Region:Asia

Author(s):Shubham

Product Code:KRAD3659

Pages:99

Published On:November 2025

Market.png)

By Type:The market is segmented into various types of services, including Design Engineering, Testing and Validation Services, Prototyping Services, Manufacturing Engineering, Embedded Software & Electronics Engineering, and Others. Among these, Design Engineering is the leading sub-segment, driven by the increasing complexity of vehicle designs and the need for innovative solutions to meet consumer demands. The focus on aesthetics, functionality, and safety in vehicle design has led to a surge in demand for specialized design engineering services.

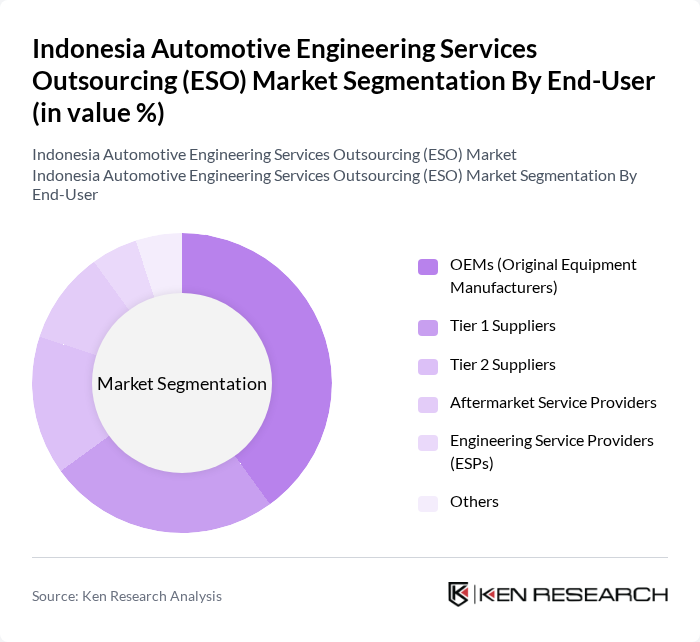

By End-User:The end-user segmentation includes OEMs (Original Equipment Manufacturers), Tier 1 Suppliers, Tier 2 Suppliers, Aftermarket Service Providers, Engineering Service Providers (ESPs), and Others. OEMs are the dominant end-users in the market, as they require extensive engineering services to support their vehicle production processes. The increasing competition among OEMs to deliver innovative and high-quality vehicles has led to a higher demand for specialized engineering services.

The Indonesia Automotive Engineering Services Outsourcing (ESO) Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Astra International Tbk, PT Toyota Motor Manufacturing Indonesia, PT Honda Prospect Motor, PT Suzuki Indomobil Motor, PT Nissan Motor Indonesia, PT Mitsubishi Motors Krama Yudha Indonesia, PT Isuzu Astra Motor Indonesia, PT Daihatsu Motor Indonesia, PT Hyundai Motor Manufacturing Indonesia, PT Tata Motors Distribusi Indonesia, PT Chery Sales Indonesia, PT BMW Indonesia, PT Mercedes-Benz Distribution Indonesia, PT Volkswagen Mobil Indonesia, PT Geely Mobil Indonesia, PT Gaya Motor (subsidiary of PT Astra International, engineering services), PT Hexaon Business Mitrasindo (local ESO provider), PT TUV Rheinland Indonesia (engineering and testing services), PT AHM Engineering (Astra Honda Motor, engineering division), PT Denso Indonesia (automotive engineering and R&D) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Automotive Engineering Services Outsourcing market appears promising, driven by the increasing focus on electric vehicles and the integration of advanced technologies. As the government continues to support local manufacturing and innovation, the demand for specialized engineering services is expected to rise. Additionally, the adoption of Industry 4.0 technologies will enhance operational efficiencies, allowing local firms to compete more effectively. This evolving landscape presents significant opportunities for growth and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Design Engineering Testing and Validation Services Prototyping Services Manufacturing Engineering Embedded Software & Electronics Engineering Others |

| By End-User | OEMs (Original Equipment Manufacturers) Tier 1 Suppliers Tier 2 Suppliers Aftermarket Service Providers Engineering Service Providers (ESPs) Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) Hybrid Vehicles Two-Wheelers Others |

| By Service Type | Engineering Design Services Software Development & Integration Services Quality Assurance & Testing Services Consulting & Project Management Services Others |

| By Technology Used | CAD (Computer-Aided Design) CAE (Computer-Aided Engineering) PLM (Product Lifecycle Management) Embedded Systems & IoT Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Others |

| By Client Type | Private Sector Clients Public Sector Clients International Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Engineering Services | 100 | Engineering Managers, R&D Directors |

| OEM Collaboration Projects | 80 | Project Managers, Product Development Leads |

| Testing and Validation Services | 70 | Quality Assurance Managers, Test Engineers |

| Electric Vehicle Engineering | 60 | EV Specialists, Technical Directors |

| Supply Chain Engineering Services | 90 | Supply Chain Managers, Procurement Officers |

The Indonesia Automotive Engineering Services Outsourcing (ESO) Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by the expanding automotive sector and increasing demand for engineering services in vehicle design and manufacturing.