Region:Asia

Author(s):Dev

Product Code:KRAD1660

Pages:99

Published On:November 2025

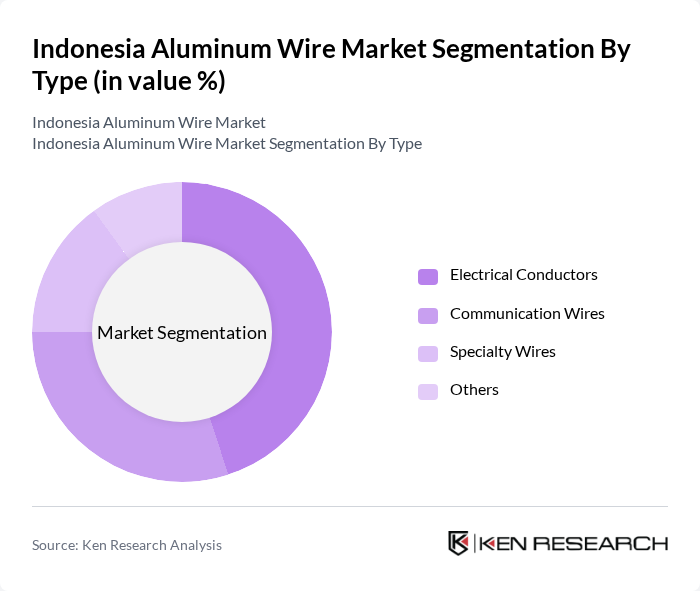

By Type:The market can be segmented into various types of aluminum wires, including Electrical Conductors, Communication Wires, Specialty Wires, and Others. Among these, Electrical Conductors are the most dominant due to their extensive use in power distribution and transmission networks. The increasing demand for reliable and efficient electrical systems in urban areas drives the growth of this sub-segment. Communication Wires also hold significant market share, driven by the expansion of telecommunication infrastructure and the rollout of fiber-optic and broadband networks .

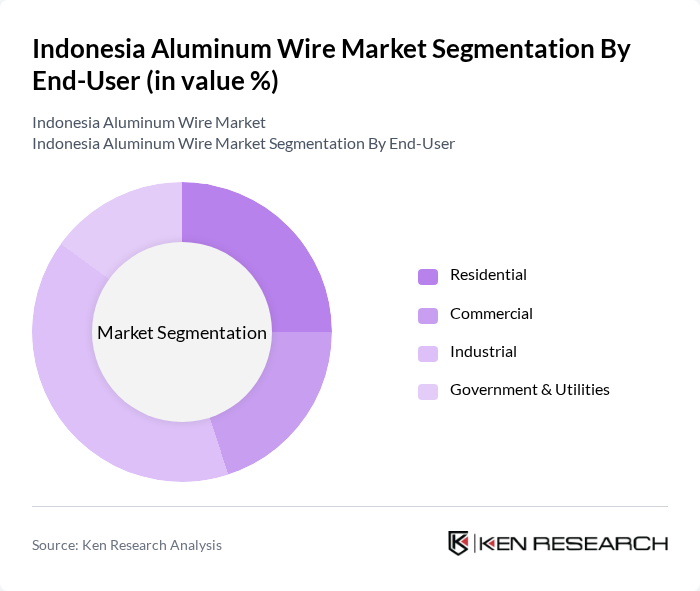

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment is the largest consumer of aluminum wire, driven by the growing manufacturing sector, electrification of industrial processes, and the need for efficient electrical systems in factories. The Residential segment is also significant, as more households adopt aluminum wiring for its lightweight and cost-effective properties. The Commercial sector is expanding due to increased construction activities, while Government & Utilities are investing in infrastructure projects and grid modernization that require aluminum wiring .

The Indonesia Aluminum Wire Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Indonesia Asahan Aluminium (Inalum), PT. Alumindo Light Metal Industry Tbk, PT. Citra Tubindo Tbk, PT. Bintan Alumina Indonesia, PT. Sumberdaya Sewatama, PT. Karya Citra Abadi, PT. Surya Semesta Internusa Tbk, PT. Adaro Energy Tbk, PT. Timah Tbk, PT. Pupuk Indonesia Holding Company, PT. Wijaya Karya (Persero) Tbk, PT. Jasa Marga (Persero) Tbk, PT. Perusahaan Gas Negara Tbk, PT. PLN (Persero), PT. Indocement Tunggal Prakarsa Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia aluminum wire market appears promising, driven by increasing urbanization and a strong push towards sustainable construction practices. As the government continues to invest in infrastructure and renewable energy projects, the demand for aluminum wire is expected to rise significantly. Additionally, technological advancements in manufacturing processes will likely enhance production efficiency, further supporting market growth. The focus on lightweight materials in various sectors will also contribute to a robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrical Conductors Communication Wires Specialty Wires Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Power Distribution Telecommunications Automotive Others |

| By Manufacturing Process | Rod Drawing Stranding Insulation Others |

| By Material Grade | Standard Grade High Conductivity Grade Alloy Grade Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electrical Industry Stakeholders | 100 | Electrical Engineers, Procurement Managers |

| Construction Sector Professionals | 80 | Project Managers, Site Supervisors |

| Automotive Manufacturers | 60 | Supply Chain Managers, Quality Control Officers |

| Aluminum Wire Distributors | 50 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

The Indonesia Aluminum Wire Market is valued at approximately USD 175 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in sectors such as construction, automotive, and telecommunications.