Region:Central and South America

Author(s):Shubham

Product Code:KRAA1871

Pages:96

Published On:August 2025

By Type:The sodium reduction ingredient market can be segmented into various types, including Potassium Chloride (KCl), Mineral Salts, Yeast Extracts, Amino Acids & Glutamates, Flavor Modulators/Taste Enhancers, Sea Salt & Low-Sodium Salts, Herbs, Spices & Natural Flavorings, and Other Sodium Reduction Ingredients. Among these, Potassium Chloride is the leading subsegment due to its widespread use as a direct sodium replacer in various food products, driven by consumer demand for healthier alternatives.

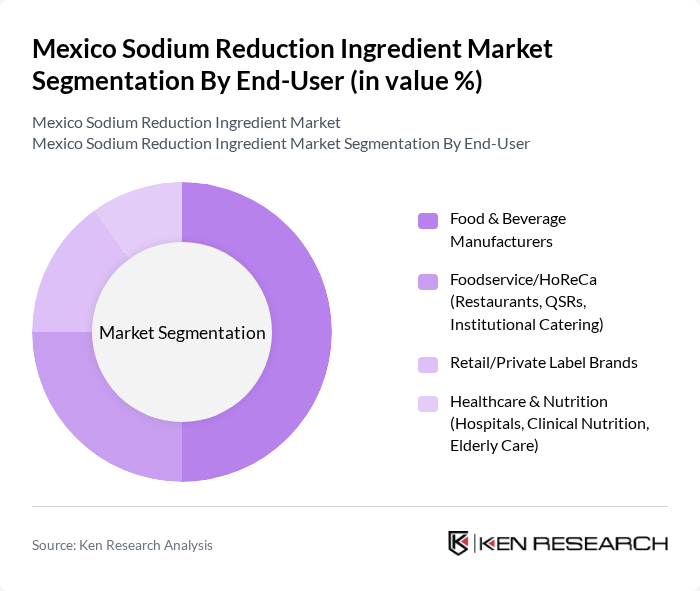

By End-User:The market can also be segmented by end-user categories, including Food & Beverage Manufacturers, Foodservice/HoReCa, Retail/Private Label Brands, and Healthcare & Nutrition. Food & Beverage Manufacturers dominate this segment as they are the primary users of sodium reduction ingredients to reformulate products in response to consumer health trends and regulatory requirements.

The Mexico Sodium Reduction Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Kerry Group plc, Koninklijke DSM N.V. (DSM-Firmenich), Lallemand Inc., Lesaffre International, Ingredion Incorporated, Tate & Lyle PLC, Givaudan SA, Ajinomoto Co., Inc., Symrise AG, Sensient Technologies Corporation, IFF (International Flavors & Fragrances Inc.), Corbion N.V., Griffith Foods, Bunge México S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium reduction ingredient market in Mexico appears promising, driven by increasing health awareness and regulatory support. As consumers continue to prioritize health, the demand for innovative, low-sodium products is expected to rise. Additionally, advancements in sodium reduction technologies will likely enhance product acceptance. Companies that adapt to these trends and invest in consumer education will be well-positioned to capitalize on the growing market, fostering a healthier food landscape in Mexico.

| Segment | Sub-Segments |

|---|---|

| By Type | Potassium Chloride (KCl) Mineral Salts (e.g., Magnesium/Potassium Blends) Yeast Extracts Amino Acids & Glutamates (e.g., Monosodium Glutamate, Disodium Inosinate/Guanlyate) Flavor Modulators/Taste Enhancers (e.g., Bitter Blockers) Sea Salt & Low-Sodium Salts Herbs, Spices & Natural Flavorings Other Sodium Reduction Ingredients (e.g., Hydrocolloids, Nucleotides) |

| By End-User | Food & Beverage Manufacturers Foodservice/HoReCa (Restaurants, QSRs, Institutional Catering) Retail/Private Label Brands Healthcare & Nutrition (Hospitals, Clinical Nutrition, Elderly Care) |

| By Application | Bakery & Confectionery Snacks & Savory (Chips, Extruded Snacks, Nuts) Meat, Poultry & Seafood Products Sauces, Seasonings & Condiments Dairy & Frozen Foods Ready Meals & Processed Foods |

| By Distribution Channel | Direct Sales (B2B) Distributors/Wholesalers Online (E-marketplaces, Supplier Portals) Retail for Consumer-Facing Low-Sodium Salts |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk/Industrial Packaging (Sacks, FIBCs) Retail Packaging (Bottles, Pouches, Shakers) Sustainable/Eco-Friendly Packaging |

| By Others | Custom Functional Blends (Salt Systems) Specialty Dietary Products (Low/No Sodium, Heart-Healthy) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Ingredient Suppliers | 90 | Sales Directors, Technical Support Managers |

| Health Professionals | 60 | Nutritionists, Dietitians |

| Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

| Consumer Focus Groups | 80 | Health-conscious Consumers, Culinary Experts |

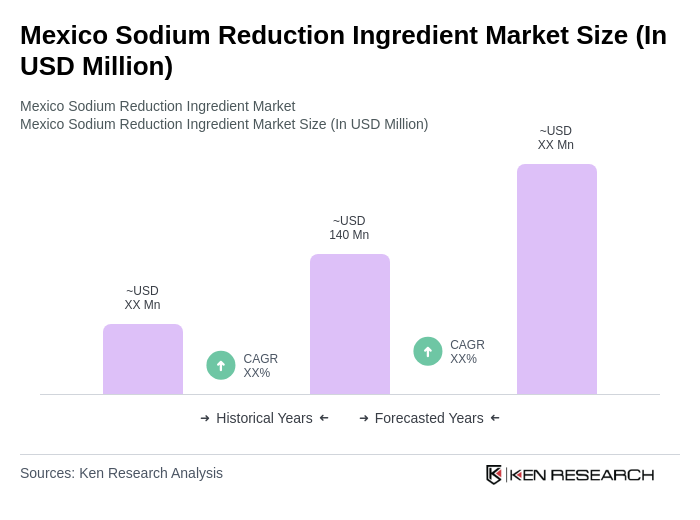

The Mexico Sodium Reduction Ingredient Market is valued at approximately USD 140 million, reflecting a significant growth driven by health awareness, regulatory pressures, and the rising prevalence of lifestyle-related diseases such as hypertension and cardiovascular disorders.