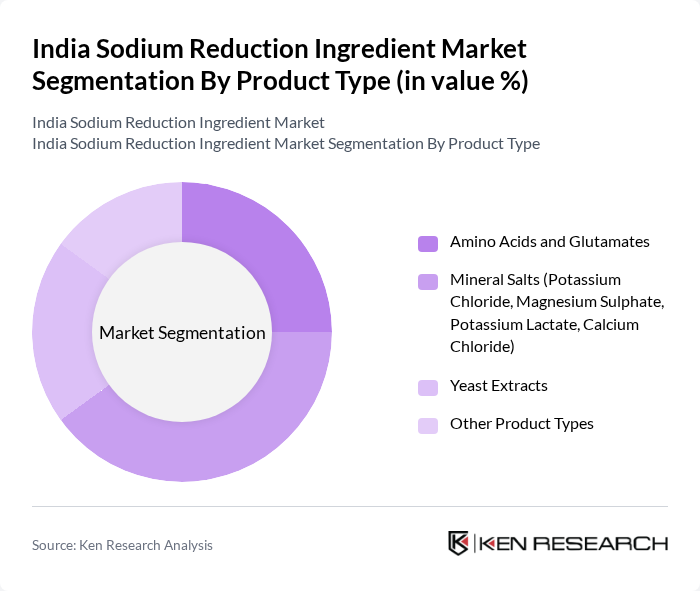

By Product Type:The product type segmentation includes various ingredients used for sodium reduction. The subsegments are Amino Acids and Glutamates, Mineral Salts (Potassium Chloride, Magnesium Sulphate, Potassium Lactate, Calcium Chloride), Yeast Extracts, and Other Product Types. Among these,Mineral Saltsare currently dominating the market due to their effectiveness in mimicking the taste of sodium while providing essential minerals. The growing trend of health-conscious consumers is pushing food manufacturers to adopt these ingredients, leading to increased usage in various food applications .

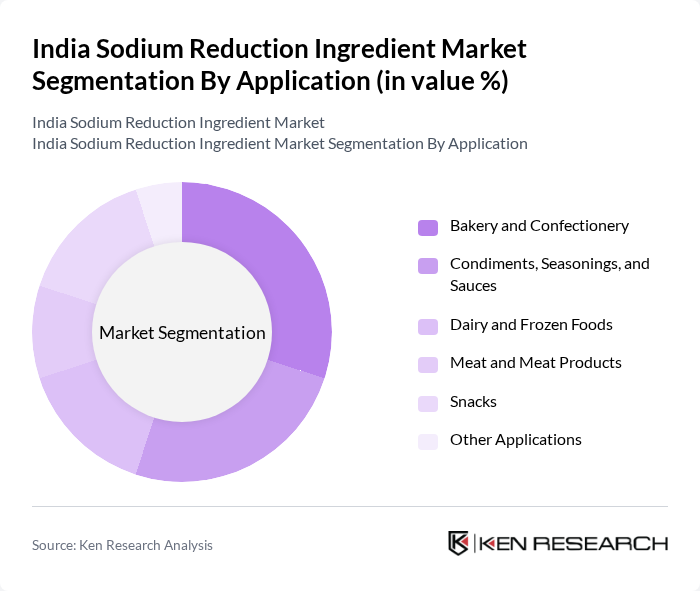

By Application:The application segmentation encompasses various sectors where sodium reduction ingredients are utilized, including Bakery and Confectionery, Condiments, Seasonings, and Sauces, Dairy and Frozen Foods, Meat and Meat Products, Snacks, and Other Applications. TheBakery and Confectionerysegment is leading the market, driven by the increasing demand for healthier baked goods and snacks. Consumers are increasingly seeking products with lower sodium content, prompting manufacturers to innovate and reformulate their offerings .

The India Sodium Reduction Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Chemicals Limited, DSM Nutritional Products, Kerry Group plc, Cargill India Pvt. Ltd., Ingredion India Pvt. Ltd., Archer Daniels Midland Company (ADM), Ajinomoto Co., Inc., Givaudan, BASF SE, Tate & Lyle PLC, Bunge Limited, Sensient Technologies Corporation, Corbion N.V., Biospringer (Lesaffre Group), E.I. du Pont de Nemours and Company (DuPont) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the sodium reduction ingredient market in India appears promising, driven by a combination of health trends and regulatory support. As consumer preferences shift towards healthier food options, manufacturers are likely to invest in innovative sodium reduction technologies. Additionally, government policies aimed at promoting public health will further encourage the adoption of low-sodium products. This evolving landscape presents opportunities for growth, particularly in the development of new product lines that cater to health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Amino Acids and Glutamates Mineral Salts (Potassium Chloride, Magnesium Sulphate, Potassium Lactate, Calcium Chloride) Yeast Extracts Other Product Types |

| By Application | Bakery and Confectionery Condiments, Seasonings, and Sauces Dairy and Frozen Foods Meat and Meat Products Snacks Other Applications |

| By End-User | Food Processing Industry Beverage Industry Catering Services |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distributors |

| By Region | North India South India East India West India |

| By Price Range | Economy Range Mid-Range Premium Range |

| By Others | Specialty Ingredients Custom Blends |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Product Development Managers, Quality Assurance Officers |

| Retail Sector Insights | 80 | Category Managers, Retail Buyers |

| Health and Nutrition Experts | 60 | Registered Dietitians, Public Health Officials |

| Consumer Behavior Analysis | 100 | Health-Conscious Consumers, Food Enthusiasts |

| Regulatory Bodies Feedback | 40 | Policy Makers, Health Regulators |

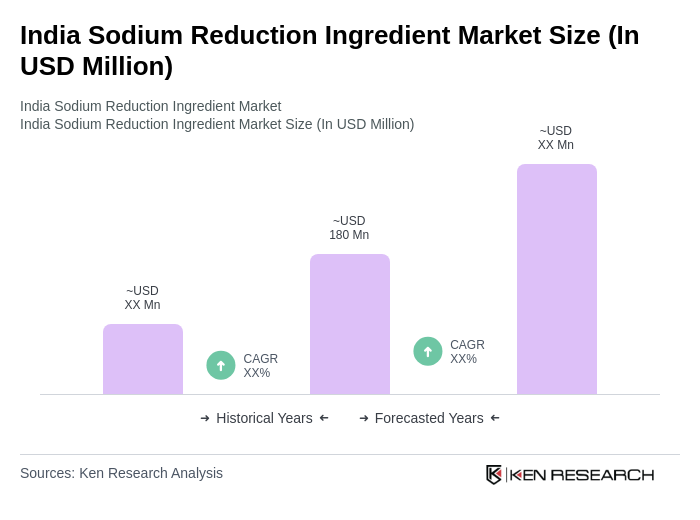

The India Sodium Reduction Ingredient Market is valued at approximately USD 180 million, driven by increasing health awareness, regulatory pressures, and the rising prevalence of lifestyle-related diseases among consumers.