Region:Asia

Author(s):Rebecca

Product Code:KRAC2569

Pages:98

Published On:October 2025

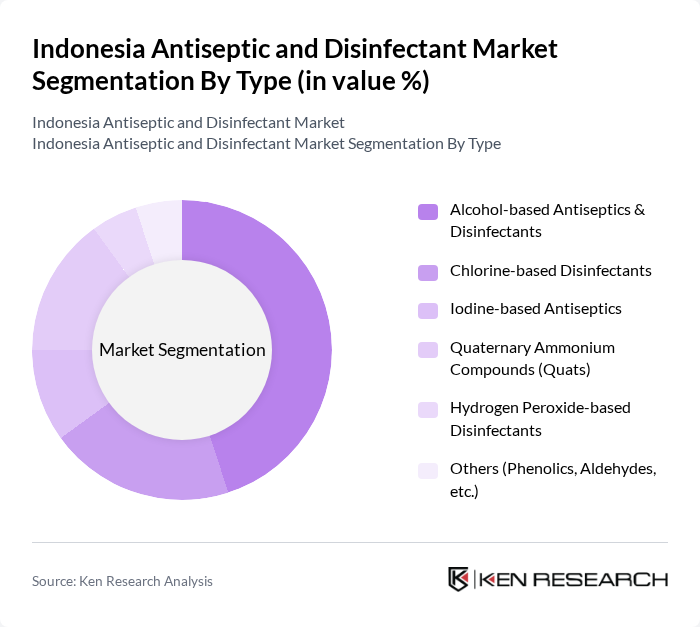

By Type:The market is segmented into various types of antiseptics and disinfectants, including Alcohol-based Antiseptics & Disinfectants, Chlorine-based Disinfectants, Iodine-based Antiseptics, Quaternary Ammonium Compounds (Quats), Hydrogen Peroxide-based Disinfectants, and Others (Phenolics, Aldehydes, etc.). Among these, alcohol-based antiseptics and disinfectants dominate the market due to their effectiveness in killing a wide range of pathogens and their widespread use in both healthcare and household settings. The convenience of use and rapid action of alcohol-based products have made them a preferred choice for consumers, especially during the pandemic.

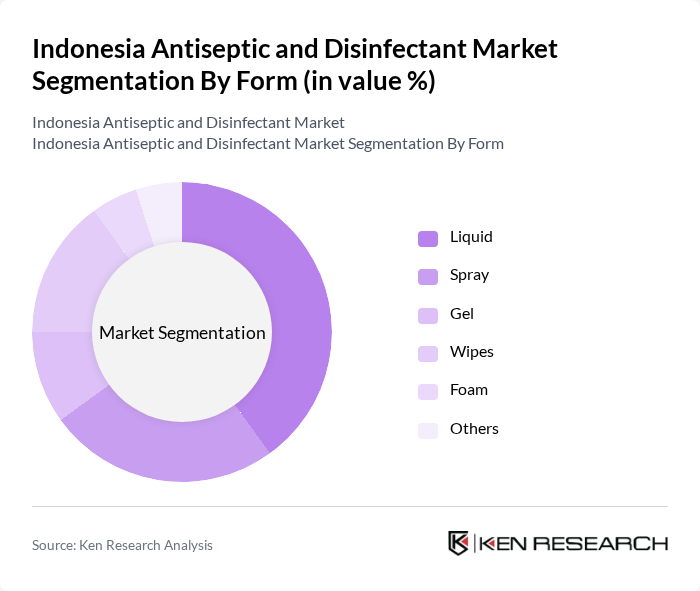

By Form:The antiseptic and disinfectant market is also segmented by form, including Liquid, Spray, Gel, Wipes, Foam, and Others. The liquid form is the most popular due to its versatility and ease of application across various surfaces and settings. Sprays are gaining traction for their convenience and effectiveness in covering larger areas quickly. The demand for wipes has surged, particularly in households and healthcare facilities, as they offer a quick and easy solution for on-the-go disinfection.

The Indonesia Antiseptic and Disinfectant Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Kimia Farma Tbk, PT. Indofarma Tbk, PT. Sido Muncul, PT. Unilever Indonesia Tbk, PT. Reckitt Benckiser Indonesia, PT. Procter & Gamble Home Products Indonesia, PT. Johnson & Johnson Indonesia, PT. Darya-Varia Laboratoria Tbk, PT. Tempo Scan Pacific Tbk, PT. Mandom Indonesia Tbk, PT. Citra Sari Makmur, PT. Sumber Alfaria Trijaya Tbk (Alfamart), PT. Bintang Toedjoe, PT. Duta Abadi Primantara, PT. Sari Husada (Danone Specialized Nutrition Indonesia), 3M Indonesia, Cardinal Health Indonesia, PT. Kalbe Farma Tbk, PT. Combiphar, PT. Mustika Ratu Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antiseptic and disinfectant market in Indonesia appears promising, driven by ongoing health awareness and government support. As the population increasingly prioritizes hygiene, the demand for innovative and effective products is expected to rise. Additionally, advancements in technology will likely lead to the development of more efficient formulations. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Alcohol-based Antiseptics & Disinfectants Chlorine-based Disinfectants Iodine-based Antiseptics Quaternary Ammonium Compounds (Quats) Hydrogen Peroxide-based Disinfectants Others (Phenolics, Aldehydes, etc.) |

| By Form | Liquid Spray Gel Wipes Foam Others |

| By End-User | Healthcare Facilities (Hospitals, Clinics, Laboratories) Households Educational Institutions Food Industry (Processing, Packaging, Storage) Hospitality Sector (Hotels, Restaurants, Spas) Industrial Facilities Others (Agriculture, Animal Care, Public Spaces) |

| By Application | Surface Disinfection Hand Hygiene Medical Equipment Sterilization Food Safety Water Treatment Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Convenience Stores Direct Sales (B2B) Others |

| By Packaging Type | Bottles Pouches Bulk Containers Sachets Others |

| By Price Range | Economy Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities | 150 | Procurement Managers, Infection Control Officers |

| Retail Pharmacy Sector | 100 | Pharmacy Owners, Store Managers |

| Household Consumers | 150 | General Consumers, Health-Conscious Individuals |

| Industrial Users | 80 | Facility Managers, Safety Officers |

| Government Health Officials | 50 | Public Health Administrators, Policy Makers |

The Indonesia Antiseptic and Disinfectant Market is valued at approximately USD 32 billion, driven by increased health awareness, rising infectious diseases, and heightened demand for hygiene products, particularly during the COVID-19 pandemic.