Region:Middle East

Author(s):Shubham

Product Code:KRAA8826

Pages:94

Published On:November 2025

By Type:The market is segmented into various types of packaging solutions, including bottles, blisters, labels and sleeves, tubes, pouches and sachets, vials and ampoules, specialty bags, closures and caps, and others. Each type serves specific needs in the pharmaceutical industry, catering to different dosage forms and ensuring product integrity. Bottles and blisters remain the most widely used due to their versatility and ability to protect against contamination, while pouches and sachets are gaining traction for unit-dose and cold-chain applications. Vials and ampoules are essential for injectable medications, and specialty bags are critical for parenteral therapies .

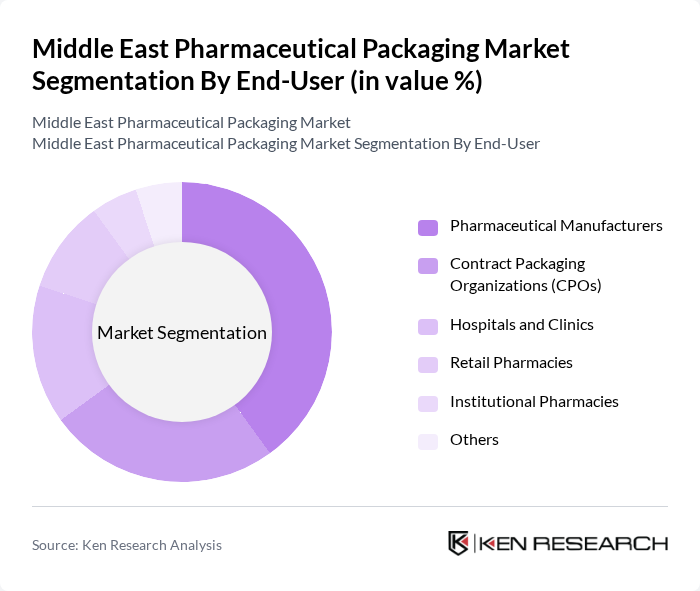

By End-User:The end-user segmentation includes pharmaceutical manufacturers, contract packaging organizations (CPOs), hospitals and clinics, retail pharmacies, institutional pharmacies, and others. Each segment plays a crucial role in the distribution and accessibility of pharmaceutical products, influencing packaging requirements based on their operational needs. Pharmaceutical manufacturers and CPOs are the largest consumers due to their scale and regulatory compliance needs, while hospitals, clinics, and pharmacies demand packaging that ensures safety, traceability, and ease of use for both patients and healthcare professionals .

The Middle East Pharmaceutical Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, West Pharmaceutical Services, Inc., Gerresheimer AG, AptarGroup, Inc., Berry Global, Inc., Schott AG, Alpla Group, NAPCO National, United Pharmapack, Mondi Group, CCL Industries Inc., Constantia Flexibles Group GmbH, Huhtamaki Oyj, Bilcare Limited, Gulf Pharmaceutical Industries (Julphar) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East pharmaceutical packaging market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As the demand for sustainable and smart packaging solutions increases, companies are likely to invest heavily in R&D to innovate and comply with regulatory standards. Additionally, the expansion of e-commerce in pharmaceuticals will necessitate more efficient packaging solutions, enhancing distribution channels. Overall, the market is expected to adapt to these trends, fostering a more resilient and responsive industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles Blisters Labels and Sleeves Tubes Pouches and Sachets Vials and Ampoules Specialty Bags (e.g., IV bags, parenteral bags) Closures and Caps Others |

| By End-User | Pharmaceutical Manufacturers Contract Packaging Organizations (CPOs) Hospitals and Clinics Retail Pharmacies Institutional Pharmacies Others |

| By Material | Plastics and Polymers (PE, PP, PET, PVC, etc.) Glass Metal (Aluminum Foil, etc.) Paper and Paperboard Biodegradable & Compostable Materials Others |

| By Application | Solid Dosage Forms (tablets, capsules, powders) Liquid Dosage Forms (syrups, solutions, suspensions) Semi-Solid Dosage Forms (ointments, creams, gels) Parenteral/Injectable Products Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia, etc.) Sub-Saharan Africa (for completeness in regional analysis) Others |

| By Functionality | Primary Packaging Secondary Packaging Tertiary Packaging Others |

| By Technology | Conventional Packaging Smart Packaging (RFID, sensors, etc.) Active Packaging (desiccants, oxygen scavengers, etc.) Tamper-Evident and Anti-Counterfeit Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Packaging Suppliers | 60 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Logistics and Distribution Firms | 50 | Operations Managers, Supply Chain Analysts |

| Healthcare Providers | 50 | Pharmacists, Hospital Administrators |

The Middle East Pharmaceutical Packaging Market is valued at approximately USD 3.3 billion, driven by the demand for advanced packaging solutions that ensure drug safety and compliance with regulatory standards, alongside the rising prevalence of chronic diseases.