Region:Asia

Author(s):Dev

Product Code:KRAD1653

Pages:81

Published On:November 2025

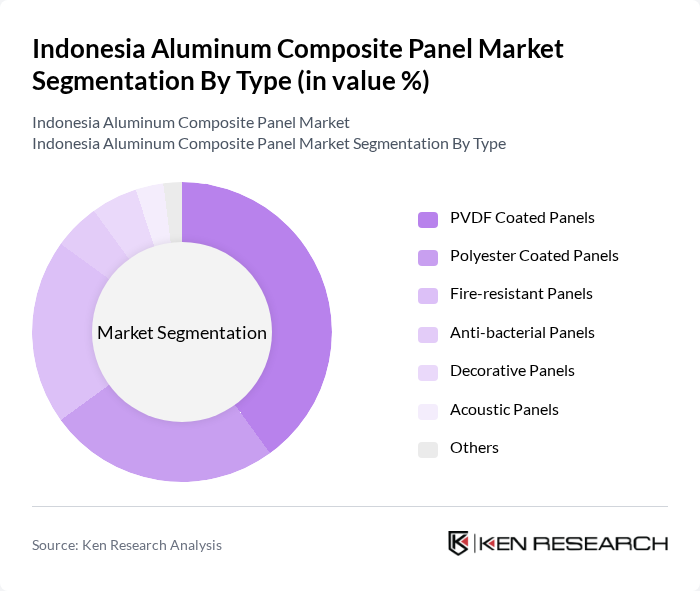

By Type:The market is segmented into various types of aluminum composite panels, including PVDF Coated Panels, Polyester Coated Panels, Fire-resistant Panels, Anti-bacterial Panels, Decorative Panels, Acoustic Panels, and Others. PVDF Coated Panels are leading due to their superior durability and weather resistance, making them the preferred choice for exterior cladding and facade applications. The demand for Fire-resistant Panels is also rising, driven by regulatory requirements and heightened safety awareness in the construction industry.

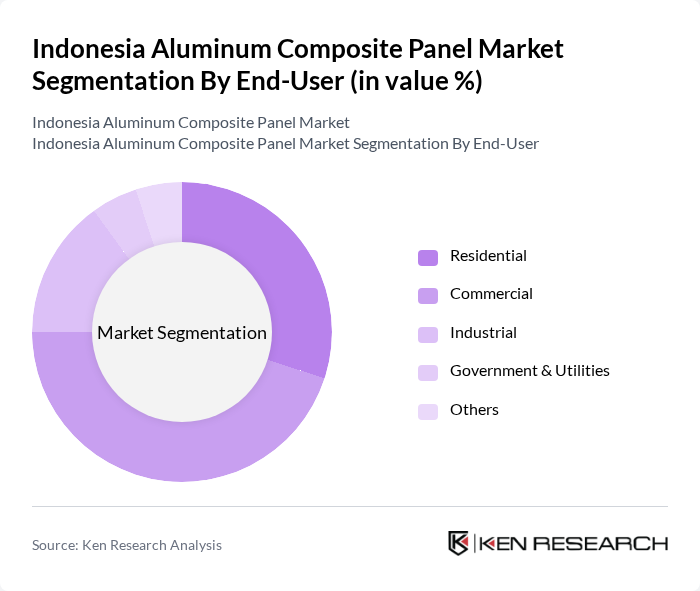

By End-User:The aluminum composite panel market is segmented by end-user into Residential, Commercial, Industrial, Government & Utilities, and Others. The Commercial segment is the largest, driven by the proliferation of office buildings, retail complexes, and hotels, all of which require modern, durable, and visually appealing facade materials. The Residential segment is also expanding, propelled by urbanization and the demand for contemporary housing solutions that emphasize both aesthetics and energy efficiency.

The Indonesia Aluminum Composite Panel Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Alucobond Indonesia, PT. Multipanel Indonesia, PT. Cipta Karya Mandiri, PT. Indal Aluminium Industry Tbk, PT. Kencana Lestari, PT. Pionir Metal Pratama, PT. Sumber Mas Indah, PT. Citra Metalindo Abadi, PT. Duta Panel Mandiri, PT. Anugerah Panel Indonesia, PT. Sinar Mas Aluminium, PT. Karya Cipta Abadi, PT. Aluprime Indonesia, PT. Alcopan Prima, PT. Alumindo Light Metal Industry Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia aluminum composite panel market appears promising, driven by ongoing urbanization and a strong focus on sustainable construction practices. As the government continues to invest in infrastructure, the demand for lightweight, energy-efficient materials is expected to rise. Additionally, advancements in technology will likely lead to innovative designs and finishes, enhancing the appeal of aluminum composite panels. This evolving landscape presents opportunities for manufacturers to differentiate their products and capture a larger market share.

| Segment | Sub-Segments |

|---|---|

| By Type | PVDF Coated Panels Polyester Coated Panels Fire-resistant Panels Anti-bacterial Panels Decorative Panels Acoustic Panels Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Application | Building Exteriors (Facades & Cladding) Interior Cladding Signage & Advertising Boards Partitions Transportation (Railways, Airports) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| By Sustainability Features | Recyclable Materials Energy-efficient Production Low VOC Emissions Green Building Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 100 | Architects, Project Managers |

| Residential Construction | 90 | Home Builders, Contractors |

| Industrial Applications | 70 | Facility Managers, Procurement Officers |

| Architectural Design Firms | 50 | Design Directors, Material Specifiers |

| Government Infrastructure Projects | 60 | Public Works Officials, Urban Planners |

The Indonesia Aluminum Composite Panel market is valued at approximately USD 310 million, driven by the growth in the construction sector, urbanization, and demand for lightweight and durable building materials.